How would you cope if your income dropped to €10,556 per annum?

You’re working away, life is good.

Then, an illness or injury has caused you to be unable to work.

You are beyond your employer’s sick pay period (typically 3 or 6 months if any) and no longer have your salary coming in.

Your only income is the state illness benefit of €10,556 per annum.

This is assuming you meet the necessary PRSI contribution criteria to receive this.

Now, let’s assume you are on the average annual full-time employee salary of approximately €49,000*.

That is the equivalent to a 79% reduction in your income coming into your household (assuming you are the sole earner in the household).

If there are two income earners in the household, both earning the average annual full-time employee salary of €49,000 that is a 40% reduction in income coming into the household.

Note – if you’re self-employed there is no illness benefit from the state so you have no income coming in at all!

Nothing, nada, zilch.

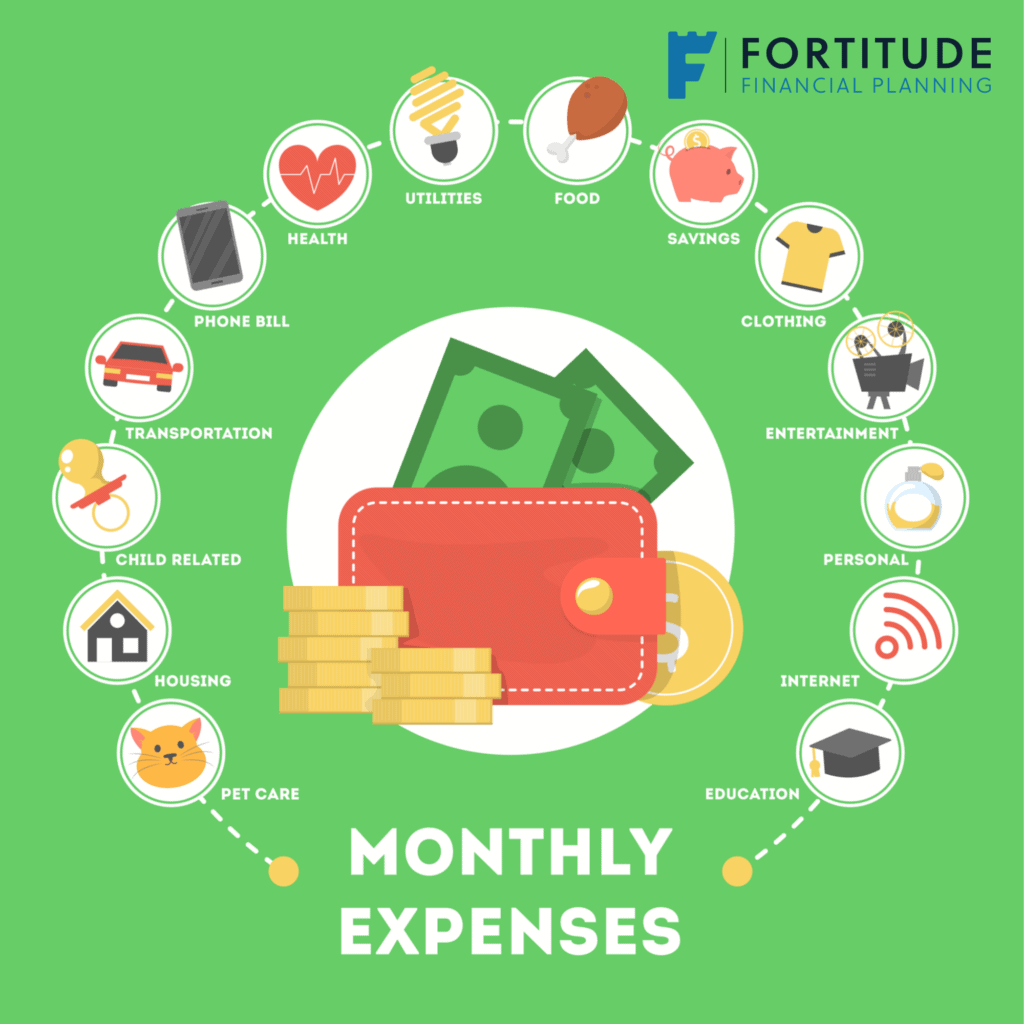

Does your mortgage repayment reduce by the equivalent income % reduction? No.

Do your household bills reduce by the equivalent income % reduction? No.

Does your food shop reduce? No.

Do your medical bills reduce? No, in fact, if you are off work long term sick due to illness or injury they are likely to go up.

You get the picture I’m painting.

