Saving versus Investing

Many financial planners talk about saving & investing.

Unquestionably key elements of financial planning.

But what is saving?

What is investing?

Is there actually a difference?

Read on, learn more.

Furthermore, hopefully, you’ll learn a bit more about when to save and why and when to invest.

What is saving?

Let’s keep it simple.

When we talk about saving, we are thinking about the bank.

Or the credit union.

Savings accounts with no investment risk or market volatility.

Low risk, extremely low (no?) return.

The only risk these generally carry is ‘inflation risk’.

What is investing?

Investing is committing money in order to earn a financial return.

The opposite of saving, investing carries volatility.

Volatility that is dictated by investment markets.

Nonetheless, unlike saving, when investing, you generate a return on your money.

Your reward for accepting the market volatility is growth in your money.

Instead of low risk no return, you take the risk and get a return.

Why invest?

So, why should one invest?

The main reason, a buzzword of 2022, inflation.

Inflation is the general increase in prices, the cost of living.

Simple, if everything is going up in price but the bank and credit union offer no return, we need to look elsewhere.

Otherwise, our money in the bank just decreases in value.

This is the ‘inflation risk’ referred to earlier in the article.

So, firstly, the main reason to invest, combat inflation.

Secondly, another reason, compound interest. Interest, added to interest added to interest.

Do you plan to be on this earth 5 years from today?

Of course you do, so you have to invest, sensibly.

When should you save?

When thinking of saving or investing, start with the end in mind.

Firstly, ask yourself “what am I saving for?” or ‘what am I trying to achieve with this money?”

Short Term

For short term goals, money should be saved in the bank or credit union.

When thinking short term, think within the next 5 years.

The reason being investment markets can be volatile within a 5 year time frame.

Some common and consistent short term goals we see with clients:

- Emergency fund (typically 3-6 months net after tax income)

- Family holiday this year or next

- Mortgage deposit

- Home improvements

- If the kids are in college, the next couple of years college fees

Think ‘5 year rule’ – less than 5 years, save, longer than 5 years, invest.

When should you invest?

When investing we’re thinking further down the track.

4 or 5 years plus, medium to long term.

You do plan on being on this earth 5 years from today, don’t you?

100%, without a doubt there is zero point in leaving money in the bank or credit union for this amount of time.

Remember inflation risk?

No return, inflation reduces the value.

Consequently, we need growth, and we achieve this through investing, sensibly.

Medium Term

Medium term, maybe think within the next 5-10 years.

Here are some common medium term objectives we would see with clients:

- If the kids are younger at the moment, future college fees

- Regular, consistent ongoing family holdays

- Changing of the family car at regular intervals

- Holiday home purchase

- Or, generally just to fight inflation

Long Term

Long term, think 10 years plus.

Some of the common longer term objectives we see would be:

- If the kids are really young, under 8, college fees

- Potential home deposit or wedding fund for the kids

- Retirement planning (pension)

- Long term growth of assets and potential to leave a legacy to the loved ones

Before Investing (sensibly)

So you now have the concept of saving and investing.

Even so, here’s an important checklist prior to kicking off your investment journey:

- Save your emergency fund, ideally 3-6 months of net after-tax income

- Clear any high interest crappy debt – think bank and credit union loans

- Hold enough short term cash (remember the 5 year rule)

One More Thing

You may notice the word ‘sensibly’ after the word investing.

This means you should invest sensibly.

Investing in one or two stocks or shares is not sensible.

Directing 100% of your investible assets to a DIY approach is not sensible.

What is sensible is carrying a diversified portfolio.

Exposure to hundreds if not thousands of different stocks and shares.

