7 quick wins to help you get Financially Fit!

The new year and resolutions are long gone, how did they work out?

Did you make any resolutions to get physically fit?

While you may continually set goals to get more physically fit, it is also important to consider your financial fitness on a regular basis.

Financial worries are one of the highest causes of stress in the United States.*

If your finances are not where you want them to be, the seven tips below will help you get your finances in shape.

1. Trim the Financial Fat

One of the first steps toward a healthier financial life is spending less.

Take the time to look hard at your budget, odds are you can find some excess that you can easily trim off without feeling a pinch.

Start with your non-essentials, such as TV and phone.

Do you really need extra movie channels? Do you watch them?

When was the last time you shopped around to compare prices?

Next, dive into spending items such as clothing, groceries, and entertainment.

See if smart shopping or more date nights at home can help free up some extra money each month.

Then, look at your utility bills and find ways to reduce them.

Shopping around for your utility bills is one of the quickest wins we can have.

Finally, discipline yourself to follow good energy-saving tips to reduce the overall cost of your energy bills.

2. Tone Up Your Debt

Do you have a credit card bill and maybe some other debt?

Do not let the debt snowball higher than it needs to by accruing interest.

Start with your highest interest rate loan and set a larger payment in your budget to begin lessening that total.

Once it is paid off, use that same payment to start tackling your next high-interest debt, and so on.

A critical part to remember is that when paying only your minimum payment, it will take you 10 years and a significant amount of interest to pay off your card.

Therefore, always pay more than the minimum if you are looking to pay off debt.

3. Whip Your Credit into Shape

Your credit score can affect many aspects of your financial life.

Whether you are looking to buy a house or car or to take out a loan to start a business, your credit score will be used to determine how much interest you will pay and how likely you are to even get those funds.

Unfortunately, many people neglect their scores until they need them.

Then at this point, it can be difficult to improve quickly.

Keep your credit card balance far from the limits, be sure to make payments on time, and monitor your score for negative marks.

4. Load Up on Savings

Once you have trimmed the fat off your budget, you will want to put some of that into savings.

One goal to start immediately is creating an emergency fund.

Surprise repairs, medical bills, and layoffs can damage your financial health if you are not prepared for them.

Aim for a fund of between 3 and 6 months net after-tax income.

Keep this in an easily accessible account.

Having this fund available for these times can lessen the blow and help you stay on top of your bills so you do not fall behind.

5. Put Pension Savings in Your Routine

Saving for retirement is critical to your future.

Many people do not save enough for their retirement or wait so long that they stress their budget to meet their goals.

Make it a point this year to focus on your pension goals and find extra funds that you can put into your pension.

This gives it the necessary time to grow as it should.

A pension is very tax efficient.

You will get tax relief on your contributions at the rate of income tax you pay.

So if you are a higher rate taxpayer, a €100 contribution will only cost you €60.

That’s correct, Revenue will cover 40% of your contribution if you’re a higher rate taxpayer.

Find out if your employer matches contributions, and if so, put in the amount required to receive their matching contribution.

6. Start a New Investment strategy

Investing is the quickest way to grow your wealth.

But many people are afraid to enter the world of investing because they are afraid of losing money.

Others are under the misconception that you must invest a lot of money when the truth is that you can begin your investment journey with as little as €100.

Start small so you can get the hang of it, build your knowledge.

Then, when you have more money to invest, you’ll feel more confident.

Should you save or invest?

Meet with us.

We can help you pick a strategy based on your circumstances.

New to investing? Click here.

7. Create a plan

Create a financial plan.

Having no plan is like jumping in the car to drive to somewhere you’ve never been without a sat nav.

A proper financial plan will clarify where you are and what you should be doing.

It will also tell you the parts of what you’re doing at the moment are good.

No one comes to us with their finances in a mess.

Everyone has some good going on.

A cohesive financial plan will simply tell you what you have to do to improve.

Summary

It’s never too late or too early to review your finances.

Get your finances healthy and set attainable goals to help you grow your wealth and get started toward a secure financial future.

Even a quick health check on them will put you in a better place mentally.

Allowing you to focus on other things.

Above I’ve outlined 6 simple and quick wins for everyone.

If you would like a copy of our budget sheet just drop us an email, info@fortitudefp.ie.

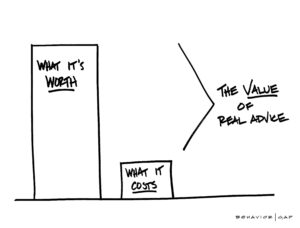

How we help

Like what you read?

Do you want to tackle your finances in greater depth?

Everyone needs a financial plan.

Contact us. We will outline how our financial review works and the clarity it will give you.

Working with us, you are safe in the knowledge you are getting advice from a company that is not only Certified Financial Planner™ certified.

But a company that is also one of the few financial planning and advice firms in the country accredited by the All Ireland Business Foundation for our trust and customer-centricity.

Get in touch

Drop me an email, francis@fortitudefp.ie or request a callback.

You can also give me a call on 086 0080 756 or access our diary here and book a call at your convenience.

We will initially have a no-obligation chat with you at our expense.

Run through our process and outline how we can help.

Why not visit our content library.

Over 50 articles on various subjects learn more about our experience and expertise.

A wealth of free information on hand, covering all aspects of saving, investing, financial planning, protection and pension advice.

*Source: American Psychological Association

Our blog posts are intended for information purposes only and should not be interpreted as financial advice.

You should always engage the services of a fully qualified financial planner before entering any financial contract.

To discuss engaging the services of Fortitude Financial Planning please email us at info@fortitudefp.ie.

Fortitude Financial Planning Ltd will not be held responsible for any actions taken as a result of reading these blog posts.

Production

Production