8 Reasons Why You Shouldn’t DIY Your Finances

We live in an era where DIY (Do It Yourself) culture is celebrated and often encouraged, from home repairs to personal fitness.

Therefore, it’s easy to see why many might consider taking a DIY approach to their finances.

The allure of saving money on professional fees can be tempting.

However, managing finances is not as straightforward as fixing a leaky tap or painting a room.

Here’s why you should think twice before DIY-ing your finances.

1. Complexity and Expertise

Managing finances is complex.

It involves understanding tax laws, investment strategies, retirement planning, estate planning, insurance, and more.

Financial planners spend years studying and staying updated with ever-changing laws and market conditions.

Attempting to manage these without expertise will lead to costly mistakes.

For instance, poor investment choices can significantly impact your financial future.

2. Emotional Decision-Making

Money is inherently emotional.

You’re emotionally tied to your own money. Emotion clouds judgement.

Whether it’s fear during a market downturn or the excitement of a bull market, emotions will drive irrational decisions.

As financial planners we provide an objective perspective, helping you make decisions based on facts rather than feelings.

This emotional detachment is crucial for making sound financial decisions, especially during volatile market conditions.

3. Time and Effort

Managing finances is time-consuming.

It requires continuous learning and staying abreast of the latest financial news, trends, and changes in legislation.

This can be particularly challenging if you have a demanding job or other responsibilities.

We save you time by handling these tasks, allowing you to focus on what you do best and what you enjoy, like family time.

4. Holistic Planning

A DIY approach often leads to fragmented financial planning.

You might focus on one aspect, such as investing, while neglecting others like insurance or estate planning.

We take a holistic view, ensuring all aspects of your financial life are coordinated and working towards your overall goals.

We can create a comprehensive plan that includes budgeting, saving, investing, tax planning, and more.

5. Access to Resources and Tools

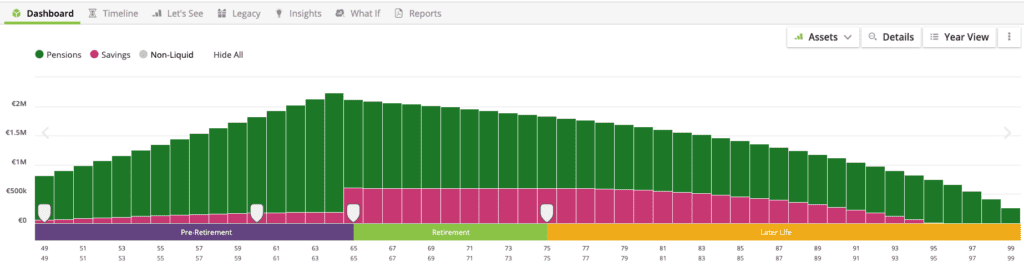

We have access to advanced tools, resources, and networks that are not available to the average person.

These tools can provide deeper insights and more effective strategies.

For example, we can access detailed market research, sophisticated financial planning software, and a network of other professionals like tax specialists and estate solicitors.

6. Avoiding Common Pitfalls

Without professional guidance, it’s easy to fall into common financial traps.

These can include inadequate diversification, timing the market, not having an emergency fund, or underestimating the importance of insurance.

Focusing solely on investing, you can read more about the 20 most common investing mistakes by clicking here.

We help you navigate these pitfalls, providing strategies and advice to protect and grow your wealth.

7. Regulatory Compliance

Financial regulations are complex and constantly evolving.

Staying compliant with these regulations can be daunting.

Financial planners are trained to understand and keep up with these changes, ensuring your financial strategies are legally sound and optimized for current laws.

8. Personalised Advice

Fact, everyone’s financial situation is unique.

Despite what the guy down the pub or your work colleague tells you, you’re different to him.

A one-size-fits-all approach doesn’t work in personal finance.

We provide personalised advice tailored to your specific circumstances, goals, and risk tolerance.

This tailored approach can make a significant difference in achieving your financial objectives.

Summary

In summary, whilst the DIY approach works well for many tasks, managing finances is not one of them.

The complexity, emotional factors, time commitment, and need for specialized knowledge make it a task best left to professionals.

By working with a Certified Financial Planner, you will benefit from their expertise, avoid common pitfalls, and achieve a well-rounded, strategic financial plan.

Remember, the goal is not just to manage your money, but to grow and protect your wealth for the long term.

Investing in professional financial advice is an investment in your future peace of mind and financial well-being.

Get in touch

Contact us and take the first steps to getting your finances in order.

Email us at info@fortitudefp.ie or click below to schedule an introductory call at our expense.

Why not visit our insights page.

A multitude of information on various financial subjects covering all aspects of saving, investing, financial planning, protection and pension advice.

Our blog posts are intended for information purposes only and should not be interpreted as financial advice.

You should always engage the services of a fully qualified financial planner before entering any financial contract.

To discuss engaging the services of Fortitude Financial Planning please email us at info@fortitudefp.ie.

Fortitude Financial Planning Ltd will not be held responsible for any actions taken as a result of reading these blog posts.

Production

Production