How can you avoid this scenario?

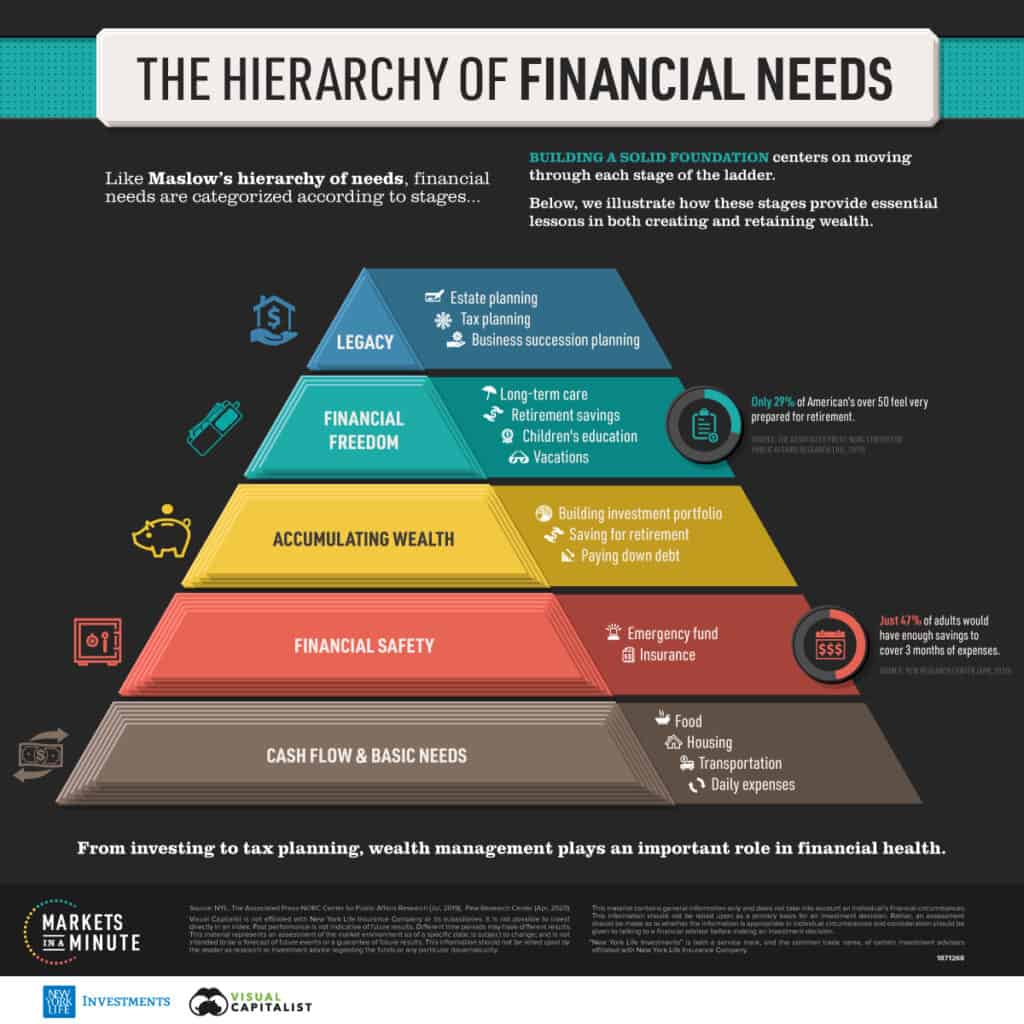

Before anyone looks at any financial product like a pension, car insurance, house insurance, life insurance, pet insurance your number one commitment should be income protection.

Your most important asset is not your family home.

It’s not your car or the holiday home.

Your most important asset is your income and your ability to earn it.

This is what pays for the family home, the car, puts food on the table, clothes on the family, pays for the holidays and the insurances etc.

If you had a money making machine in the garage that printed €50 notes for you, would you be worried about it breaking down?

Of course you would.

If you could effect insurance to replace those €50 notes should it break down, would you?

Of course you would.

In your family life, you are the machine that earns the money and you have to protect the money against the machine breaking down.

I’m healthy, it’ll never happen to me.

We all go through life thinking we’re bulletproof until we feel that pain or niggle that won’t go away.

A story close to home for me, a 26 year old male with a young family and home to keep.

Playing footgolf, 30 minutes after finishing his knee gave way.

Long story short, a torn meniscus in his knee, surgery required with expected 6-12 months out of work.

Cancer in Ireland 2020 – 45,753 new cases.

