Are you planning early retirement? Here are 4 considerations for you

Do you dream of retiring at 60?

How about retiring at age 55?

If so, you might want to think again before you make the move.

If your heart is set on leaving work early, be sure you leave with the right mindset.

And the correct estimation of your financial circumstances.

Here are 4 key considerations for you if you’re planning or considering an early retirement.

We’re covering a combination of both financial and personal considerations.

Retire with a realistic picture of your income needs.

A report by the Irish Time in January 2022 stated that one in three workers in Ireland have no private pension coverage.

This was based on data from the Central Statistics Office (CSO).

Across the pond in the USA, in late 2006, the Center for Retirement Research at Boston College surveyed 400 private sector employers.

Those employers estimated that 25% of their employees between 50 and 60 years old lacked the financial resources to retire even at the traditional retirement age.

Expenses in retirement don’t drop as much as one would think.

Most people place too much emphasis on the effect being mortgage free will have on finances.

We estimate most people’s retirement expenses would be in the region of 80%-90% of pre-retirement expenses.

Every day becomes a Saturday and Sunday, more time equals more expenditure.

So, you need to determine if the income derived from your private pension and other sources can meet your needs.

Remember, the state pension is payable from age 66 (subject to ongoing review).

Even then it’s only €13k per annum.

Retire with the idea that you’ll live to be 100

With recent advances in health care, you might become a centenarian.

That means your income streams may need to last 20, 30, or even 40 years.

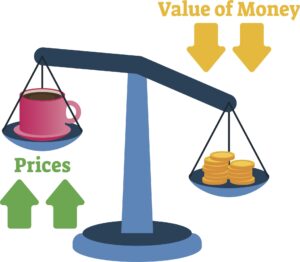

Any income streams that you have today may need to be supplemented or adjusted due to unforeseen needs and inflation.

Many new retirees make the mistake of withdrawing income at too high a rate in the first few years after leaving work.

They live “high on the hog” for a while, only to discover, to their chagrin, that their retirement nest egg is shrinking because they are spending more than their portfolios can earn back.

This may point you in the direction of part-time employment rather than total retirement.

Which isn’t necessarily a bad thing if you’re in a position where you want to work, not because you have to work.

Retire with a purpose

Leaving work behind can be exhilarating.

But after the first few months of fun, you may also face the question, “Now what?”

Early retirement is better with a plan for purposeful and meaningful living regardless of your finances.

If you do a Google search with the right keywords, you’ll come across a number of articles about people who chose to retire late.

They kept working out of passion or necessity.

We would prefer it to be out of passion or want, not a necessity.

If that’s not for you, and you don’t want to work much longer, talk to us, and we’ll take a look and see if you are financially prepared to retire.

We’ll share our professional insights and discuss how feasible it is and discuss your options.

Top Tip

Take a sheet of paper and create 8 columns.

Across the 8 columns create 4 rows, you should now have a total of 32 boxes.

Leave the top left box blank, underneath, headline the next three rows morning, afternoon, and evening.

Across the top row, name the columns Monday, Tuesday etc.

Here is your weekly time planner, morning, afternoon and evening across all 7 days, fill in the blanks.

Do you have a purpose?

How do you picture your future?

If you are like many people who are contemplating retirement, your view is likely more pragmatic compared to your parents.

This doesn’t mean you must have a “plain vanilla” tomorrow.

Even if your retirement savings are not as great as you would prefer, you still have lots of potential to design the life you want.

With that in mind, here are some key things to think about.

What do you absolutely need to or want to accomplish?

If you could only get four or five things done in retirement, what would they be?

Answering this question might lead you to compile a short list of life goals.

While they may have nothing to do with money, the financial decisions you make will be integral to achieving them.

What would revitalize you?

Some people retire with no particular goals at all.

Others are simply burnt out.

After weeks or months of respite, ambition returns.

They start to think about what pursuits or adventures they could embark on to make these years special.

Others have known for decades what dreams they will pursue, and yet, when the time to do so arrives, those dreams may unfold differently than anticipated and may even be replaced by new ones.

In retirement, time is your most valuable asset.

With more free time and opportunities for reflection, you might find your old dreams giving way to new ones.

You may find yourself called to volunteer as never before or motivated to work again in a new context.

Time can also be your biggest enemy if you’ve no purpose.

Who should you share your time with?

Here is another profound choice you get to make in retirement.

The quick answer to this question for many retirees would be “family.”

Today, we have nuclear families, blended families, and extended families; some people think of their friends or their employees as family.

You may define it as you wish and allocate more or less of your time to your family as you wish (some people do want less family time when they retire).

Regardless of how you define “family” or whether or not you want more “family time” in retirement, you probably don’t want to spend your time around “dream stealers.”

If you have a grand dream in mind for retirement, you may meet people who try to thwart it and urge you not to pursue it.

Hopefully, these people are not in close proximity to you.

Reducing their psychological impact on your retirement will increase your happiness.

How much will you spend?

We can’t control all retirement expenses, but we can control some of them.

The thought of downsizing may have crossed your mind.

You can also lose one or more cars (and the insurance and other costs that goes with them).

Ditching or reducing premium TV can bring more savings.

Garage sales or making donations can have financial benefits while also helping you reduce clutter and generating cash.

What about inflation? Have you considered that?

Summary

So, how are you preparing for retirement?

This is the most important question of all.

Not only do you need to prepare financially, but you also need to prepare for the transition.

The transition to more time, the transition to your second life.

How We Help

If you feel you need to prepare more for the future or reexamine your existing strategy in light of recent changes in your life, contact us.

It’s a smart move.

On the personal side, we may be limited as to how we can help you.

On the financial side, however, we can definitely help you.

We can map out where you are and where you are heading.

Particularly, we can tell you how well prepared or ill prepared you are for early retirement.

Furthermore, we can advise you on what changes to make to become better prepared or consolidate your plans.

As a result, you’ll have a plan for, and confidence in your finances.

Leaving you to focus on the other aspects.

Get in touch

Email us at info@fortitudefp.ie or request a callback.

Alternatively, you can get us on 086 0080 756 or access our diary here and book a call at your convenience.

Why not visit our insights.

A multitude of information on various financial subjects covering all aspects of saving, investing, financial planning, protection and pension advice.

Our blog posts are intended for information purposes only and should not be interpreted as financial advice.

You should always engage the services of a fully qualified financial planner before entering any financial contract.

To discuss engaging the services of Fortitude Financial Planning please email us at info@fortitudefp.ie.

Fortitude Financial Planning Ltd will not be held responsible for any actions taken as a result of reading these blog posts.

Production

Production