Is it worth paying for financial advice?

Financial planning and advice, the dark art!

No, not really.

Unfortunately, financial advisors come with a bit of a historical stigma attached to them in Ireland.

Undoubtedly, there was a time when it was a high commission industry.

That nice man that used to come round to your mum and dad and collect the insurance money.

Probably he was receiving half of it in commission.

In the current world, dealing with banks and corporate companies.

They take your money, invest it, receive an ongoing % fee and you never (or rarely at best) hear from them again.

On the other hand, when you work with a real financial planner, a planner/advisor who has their clients’ best interests at heart and not making a quick buck, is paying for advice worth it?

Everyone clearly understands that no one works for free.

When it comes to financial advice, some of the benefits can be intangible.

This is one of our greatest challenges as advisors.

So let’s have a dig in and see, is paying for financial advice worth it?

Why Seek Financial Advice?

Firstly, let us recap why people initially seek advice, there are a number of reasons one may contact us, typically one sole pain point initially.

You’ve reached a point in life where a financial decision has to be made.

Such as, you are a few years from retirement and worry about your income in retirement?

On the other hand, you may be at retirement and are faced with pension options, tax free cash, annuity or Approved Retirement Fund (ARF).

Maybe you are a young couple, planning a wedding and a family.

Alternatively, you may have children already and want to plan for them going to college.

You may have money in the bank, you are worrying about inflation reducing the real value of this and want to make it work harder for you.

In contrast, you may be worried about current investment markets and the effect on your portfolio.

Another common pain point, leaving employment and what to do with the ex-employers pension?

You may just be thinking ‘am I doing the correct thing with my money?’ or ‘can I improve the efficiency of what I am doing?’.

The point is, it’s generally one or two things that cause people to seek out the advice of a financial planner.

According to the American Psychological Association, financial worries is the number one cause of mental health issues in the States.

A nation of 329 million people.

So what makes you think that Ireland is different?

As good a reason as any to take charge of your finances wouldn’t you agree?

Who can benefit from financial advice?

Despite what people think, financial advice is not just for the wealthy.

Everyone (literally) can benefit from financial advice.

Generally speaking, absolutely, people can have a good knowledge and handle on their finances.

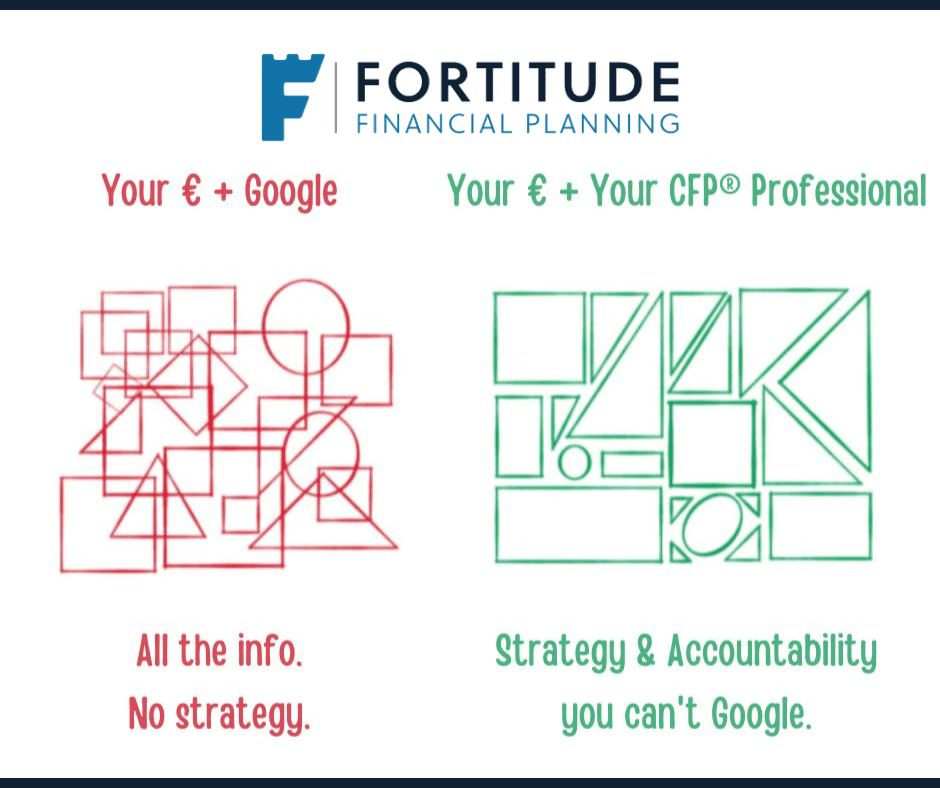

However, Google or your mate down the pub can only tell you so much.

A financial planner brings knowledge of the domain to the table.

We can pull everything together, add in education, experience and recommendations that are not based on emotion.

As a result, everything for you is more efficient and planned better.

In day to day practice, it’s rare for us to see someone who’s finances are 100% awful!

