Do you have a form of defined contribution pension?

This could be a PRSA, Personal Pension (PP), Personal Retirement Bond (PRB or BOB) or an Occupational Pension Scheme.

If so, how it performs is important.

If it underperforms the long term implications can be irreparable.

This is something that should be reviewed once a year.

Potentially twice a year if you are over age 55.

Your defined contribution pension is a key component of how you will live in retirement.

Make sure it’s on track.

Like the car, take the time to give a pension an annual NCT to limit the chances of nasty surprises down the line.

Nobody likes an NCT and not many more like pensions so the two can go hand in hand as an analogy!

Below are some reasons in detail why a regular pension review is important.

#1 Defined Contribution Pension Charges

One of the main things that pop into the mind when it comes to pensions – charges.

There is a common theory amongst the consumer that pensions are a rip off due to high charges.

Yes, some pensions can be a rip-off – the charges can be extremely high.

Particularly older ones.

But with the heavy regulation of the industry, in 2021 most are extremely competitive.

A pension is like any product we buy, there are charges associated

There’s nothing wrong with charges once the consumer is aware of them, they’re competitive and the consumer is getting some service in return.

Some charges that can apply to pensions are:

- Entry/Allocation rate charge

- Annual Management Charge (AMC)

- Ongoing Charges Figure (OCF)

- Policy fee

- Trustee fee

- Encashment penalties

- Pensions Authority fee

- Fund switch charges

An updated review of your pension will clarify all of the above for you.

You’ll know what you’re paying and whom you’re paying.

#2 Your attitude to and capacity for risk

When you set up any form of investment account (pension or otherwise), there should be a risk assessment done.

This captures two elements, 1) your tolerance for risk and 2) your capacity for risk.

Your risk tolerance is the degree of variability in investment returns an investor can tolerate.

Risk capacity is how much risk an investor can take with that investment.

A good example of risk capacity

- If an individual has €20,000 in the bank they require to draw down on in two years, they have no capacity to take risk with this.

A market downturn would significantly impact that in the short term, reducing the amount of money they have to draw on.

- If a 35-year-old investor is investing in a pension, that is potentially a 30-year investment so they have increased capacity for risk.

Your investment strategy should directly reflect your tolerance and capacity for risk.

As you get older, your investment term can shorten, your capacity for risk reduces.

Generally, our tolerance for risk reduces as we get older also.

Without a pension review, you may be exposed to higher risk assets.

This could then be outwith your tolerance and capacity for risk.

Any changes in these factors would be captured and your investment strategy can be corrected.

If not, this can leave you susceptible to a market downturn.

Something you don’t want just before retirement – think 2008.

#3 Inadequacy of the state pension

Hot topic. Up for debate annually!

The state pension is increasing to €13,171 per annum (€253.30 per week), payable from age 66.

The average annual salary in Ireland is approximately €49,000*.

This represents a 74% drop in income in retirement if someone has no private pension provision.

And there are issues surrounding the ability to keep funding the state pension.

Longer life expectancy is increasing liabilities.

If you want to continue to live in retirement as you are living now a private pension is imperative.

Relying on the state pension is not enough. If it is reduced or delayed due to increasing liability, it’s even more inadequate.

If you have a private pension, reviewing it now will inform you whether you are on track to have enough income in retirement for how you want to live.

*source Irish Times report June 2020

#4 Annuity or Approved Retirement Fund (ARF)

Maybe you’re at retirement age and planning to draw on your pension.

Or are you within the final 5 years of the expected drawdown age?

When you draw down your defined contribution pension, your choice will be purchasing an annuity or investing in an ARF.

Both are completely different options, each with its own pros and cons.

It’s important to engage in these options at the most 5 years from the expected retirement drawdown age.

A) so you know what you are doing but also B) to ensure the correct asset allocation.

Your asset allocation (between cash, bonds, equities etc) should be dictated pre-retirement by your expected likely retirement option.

If you are purchasing an annuity, you want to be weighted towards cash and bonds.

Investing in an ARF, you would like a bit of cash but also with equity exposure.

Your asset allocation in the final years is a key aspect of retirement planning.

You want to avoid exposure to equities if you are looking to purchase an annuity.

A pension review will ensure you are invested correctly.

#5 How much can you retire on?

Unless you review your pensions regularly, it’s unlikely you have an idea of how much income you actually require in retirement.

Or you will likely have no idea how much income your pension is going to generate for you/

Some questions;

- Do you know your tax-free lump sum entitlement?

- Do you know the expected annual income from your pension?

Your pension review will give you realistic projections.

#6 Maximising Tax Efficiency

A pension is the most tax-efficient vehicle available to us.

There is no other arrangement the Revenue will cover 40% of our own contributions (assuming you’re a 40% tax-payer).

It’s important not to miss out on any tax-saving opportunities.

By being asleep at the wheel and putting a review on the long finger, you could be costing yourself money.

#7 Are you getting ongoing advice?

