Can I consolidate my old pensions?

A client of mine asked me recently ‘Can I consolidate my pensions from previous employers?’.

She recently left employment and her Defined Contribution (DC) pot with her employer remains in the employer’s scheme.

Additionally, she had another DC pot with an even older employment that was still in that employer’s scheme.

It’s a question that comes up regularly.

Particularly during a financial review.

It’s a great question as many of us have an old pension from previous employment(s).

For the purpose of this blog, I am going to focus strictly on Defined Contribution Occupational Pension Schemes.

The pension landscape in Ireland is so convoluted I could write blogs on Personal Pension consolidation and PRSA consolidation.

For now, we will stick solely to Occupational Pension Schemes.

What is pension consolidation?

So exactly what is pension consolidation?

Simply put, it means combining all of your pensions with one provider.

The days of us working our whole adult lives with one, maybe two employers are gone.

We change jobs regularly.

A key employee benefit provided by employers is a pension.

Therefore it’s not uncommon for us to clock up numerous pensions as we move along the employment journey.

We can consolidate them with one pension provider keeping things nice and tidy.

Don’t lose or forget your old pension(s)

This likely sounds crazy but it happens.

At the last report I read, there is an estimated €500 million in lost or unclaimed pensions in Ireland.

There can be a number of reasons for this.

Employees who have left service may not even have been aware they were in a pension.

Or they think it’s so small they forget about it.

They could have moved address and the Trustees of the scheme can no longer contact them.

First things first, don’t lose your old pensions.

Or forget about them.

Contact your old employer, or even the pension company if you know who looks after it and request an updated statement of Leaving Service Options.

Avail of our Pension Tracing Service

Pros of consolidating your pensions

Neat and tidy

Simply put, having different pensions with different providers can create headaches.

Multiple funds and investment performance to track.

Multiple passwords and online logins to remember.

Consolidating your pensions with one provider means one login, one dashboard.

You will also save a significant amount of time.

One overall value of your portfolio due to one online dashboard.

No more logging into multiple different systems.

Cost

This isn’t as straightforward.

Costs between where you are at the moment and consolidation should be compared.

Consolidating all of your pensions with one provider sometimes means you can reduce the costs and ongoing Annual Management Fees applicable to your funds.

Death

No one likes to think about it, but it happens.

If you pass away with multiple pensions held by different providers, it can leave a significant headache for your beneficiaries.

They will have to deal with multiple administration companies and Trustees to get your funds out of your pensions and into your estate.

Because they are dealing with one provider it will make the process much smoother at the worst possible time.

Investment strategy

Most occupational schemes have limited investment choices.

The Trustees don’t want too many members opting outwith the default investment strategy. Even if they do the choice is limited.

By taking charge of your own pensions you gain access to other providers and assets.

You can make investment choices as simple or as fancy as you like.

This could be a self-invested pension or a simple index tracker pension.

It’s important you have one cohesive investment strategy in line with your individual risk tolerance, capacity to take risk and investment objectives.

Access to financial planning and additional services

When you have a pension with an old employer are you getting any advice on it?

Are the underlying investment assets suitable?

I think back to 2008. Numerous pensions of people who were due to retire in the near future were significantly damaged.

A contributor to this was the pensions sitting with old employers (and also current employers) and no ongoing advice being provided by the scheme advisors.

Definitely not to members who had left service anyway.

If we consolidate your pensions for you, you become our client.

We will work with you to ensure your pensions are invested accordingly in line with your risk tolerance, capacity for risk and investment objectives.

Control over access to your pension

Usually, in an employers scheme, you will have to draw the benefits at Normal Retirement Age.

By consolidating your pensions, you decide.

You don’t have to draw them until age 75.

As a pension is a tax-free growth vehicle, this essentially means you can park them and let them grow tax-free.

If that’s not your thing and you want to get your hands on the pension early, you can access them as early as age 50.

If it remains in the scheme, the scheme Trustees have to sign off on this.

Difficulty accessing the pension

In the corporate world today mergers and acquisitions are common. Companies liquidate.

This means Trustees of pension schemes change.

It’s not uncommon for an ex-member to try to get money out of a scheme and they can’t get a Trustee to sign off on it as the Trustees are no longer there and the people there now know little or nothing about it and don’t feel comfortable.