The value of financial advice

So, what is the value in seeking financial advice?

For this, we will refer to studies.

Firstly, let’s look at Australia.

In 2019, Fidelity International, a fund manager, undertook a study ‘the value of advice’.

Some of the key findings:

- Almost 89% of Australians receiving advice believe it has given them greater peace of mind financially

- 86% believe it has given them greater control on their finances

- Four in five confirmed they were able to achieve their financial goals with the help of advice

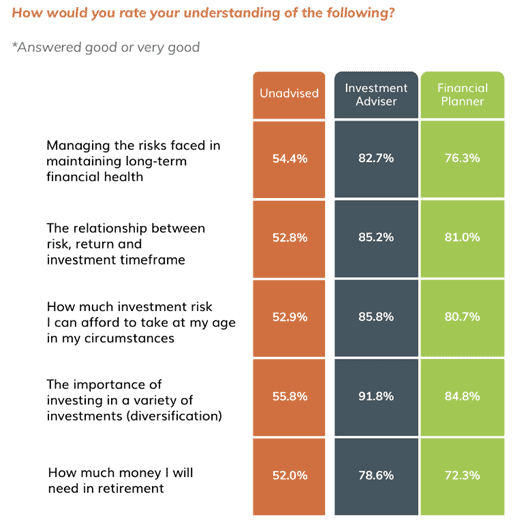

The Financial Services Council of New Zealand performed a study.

Here, you can see the results to see how advice helped clients understand more about their circumstances, needs and options:

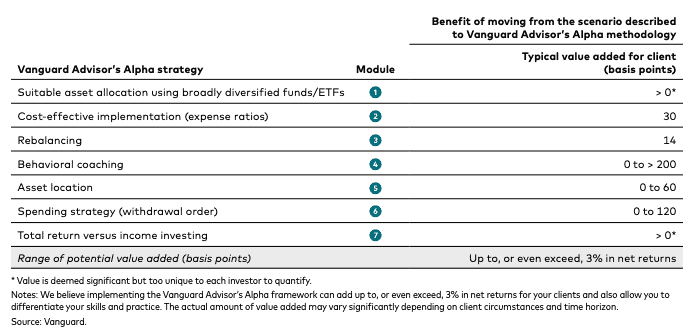

In the US, the second largest fund manager in the world, Vanguard, completed a study.

This found that investors, whilst using an advisor, did approximately 3% better on average.

Interesting that the majority of the value added comes from behavioural coaching.

The Financial Planning Standards Board (FPSB) is the global governing body who license CFP® professionals.

This short video produced by the FPSB is based on a consumer survey and is further evidence of the value of financial planning.

Unquestionably, the value is there, and independent studies confirm it.

The benefits of financial advice

Along with the value, let us look at the benefits.

The actual benefits can sometimes be more difficult to illustrate as they can be intangible, not necessarily in monetary terms.

Behavioural Coaching (See Vanguard Study above)

A key element of financial planning is investing in stock markets.

Unfortunately, stock markets aren’t plain sailing, they get turbulent, sometimes large declines.

See 2022 year to date!

When this happens, it can be difficult for an investor to keep emotions in check, thus leading to irrational decisions.

We are, 100% fact, emotionally tied to our own money.

Example:

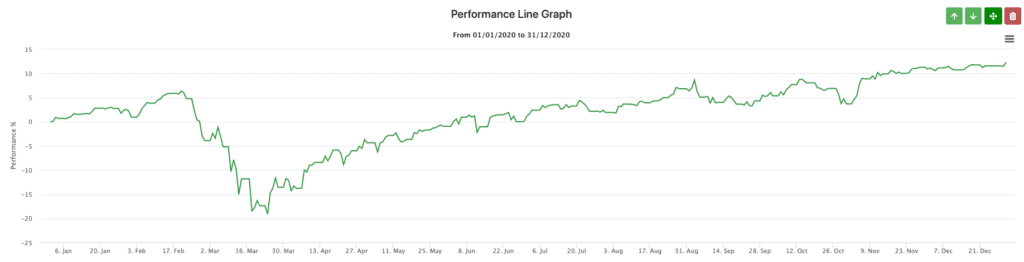

Let us assume an investor invested €10,000 into the below portfolio on 01/01/2020.

It grows by 6% and then Covid hits, causing a market selloff.

It subsequently declines in value to approximately 20% less than the original investment, approximately €8,000.

The brain is hard wired to want you to sell the investment at this point and put it in the bank, turning the devaluation into a loss as once it’s in the bank, it will never recover.

However, once we keep the investor on track and ride this out, they return over 12% of their original investment that year.

Working with a planner who has developed an individual plan for you, will help keep you on track, particularly during times of anxiety.

Avoid Unnecessary tax

No one likes paying tax.

A proper financial planner will assist you in keeping your tax bills to a minimum.