Sadly, only a small number of individuals who have pension benefits have reviewed their pension plans on a regular basis.

Many individuals hold a number of different defined contribution pension plans.

They have no understanding of how their pension plans work.

The charges, risks or benefits they could expect to receive.

Generally, most pension plan holders do not know what or how their income will be generated in retirement.

Ongoing advice is crucial to delivering the best outcomes for clients.

Without a plan and the monitoring of that plan, your chances of a happy retirement could be limited.

#8 you hold Multiple pensions

As outlined here, it’s not unusual for many of us to carry numerous pensions.

Typically from previous employments.

A pension review will capture all of your pensions.

You will receive a nice top-down view of what you have and where they are invested.

In this article, I have discussed the pros and cons of consolidating your various pensions.

Post review, you will be in a position to make an informed decision on whether you want to consolidate.

#9 Ownership

This applies to those who have a pension with a previous employer.

When you leave the pension under your old employer’s scheme, the Trustees of that scheme own the fund.

You are the beneficiary.

However, if you want to access the fund early, the Trustees have to sign off on it.

When you retire, the Trustees have to sign off on it.

You’re also restricted to the existing schemes investment choices.

A pension review will allow you to make an informed decision on whether you want to take ownership of the fund and more control over it or not.

Summary

Outlined above are solid reasons to review your pension(s).

Some of them carry more importance than others but all of them are important to some degree.

Do your future self a favour and take the time to run a check on your pensions.

Avail of our second opinion service.

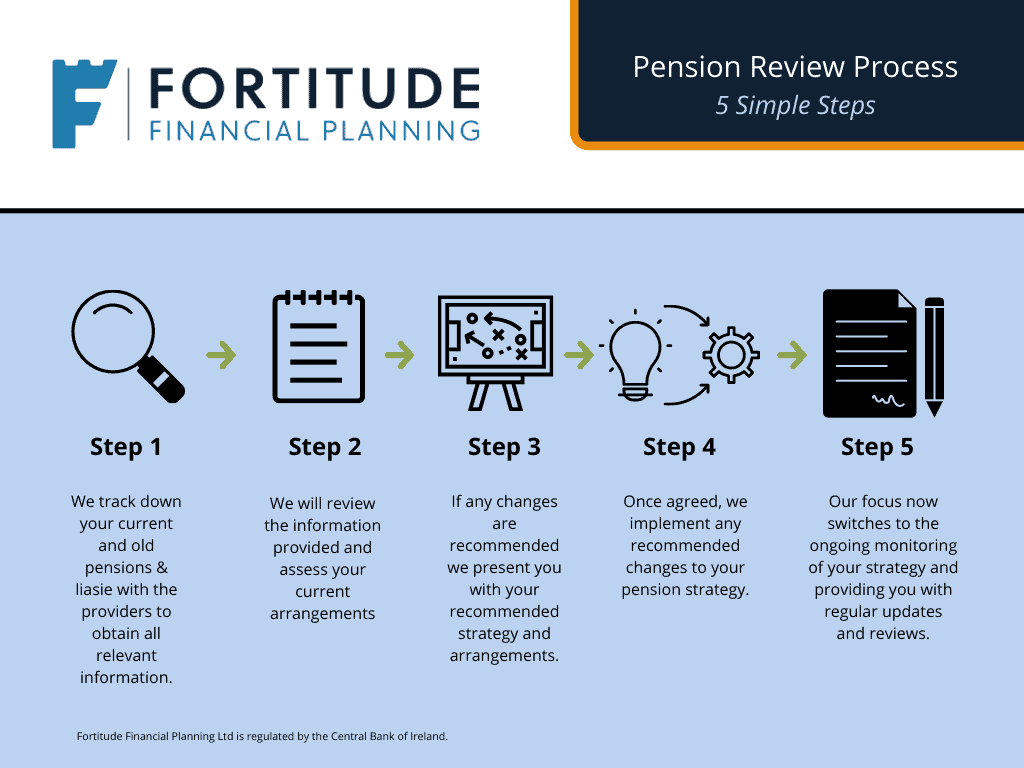

How we help

Our second opinion service is designed specifically for reviews of existing benefits.

We do the heavy lifting for you, all you have to do is give us a bit of your time and engage in the process.

We work in an open and collaborative manner with you.

Your review will be delivered in a simple to understand, jargon-free manner.

It’s our aim to simplify financial advice for you as much as possible, please request a callback for more information.

Alternatively, call me on 086 0080 756 or drop us an email, francis@fortitudefp.ie.

Francis McTaggart CFP® SIA RPA QFA

These blog posts are intended for information purposes only and should not be interpreted as financial advice.

You should always engage the services of a fully qualified financial planner before entering any financial contract.

To discuss engaging the services of Fortitude Financial Planning please email us at info@fortitudefp.ie.

Fortitude Financial Planning Ltd will not be held responsible for any actions taken as a result of reading these blog posts.

Production

Production