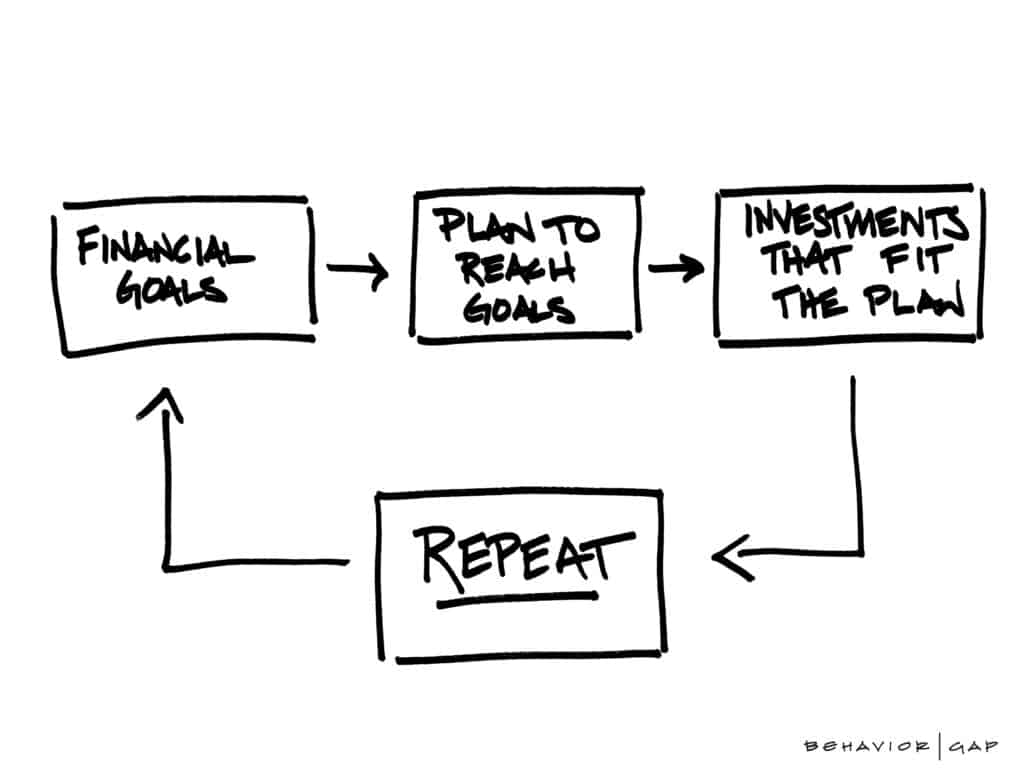

Having an investment strategy aligned to your tolerance for investing, your capacity to invest and what you actually want to achieve.

That’s sensible.

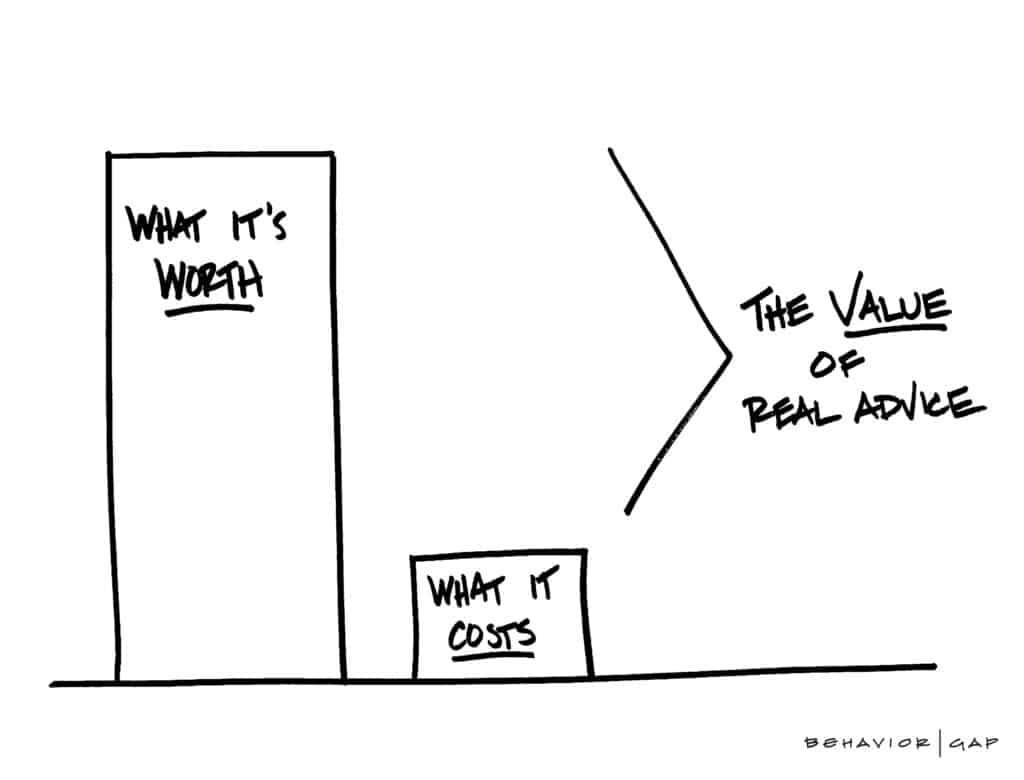

How We Help

Finances can be complicated and cause worry.

The current cost of living crisis and inflation can cause anxiety.

You may hear all this talk about investing, want to invest but don’t know where to start?

Maybe you just want to grow your assets and wealth.

We can work with you and create a sensible investment plan with you.

A plan that caters for:

- Your tolerance for investment risk

- The capacity you have for investment risk

- And of course, your financial objectives

We will empower you with the knowledge you need to stick to that plan.

Even when markets are volatile.

You’ll be invested in line with our investment philosophy which will be your roadmap.

Consequently, you’ll be wealthier for it.

Get in touch

Email us at info@fortitudefp.ie or request a callback.

Alternatively, you can get us on 086 0080 756 or access our diary here and book a call at your convenience.

Why not visit our insights.

A multitude of information on various financial subjects covering all aspects of saving, investing, financial planning, protection and pension advice.

Our blog posts are intended for information purposes only and should not be interpreted as financial advice.

You should always engage the services of a fully qualified financial planner before entering any financial contract.

To discuss engaging the services of Fortitude Financial Planning please email us at info@fortitudefp.ie.

Fortitude Financial Planning Ltd will not be held responsible for any actions taken as a result of reading these blog posts.

Production

Production