Approved Retirement FundApproved Retirement Fund (ARF) Strategy: Money, Inflation and Longevity

When considering your retirement options and your ARF, how much thought do you give to how long you might live and inflation?

It can be an uncomfortable reality to consider, but this shouldn’t dissuade you from giving it some serious thought.

For many people preparing for retirement, one of the biggest fears is running out of money.

If you’ve lived to 65 years, you will probably live to at least 79* years if you’re male and 83* years if you’re female, according to Social Security tables.

These are only estimates, but it’s important to keep in mind that you might live much longer than you expect, and some household members could outlive others by many years.

You might, in fact, live to 100 years and beyond: the National Institute on Aging anticipates that the number of centenarians will grow by a factor of 10 during the first half of this century, representing a host of challenges for anyone attempting to devise a retirement strategy.

Approved Retirement Fund (ARF)

Firstly, let us recap what an ARF is.

An ARF is a post-retirement investment vehicle.

It allows you, when you take your lump sum, to continue to invest the balance of your pension fund in retirement.

An ARF provides you with flexibility and control of how you draw your pension income.

It also affords you the opportunity to pass on your pension fund to your estate, subject to relevant taxes.

However, it remains invested and is subject to the vagaries of the investment market.

You can learn more about an Approved Retirement Fund by clicking here.

Inflation

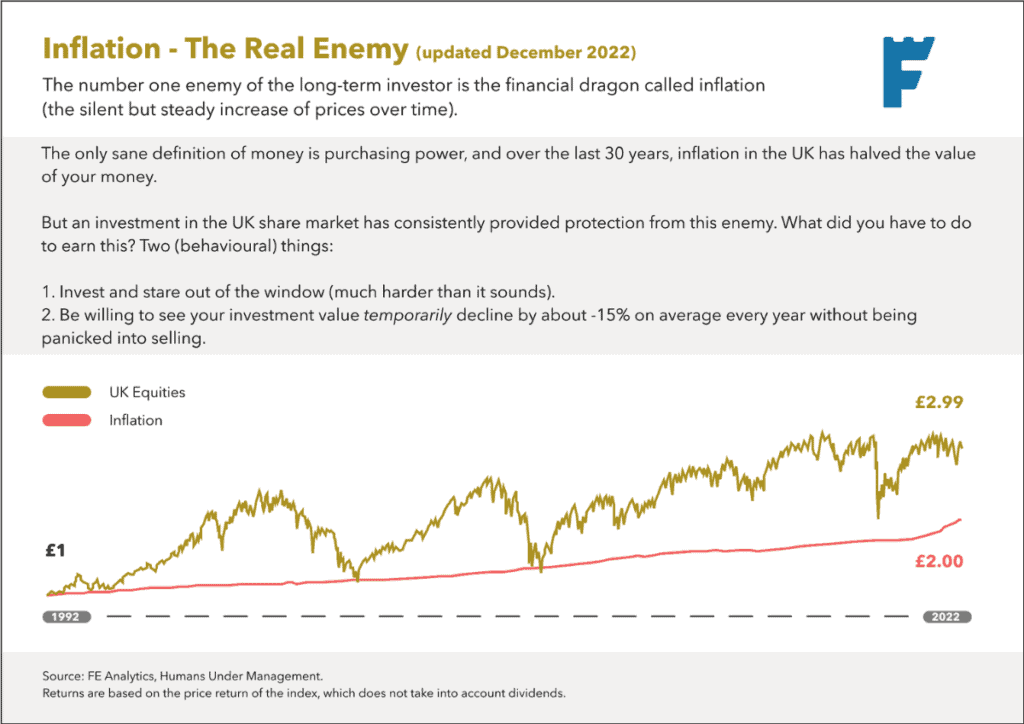

Secondly, what is inflation and how does it affect your retirement?

We’ll keep this simple, inflation is the cost of goods rising.

It is essentially a tax on your hard earned money.

Understanding inflation and how it affects your wealth is crucial for creating an effective long term plan.

You can grab your free guide to inflation by clicking here.

Living Costs

Have you given consideration to ongoing potential lifestyle costs?

Such as healthcare costs which should be incorporated.

As you age, your healthcare needs will likely grow.

From simple doctor’s visits to potentially living in an extended care facility.

These costs, along with everything else, naturally increase over time with inflation.

So, while you can look at today’s prices as a guide, you will likely need much more money to cover your healthcare in retirement.

Your ARF Investment Strategy

Your ARF investment strategy should include a spending plan that considers the likelihood that you will want to travel, pursue your interests, and spend time with your family.

Particularly in the first 5 to 10 years of retirement when you are likely to be more active.

As well as allowing for a long life and covering the associated financial expenditures.

Unless you are working beyond retirement age, it can be difficult to make up for a market dip, emergency expense, or heavy spending, so your strategy should cover many circumstances.

How much will you need to withdraw per year without diminishing your account too quickly, while still controlling for inflation and other factors?

Factoring this into your ARF retirement drawdown strategy is essential.

Other factors to consider include focusing on tax-efficient withdrawals from your ARF.

Are you taking more than you need to? Is this causing you to pay more tax than you need to?

You might also decide that working longer or taking your state pension later (allowable from 2024) could help your retirement strategy further.

How we help

Do you hold an Approved Retirement Fund are you being faced with your retirement options?

An Annuity or an ARF?

It’s important your ARF investment strategy is optimized around how you spend.

After working hard, it’s important to live how you want to live in retirement.

We can create a financial plan specific to you.

We’ll get to the bottom of what’s important to you, what you do, and what you want to do.

Then, you’re ARF will be set up to support you.

We can build in anything you want to, and we’ll discuss your requirements, and what you want to consider.

The result, you’ll feel better and more confident.

The alternative, a silly, one size fits all off the shelf investment provided by a bank or corporate advisory company.

If you would like to discuss the above, schedule a call with us.

Get in touch

To discuss further email us at info@fortitudefp.ie or request a callback.

Alternatively, you can get us on 086 0080 756 or access our diary here and book a call at your convenience.

Why not visit our insights.

A multitude of information on various financial subjects covering all aspects of saving, investing, financial planning, protection and pension advice.

Our blog posts are intended for information purposes only and should not be interpreted as financial advice.

You should always engage the services of a fully qualified financial planner before entering any financial contract.

To discuss engaging the services of Fortitude Financial Planning please email us at info@fortitudefp.ie.

Fortitude Financial Planning Ltd will not be held responsible for any actions taken as a result of reading these blog posts.

*www.cso.ie

Production

Production