Pension retirement options

When you reach retirement it should be a happy time.

The start of a new chapter. The drawdown of the pension.

However, pension and finance jargon can complicate it and cause stress.

Paperwork, figures, investments, annuities, ARF’s, income????

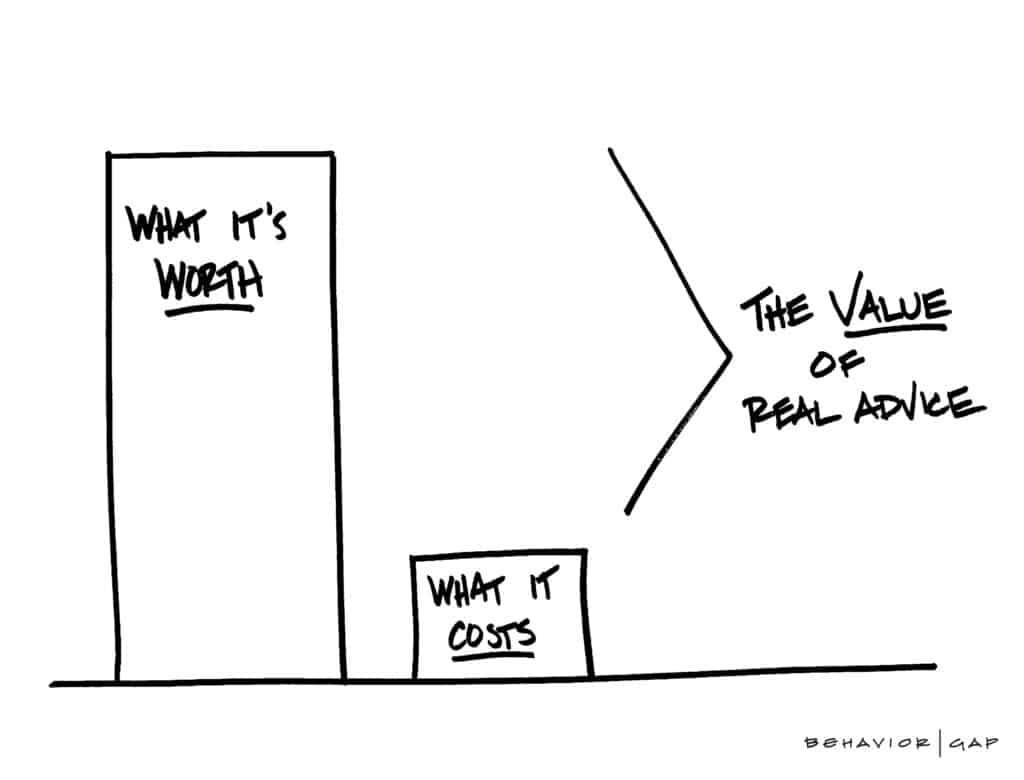

We regularly write articles providing real examples of clients who take advice from us.

Consequently, we get really good feedback and enquiries on these, likely as some readers will resonate with the situation.

There is no better way to outline the benefits of our advice than real examples.

This encourages us to make it a regular feature of our article writing.

Below, we will cover a client who contacted us to review his pension retirement options.

The Situation

Our client was due to reach retirement age in his employer’s pension scheme towards the end of 2021.

He had received his retirement options on his pension from the administrators of his employers’ scheme.

Initially, the client was under the impression he had to take retirement advice from the financial advisory arm of the company scheme administrators.

He had read our article comparing an Approved Retirement Fund (ARF) versus an Annuity and wanted a second opinion on his options.

He had been provided with an overview of his options by the pension administration company.

I advised the client that he is not tied to the scheme administrators for his individual retirement advice and he was free to seek advice on his retirement elsewhere.

Following discussion, he agreed to engage us as his advisors.

Our client had two pensions, his employers’ occupational pension scheme and a personal retirement bond (PRB).

The PRB related to a previous employment.

The main areas to discuss were:

- How do we maximise his tax free cash

- What is an ARF

- What is an Annuity

- And what is the best option for him?

The Journey

Gathering the information

Our client and his wife completed a financial planning questionnaire.

Whilst we offer this online through our client portal for their convenience, in this instance the client preferred the traditional method: pen and paper!

We received a copy of his retirement options for both pensions and an authority was signed for us to get access to the PRB and employers pensions.

We then advised both pension providers of the other pension and got updated options calculated.

Preparing the Analysis

We were now in a position to analyse the pension retirement options along with their financial planning questionnaire.

The main objective the client had was to maximise his tax free cash.

After that, it was to contrast and compare an ARF and an Annuity.

What is the difference?

What’s most suitable?

Some of the key information points we highlighted:

- Both would receive the full state pension in 2022

- They had a good level of cash assets

- The household outgoings were average

- They had other sources of income

- Our client had worked hard to build his ‘fun fund’ and wanted to heavily consider the treatment of his pension on death

Discussing the findings and pension retirement options

Upon completion of the analysis, we prepared our report and met again.