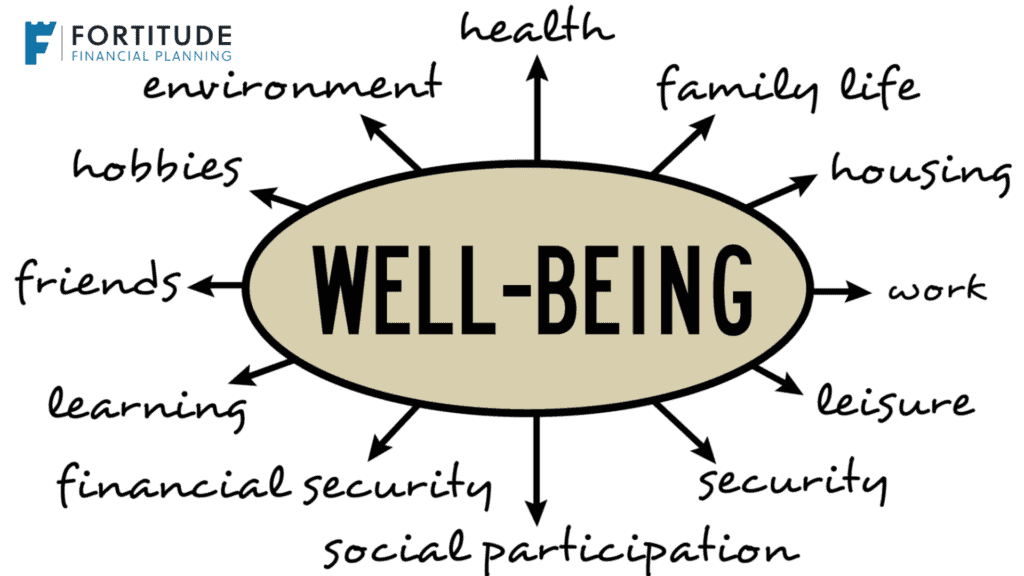

Promoting Financial Wellness

I’ve said on this page earlier, and in previous blogs and I’ll say it again, the American Psychological Association confirm the number one cause of mental health issues in the States are financial worries.

Planning your present and future, is about more than finances.

Building a sound financial roadmap is also about your and your families emotional well being.

Having a financial roadmap will help you navigate times of uncertainty and provide you with peace of mind.

Create a long-term financial strategy for YOU

Fact, the investment world is filled with shiny new products.

Fund managers, banks, sales orientated ‘financial advisors’ trying to sell consumers everything.

A proper financial planner will help you cut through the nonsense by:

- Identifying quality, easy to understand investment strategies

- Build you a strategy in line with your own financial roadmap (goals and objectives)

- Continue to provide you with knowledge and guidance to give you peace of mind and have you in control

- As well as that, communicate with you regularly

Without a doubt, these are just some of both the tangible, monetary benefits and intangible benefits of working with a financial planner.

Summary

So, is it worth paying for financial advice?

To summarise, financial advice is like anything.

If you need the car fixed, you go to a mechanic.

If you have a leak, you call a plumber.

You may be able to do one or two things yourself but will likely have to call on a qualified pro at some point.

Finances are the same, you can do so much, but a pro helps.

Nonetheless, you get bad plumbers, bad mechanics and also bad financial advisors.

These advisors tend to be those who work for corporate companies and banks in sales roles.

They wake up on 1st January and have significant sales targets on their backs.

Consequently, they give clients the hard sell, get them in the door with little consideration for the clients big picture, get the business and then the client doesn’t hear from them.

That is why it’s important to work with a company and advisor who value clients and the relationships they create with them and you can see testimonials and reviews from existing clients of that firm.

As a result of independent studies combined with existing client stories, testimonials and reviews, unquestionably, the evidence is there that financial advice is unquestionably worth paying for.

With the benefits, both tangible and intangible, far outweighing the actual cost.

So, do your current and future self a favour and get a financial plan!

How We Help

We can be your trusted advisor.

Unquestionably, we can bring the value to you the independent studies say.

We consistently receive 5 Star reviews from our happy clients, you can read them here.

Furthermore, you can see more about what our clients say by clicking here.

Our fees are structured to ensure our impartiality at all times.

Importantly, to assist new clients, we have a set process we run through.

We have an initial call, at our expense, to ascertain if we can in fact benefit you and add value to you.

If we can, we will tell you, if we can’t, we can point you in the correct direction.

Click the link below to schedule an initial call with us.

Get in touch

To discuss further email us at info@fortitudefp.ie or request a callback.

Alternatively, you can get us on 086 0080 756 or access our diary here and book a call at your convenience.

Why not visit our insights.

A multitude of information on various financial subjects covering all aspects of saving, investing, financial planning, protection and pension advice.

Our blog posts are intended for information purposes only and should not be interpreted as financial advice.

You should always engage the services of a fully qualified financial planner before entering any financial contract.

To discuss engaging the services of Fortitude Financial Planning please email us at info@fortitudefp.ie.

Fortitude Financial Planning Ltd will not be held responsible for any actions taken as a result of reading these blog posts.

Production

Production