See client case study #2 below.

By consolidating you take control and charge.

The cons of consolidating your pensions

Costs

The only one to watch out for, costs. And you have to be careful.

It’s not unheard of for a large corporate scheme to have a really low Annual Management Charge.

You could potentially move this from a low charge to a higher charge.

For example, if you were moving from a 0.30% per annum charge to a 0.75% per annum charge it’s important to know.

That’s not to say you shouldn’t. You can. But you have to be 100% in the knowledge your charge is going up and there are reasons to support it.

Any advice you receive on a pension consolidation exercise should fully disclose all fees and charges upfront.

At Fortitude Financial Planning we disclose everything in black and white.

We don’t just slip in a disclosure document which is pages upon pages of black and white text with the charges tucked in away at the end.

We disclose all upfront in a letter from us to you. Honesty, and transparency.

It could be the extra charge is for additional services like financial planning but you have to ensure it’s disclosed to you.

Client Case Study One

Gary held three different pensions from various employments.

The most recent being from a period of running his own company which was now wound up. All three pensions were with different providers.

The issue Gary came to us with was having pensions in different places was time-consuming for him to get updates on his portfolio and put them together.

We also flagged that when it came to pension drawdown time, each different administrator needs to know about the other to ensure no Revenue limits are being broken and this can cause an unnecessary delay in accessing benefits.

Gary completed some straightforward paperwork remotely with us, and we presented a consolidation option.

Gary’s pensions will now be with one provider, there are no additional costs and Gary avails of our full financial planning service.

When Gary wants an update on his portfolio, he has one online logon he can access via an app on his phone.

Additionally, when Gary turns 50, he will be able to access his pension funds tax-free lump sum should he choose to do so.

Client case study two

John contacted us trying to access an old pension benefit from way back. The problem was the company his employment was with was now liquidated.

To compound the problem, his old employer (who no longer existed), were the appointed Trustees on the scheme.

This meant they had to sign off on John drawing his benefits – but they couldn’t as they no longer existed.

The company who took them over wouldn’t sign off on it as they didn’t know about it.

So John’s pension was stuck in the scheme – he couldn’t access it.

We eventually arranged a signature but this caused close to a four-month delay for John getting access to his tax-free cash.

If this pension had been put in John’s name when he left employment that situation wouldn’t have risen and he could have accessed his benefits immediately.

Should I consolidate?

The answer is different for everyone. For some, it may make sense and be yes, for some, it may not make as much sense.

The important thing is you undertake a review to provide clarity on your options and what’s best for you.

If the end result is to leave where they are, at least you’ve given your pensions an NCT and you know what is what, where it is and how much you are paying.

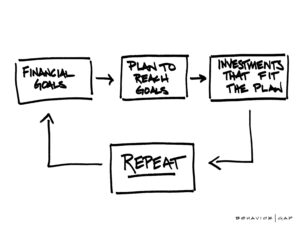

3 Simple Steps to Review and Consider Consolidating

- Provide us with some initial information – this is all done via our remote portal for your convenience

- Leave it with us, we will review your pensions, advise you whether it’s best to consolidate and if so provide you with consolidation options

- If the recommendation is to consolidate, we will implement your plan for you

Great, review my pensions now!

How we help – review of your old employers’ pensions

If you hold a pension with an old employer we can review it with you.

We also provide a pension tracing service – this falls under the umbrella of our second opinion service.

All we require are a few simple details from you and we will trace your old pensions down for you, review them and provide our opinion.

Get in touch

Drop me an email, francis@fortitudefp.ie or request a callback.

You can also give me a call on 086 0080 756 or access our diary here and book a call at your convenience.

Visit our insights.

A multitude of information on various financial subjects covering all aspects of saving, investing, financial planning, protection and pension advice.

Our blog posts are intended for information purposes only and should not be interpreted as financial advice.

You should always engage the services of a fully qualified financial planner before entering any financial contract.

To discuss engaging the services of Fortitude Financial Planning please email us at info@fortitudefp.ie.

Fortitude Financial Planning Ltd will not be held responsible for any actions taken as a result of reading these blog posts.

Production

Production