Firstly, we discussed the tax-free cash.

When it comes to pension retirement options for an occupational scheme, there are two ways of calculating the tax-free cash, salary and service versus 25% of the fund value. Learn more here.

Our tax-free cash figure down the salary and service route was less than quoted by the scheme administrators.

‘Why was this?’ the client understandably asked.

When issuing options, the corporate scheme administrator and PRB holder had not factored in the other pension.

A quirk in Irish pensions legislation means one benefit can potentially affect the other.

So, we compared the tax-free cash down both routes.

Both were similar sums so it came down to an ARF versus an Annuity.

We discussed in depth our clients need for a guaranteed set amount of income an annuity would provide.

Also, we discussed in depth how an ARF works, the risks associated, the investment side and how the income works.

Part of this discussion was the treatment on death of the annuity and ARF.

As the ARF can be passed on (subject to tax treatment) on death, this was a positive for the ARF.

Our client had no need for the guaranteed income of an annuity due to his other income streams.

Additionally, due to their income streams and cash assets, they had the capacity and tolerance for the investment risk that comes with an ARF.

So, following our in depth analysis, review and discussion we were maximising our clients tax-free cash and planning their retirement via their ARF.

Implementing the chosen pension retirement option

Following agreement on the recommendations, we implemented the following solutions:

- Got our clients maximum tax free cash paid to him before Christmas

- Set up his ARF with the balance of his fund

In line with our advice and monitoring process, his ARF specifically to his requirements.

His investment strategy and income plan, all within a competitively priced structure with a clear and concise ongoing advice level agreement.

The benefits to the clients

Following the review of the pension retirement options and set-up of the ARF, our client now has considerable peace of mind.

The tax-free cash was maximised.

His ARF is in force, on a structure specific to his circumstances.

It is competitively priced.

The cheapest, lowest cost ARF doesn’t always win.

Once there is a clear outline of any service to be received.

Above all, our client has peace of mind.

Both the client and his wife have peace of mind over their future.

They know what income is coming in and what additional assets they can draw down on.

Through our interactive financial forecasting, we could show them that if markets take a hit in 2022 or in future, they need not worry.

Their investment strategy in their ARF will ride it out, they will still have enough income to live as they want to live.

The assets within the ARF will pass on on death in line with as they planned.

This was achieved by seeking independent advice and simply looking for a second opinion on an element of their retirement options.

Summary

As you approach retirement, whether you’re a member of your employers’ scheme or holding personal pensions, it’s important to seek advice.

You need to be aware of all of your options.

Individuals are not tied to the administrators of their employers’ scheme for advice on retirement.

It’s important to seek independent advice, bespoke to them.

To know that when it comes to setting up an ARF specifically, there is thought behind the recommendation.

It’s not just an off the shelf arrangement and thrown into a specific risk bucket.

Ensure your objectives are met in retirement.

What income do you require? Where will it come from?

Are you maximising your benefits from your pensions?

After all, you’ve worked hard to save as much.

Our client now has his retirement income planned around how he wants to live.

Review Your Retirement Options

How we can help you

Are you approaching retirement in the next 4 or 5 years or have you received your retirement options?

Do you want to access your pension benefits early?

Or do you know of anyone in this position?

At Fortitude Financial Planning we’ve helped and continue to help many of our clients and contacts with their pension retirement options.

Not just with their retirement options but beyond the pension drawdown.

I’ve said before our industry is changing.

It’s becoming more service-based.

Consumers not only want good advice, but they also want (and need) ongoing service. And deserve it.

If you are approaching retirement or considering drawing your pension early, we will review your pension retirement options with you.

We will lay them out in a simple, jargon-free manner for you.

Then we will work with you to determine what is the best option for your individual circumstances and needs.

We work back to what our clients require, ensuring our clients only get recommendations suited to their specific needs.

Finally, we will process all of the paperwork for you and implement your chosen options.

Get in touch

Take the first steps to working through your retirement options or learning what they will be and request a callback.

You can also drop me an email, francis@fortitudefp.ie give me a call, 086 0080 756 or access our diary here and book a call at your convenience.

We are also happy to have a no obligation chat with you initially, this allows us to assess if we can help and bring value to you.

We have over 40 articles in our content library on various subjects and you can access them here and learn more about our experience and expertise.

A wealth of free information covering all aspects of saving, investing, financial planning, protection and pension advice.

Francis McTaggart CFP® SIA RPA QFA

These blog posts are intended for information purposes only and should not be interpreted as financial advice.

You should always engage the services of a fully qualified financial planner before entering any financial contract.

To discuss engaging the services of Fortitude Financial Planning please email us at info@fortitudefp.ie.

Fortitude Financial Planning Ltd will not be held responsible for any actions taken as a result of reading these blog posts.

Production

Production