Financial Planning Priorities in your 20’s

Financial planning is important at any stage in life.

However, there is truth when you say you can make it easier on yourself in later life if you start earlier.

No one has to make sweeping changes to their finances however small steps you take will set you off on the correct track.

We are going to look at different financial priorities and things to do in the different decades of your life.

In this article, we will kick off with what you should be doing in your 20’s.

Your 20’s

In your 20’s you establish habits that will follow you throughout your life.

This is the stage when you might commence your career.

You may get married, be preparing to start a family or even start a family.

Once you adopt good financial habits in your 20’s, your future self will be in a much better place.

Create a Budget

Before you move on to your financial priorities, you have to create a budget.

A budget is not about restricting yourself.

It’s about being conscious of where your money is going.

As a result, you know what resources you have to direct to your various priorities.

Click here and learn more about creating your budget and download our free budget template.

Priority #1 Establish the habit of saving

Firstly, your number one financial priority and a really good habit to adopt early on is the ability to save.

Saving doesn’t equal depriving yourself of nice things.

Create your budget and set up your savings account.

Automate your contribution to your savings account, treat it like a bill.

You can also look for ways to reduce larger recurring expenses so that you have more money in your pocket to put toward your savings and investing goals.

For example, once you create a budget, you can cut or eliminate spending on budget-busters such as dining out or a seldom-used gym membership if you start to cook more at home or exercise outdoors.

Embracing frugality will allow you to spend more on the things that are the most important to you now and will establish responsible financial behaviors that will serve you well beyond your 20s.

Priority #2 Build an Emergency Fund

One of the most important things, build an emergency fund.

Why? Because stuff happens. Life happens.

People can lose jobs without notice.

Health issues or accidents can crop up.

Stuff breaks down, cars, and home appliances.

These are just a few reasons you need an emergency fund.

As a rule of thumb, we recommend aiming for 3-6 months of net after tax income or 3-6 months of living expenses.

Keep this in a low risk account like a bank or Credit Union.

Start saving now to accumulate this.

Priority #3 Get income protection

Undoubtedly, the most important financial product anyone can have is income protection.

Income protection pays you a % of your salary should you be unable to work due to illness or injury.

You may be lucky and have an employer who provides this.

As a result, you wont have to pay for it yourself.

If your employer doesn’t provide this for you, you’ll get tax relief at your rate of income tax on the cost.

Therefore, if you pay 40% income tax, you’ll get 40% off the cost.

As well as that, taking it out in your 20’s it will be cheaper still.

Income protection will ensure if you get sick or injured, can’t work, you’ll still have a good % of your salary.

You can learn more about income protection by clicking here.

Undoubtedly, if you work and earn, you need income protection.

Priority #4 Start to Save for a Mortgage Deposit

It should be noted, the average age of purchasing a house in Ireland is 38.

Unfortunately, one of the most difficult things to do at the moment is get on the property ladder.

Nevertheless, unless you want to be paying rent in retirement, you need to put the wheels in motion to get on it.

Thus, the earlier the better.

As well as this, the larger deposit you have, the lower the mortgage, and the less interest you pay.

Therefore, create a seperate saving and investing account for your future mortgage (see priority #6).

Priority #5 Plan to Get out of debt

Are you carrying any debt?

Bank loan? Car loan? Student loan? Credit card?

This is all bad debt, high interest stuff.

If you have a credit card, cut it up.

If this is the case, start allocating a higher repayment to your debt.

Firstly, note down all of your debts and their relevant interest rates.

Secondly, increase your payment to the debt with the highest rate.

Thirdly, when that debt is clear, take your repayment amount and apply it to the debt with the second highest interest rate.

And so on.

As a result, you will work your way through your debt, clearing the high interest rate stuff first.

When done, start saving your repayments.

Priority #6 Start Investing

Undoubtedly, one of the best hacks to create long term wealth is through investing sensibly.

For example, the stock market generally moves upwards three years in every four, great odds.

However, unfortunately, in this country, there is a combination of little information and misconceptions around investing.

By investing, you’ll benefit from compound interest.

As a result, this grows your savings.

The sooner you start, the better off you’ll be.

The key to successful investing is a diversified portfolio, diversified across thousands of different equities.

Should you opt to invest in a small number of equities, you can lose everything.

Diversifying is your free lunch.

Never invest without the assistance of a certified financial planner CFP®.

As well as that, it’s important to get the balance between saving and investing aligned with your goals, like mortgage target etc.

The biggest compliment I can pay investing, I wish I knew at 18 about it what I know now.

Learn more by clicking here.

Priority #7 Contribute to a Pension

Ok, so this may seem a bit whacky for a financial priority in your 20’s as you are young and retirement is miles away.

However, enter the 8th wonder of the world, Compound Interest.

If you can even squirrel a small amount away to your pension now, you’ll benefit from:

- Compound interest (interest added to interest)

- Tax relief on your contribution

- Tax free growth

Without a doubt you will see the benefit of this in years to come.

If your employer operates a pension scheme and will contribute to it for you, join it, even if you have to match their contribution.

As with the income protection where you can claim tax relief on the cost, you can claim tax relief on the pension contributions.

Learn more about the tax benefits of a pension by clicking here.

Summary

In summary, the earlier you start with anything, the better off you’ll be.

This logic is no different when it comes to your finances and your financial priorities.

Continuation of poor financial behaviour can leave you feeling the effects of it for years to come and can even be difficult to correct.

Small positive behaviours you implement now will benefit you both now and into the future.

As a result, you’ll feel more confident and secure in what you’re doing, where you are and where you’re going.

Financially at least!

How we help

We have a super value low cost starter financial planning service.

For one small fixed cost we can help you with all of the above and guide you on implementing the positive behaviours.

Your current and future self will thank you for it.

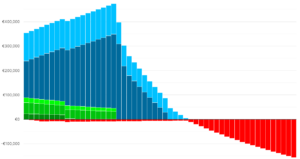

As part of the service you will also see a graphical forecast of your financial present and future.

To schedule, simply click the button below.

Schedule My Financial Planning Consultation

Get in touch

Questions?

Email us at info@fortitudefp.ie or request a callback.

Alternatively, you can get us on 041 213 0307.

Why not visit our insights.

A multitude of information on various financial subjects covering all aspects of saving, investing, financial planning, protection and pension advice.

Our blog posts are intended for information purposes only and should not be interpreted as financial advice.

You should always engage the services of a fully qualified financial planner before entering any financial contract.

To discuss engaging the services of Fortitude Financial Planning please email us at info@fortitudefp.ie.

Fortitude Financial Planning Ltd will not be held responsible for any actions taken as a result of reading these blog posts.

Production

Production