Financial Planning Priorities in Your 50’s

In our recent insights, we looked at financial priorities for those of us in the 20’s, 30’s and 40’s decades.

Continuing the trend of decades, here we will zone in on the 50’s!

They say life begins at 50 right?

Or is that wrong?!

Your 50’s

Turning 50 is a milestone for a number of reasons.

Children are grown (or growing), big debts, such as saving for college and the mortgage, make less of a dent.

However, as with any decade, financial planning in your 50’s is tricky, however, no less important.

For many in their 50’s, a target retirement age is now in sight.

As we get older, time seems to move faster as well.

Let’s say you plan to retire at 65 and you’re age 50, 15 years away.

Do you remember what you were doing 15 years before at 35? Does that seem close?!

You now really understand how quickly 15 years can get by you and the importance of avoiding bad money choices as retirement nears.

Once you hit 50 plus, retirement all of a sudden doesn’t seem that far away.

Create a Budget

Budget, zzzzzzzzzz!

Again, start with a budget.

One can’t get a handle on their finances without an idea of what’s coming in versus what’s going out.

As always, Click here and learn more about creating your budget and download our free budget template.

Priority #1 Map out your strategy

Spend a weekend gathering your financial information.

Your savings, investments and other assets as well as your debts and bills.

Then, move on to priority number 2 and map out your strategy for retirement.

Seeing all of the details of your finances and setting goals for your life beyond work will expose the gap, if any, between your plans and savings.

It will also spur you to close that gap while you still can.

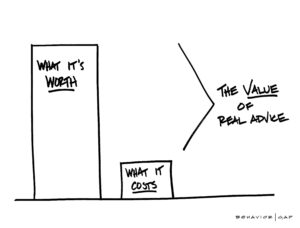

Priority #2 Meet with a financial planner, set a tentative retirement date

How’s your overall retirement plan?

Do you have one? Do you have a strategy for implementing it?

Creating a plan “will pay huge dividends.”

You’ll get a psychological boost from having a plan, and you can use it to check your progress toward retirement.

If you don’t have a plan, then a Certified Financial Planner, CFP® can help you prioritize your goals.

A CFP® will have objective, unbiased opinions and see things that you do not.

We can even stress-test different good and bad scenarios that could happen before and during retirement.

This is a good moment — while there’s still time for course corrections — to make sure you haven’t missed any crucial piece of planning.

Even people who comfortably manage their own investments can profit from one or two meetings with a financial planner.

Priority #3 Avoid Major New Debt

Many people consider downsizing, or rightsizing, their house.

The kids have flown the nest, the house is too big.

However, consider how your cash flow will work in retirement and what impact that would have.

If your planned changes are a big part of the spending pie, consider your options.

Priority #4 Pay off debt aggressively

When you retire, interest payments on debt can eat up your limited income.

In turn, this can make it difficult to pay off loan balances.

Now, in your highest earning years, is the time to aggressively eliminate non-mortgage debt.

This is anything from credit cards to bank and credit union loans, car loans and anything in between.

All crappy debt.

One of our favourite ways to deal with this is to write down details of your debt including outstanding amounts, repayments, and importantly, interest rates.

After creating your budget, allocate additional cash to the repayment of the debt with the highest interest rate until that is clear.

When that is clear, allocate that full repayment saving to the debt with the next highest interest rate.

And so on until you are debt free.

Priority #5 Take Stock of where your mortgage is at

In a previous era, workers tried to enter retirement with no debt at all.

Paying off the mortgage before retirement still is a good goal, but it’s not always possible today.

Take stock of when your mortgage is due to be clear, is it pre or post your planned retirement age?

Once you know this, you can work with your financial planner on whether it’s a good plan to accelerate payments to the mortgage.

Whilst it is not the be all and end all, you can’t discount the psychological value, at least for some people, of owning their home free and clear in retirement

Priority #6 Plan to Invest for decades to come

Assuming you plan to retire at 65, it’s easy to look at 65 as the “finish line”.

However, the fact is you are likely to live for another 20 years or more.

If you are 50 today, that’s 35 years of market ups and downs, inflation, and all the rest of it.

While moving toward more conservative investments can psychologically make sense as you get older, don’t overdo it.

You’ll need the power of compounding to ensure that your money maintains its real value and lasts well into your later years.

Playing it safe is a natural inclination at this stage in life.

You want to protect your hard-earned savings, but if your savings don’t at least keep up with inflation you’ll lose spending power.

The solution?

Keep a good portion of your retirement savings invested in the stock market.

Because retirement is a stage of life that can last 20 or 30 years, there’s time to recover if some of your investments lose value.

Priority #7 Maximise your pension contributions

If your employer matches a portion of your pension contributions, take full advantage of the free money — no matter your age.

If your employer matches up to 5%, for example, you contribute at least 5% to capture that gift.

Nevertheless, this is a decade where you should be looking to get as much into your pension as possible.

There is a clear reason the age-related maximum contribution allowance increases as we get older, we’re expected to have more disposable income.

Practically, we have fewer commitments, fewer debts, and less expenditure.

Get as much as you can into your pension and avail of the tax relief.

The bottom line, time is running out to avail of this priceless opportunity.

Click here to learn more about the tax benefits of your pension.

Summary

To summarise, and be brutally honest, when you are in your 50’s, time is running out between now and retirement.

The longer you put making a plan on the long finger, the less time you have to make any corrections.

The state pension in Ireland is just under €14,000 per annum.

Assuming you earn €50,000 and have no private pension, that’s a 72% drop off of your income in retirement.

Do you have an equivalent 72% drop in expenses? Absolutely not.

How we help

We can and would be delighted to help you with this.

We can create a plan for you, tell you what you are doing correctly and what changes to make to improve your situation.

Without a doubt, you will feel better about it and in control.

You can schedule your initial financial planning meeting by clicking the link below.

Schedule my initial Financial Planning Meeting

Get in touch

Questions?

Email us at info@fortitudefp.ie or request a callback.

Alternatively, you can get us on 041 213 0307.

Why not visit our insights.

A multitude of information on various financial subjects covering all aspects of saving, investing, financial planning, protection and pension advice.

Our blog posts are intended for information purposes only and should not be interpreted as financial advice.

You should always engage the services of a fully qualified financial planner before entering any financial contract.

To discuss engaging the services of Fortitude Financial Planning please email us at info@fortitudefp.ie.

Fortitude Financial Planning Ltd will not be held responsible for any actions taken as a result of reading these blog posts.

Production

Production