Every 3 minutes in Ireland someone gets a cancer diagnosis**

Almost 45,000 people in Ireland get cancer every year.

We’re not bulletproof.

We can all get sick or injured.

I have savings, I’ll use them

Some think, I have accumulated savings and investment, I’ll use them.

You’d be surprised at how quickly your savings would erode.

Lets assume a potential claimant has €50,000 saved.

Monthly household outgoings of €3,000.

The €50,000 would last just 17 months.

However, practically, if one has worked so hard to accumulate a nice level of savings and investments, it would be foolish to be happy to then use these to live on day to day.

Also, as a famous retail store my wife shops in says, when it’s gone, it’s gone.

It’s a waste of money, insurers never pay out

A common theory.

One I don’t think will ever cease to exist.

I wrote a specific article on this putting paid to this myth.

So what is income protection?

Put simply, Income Protection is a type of protection that replaces a % of your income should you be unable to work mid-long term due to illness or injury.

It means you still have a regular income being received and are still able to meet your financial commitments.

It is the solid foundation of ANY financial plan.

Here is another article written about income protection.

This article breaks it down further even into business owners and PAYE workers.

It also tells you how you can claim the tax relief by way of a tax credit.

How much income protection do I need?

The maximum allowable benefit is 75% of your salary (including any state illness benefit you may be entitled to).

When creating any financial plan, if a client can’t afford the maximum benefit it can be scaled back to cover 2/3rds of their salary or even 50% of their salary.

Ultimately, 50% coverage is better than zero coverage.

Example 1. You are an employee, salary of €40,000 then the maximum benefit allowable is €19,444 (€40,000 x 75% less €10,556 state illness benefit).

Example 2. You are self-employed. Drawing a salary of €50,000 from your company, the maximum allowable benefit is €37,500 (€50,000 x 75% – remember us self-employed don’t receive any state illness benefit!)

How much does income protection cost?

The cost varies.

A few things that affect the cost but are not limited to are age, smoker status, occupation.

Typically speaking the more manual your occupation the higher the risk of a claim therefore the higher cost.

Some occupations can’t even get the cover.

Note however Revenue recognizes the importance of this cover for an individual and allow full tax relief at the rate of tax you pay.

So if a monthly premium was €150 per month, the actual cost to you is €90 (€150 cost minus 40% tax relief).

Yes, that is correct, Revenue will actually pay you to take out this cover.

Furthermore, if you are self-employed drawing a salary from your Ltd company the company can provide this benefit to you and the full cost is tax-deductible against corporation tax.

How long can income protection pay me for?

Income protection will typically pay you till the earlier of you returning to work or reaching the nominated retirement age under the policy.

It can potentially pay you until retirement age.

Summary

If you’re still reading I hope I have underpinned the importance of income protection and outlined it as the basis of any solid financial plan.

As mentioned previously, before one looks at car insurance, home insurance, pet insurance etc, income protection should be number one on the agenda.

Particularly where there is a sole or main earner in the household or where there is a significantly higher salary aligned to one earner.

Your income is your main asset.

It makes no sense that someone would insure their car, home or pet and not insure their income.

Some of us will get sick, some of us won’t. That’s life.

I hope you take the decision to protect against the possibility.

So, that in the event it does happen, you still have a regular % of your salary being paid to you.

This will then allow you and your family to concentrate on getting you better with no financial burden.

How we help

We specialise in income protection arrangements.

We will work with you to find a level of benefit and cost you are comfortable will.

There are many product variations available on the market for income protection and therefore it’s important the consumer takes advice.

We work with all of the market providers and deal specifically with those who have a trustworthy claims experience and claims record.

Our worst nightmare would be an income protection claimant being declined a claim.

We assess providers to ensure our clients are getting the best available product.

Contact Us

Take the first step to protecting your income with us and request a callback.

Alternatively, drop me an email, francis@fortitudefp.ie or give me a call, 086 0080 756.

You can also access our diary here to book your specific protection consultation.

We have over 30 individually written articles we’ve written on various financial planning subjects and they can be accessed here.

A wealth of free information covering all aspects of saving, investing, financial planning, protection and pension advice.

Francis McTaggart CFP® SIA RPA QFA

These blog posts are intended for information purposes only and should not be interpreted as financial advice.

You should always engage the services of a fully qualified financial planner before entering any financial contract.

To discuss engaging the services of Fortitude Financial Planning please email us at info@fortitudefp.ie.

Fortitude Financial Planning Ltd will not be held responsible for any actions taken as a result of reading these blog posts.

*Source – Central Statistics Office

**Source, Irish Cancer Society

Production

Production