January Is National Financial Wellness Month

In this article here I mentioned the proven link between financial worries and mental health.

Finances are the number one cause of stress in the United States of America, a country with a population of 329 million.

Financial Wellness Month is a great time for people to plan and update their financial plans, strategies and behaviours.

It’s a great time to connect with a financial planner to discuss your financial situation and aspirations for their future.

It’s also a good time to connect to see if your financial plans needs any adjustments or changes based on your lifestyle.

Start your year off on the correct foot.

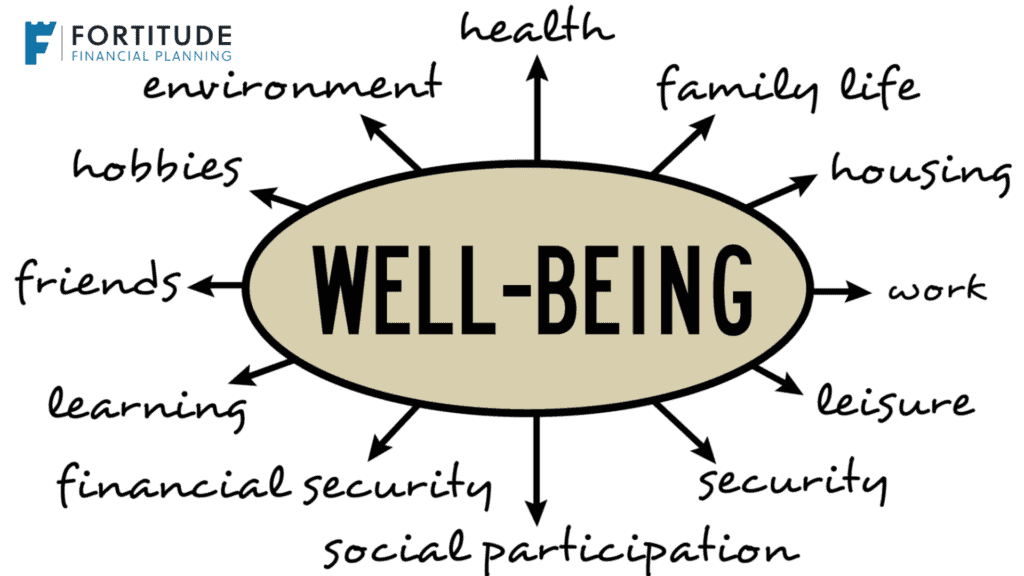

Defining Financial Wellness

The first thing to do is define what “financial wellness” means for you.

This can vary drastically from person to person.

It is informed by who you are, where you are coming from and what your experiences with money are.

And also where you want to go.

A person who has had serious financial troubles in their life might have different expectations from a person who has enjoyed relative financial stability.*

How, then, do you define this?

First, ask yourself what you need to feel secure, financially speaking.

Here are some questions to consider:

- Do you have savings or investments? If so how much?

- How much should you have saved?

- How much income are you be bringing in each month?

- Where are you at with your debt?

- Would things be simpler if you carried less debt?

- How fluid is your cash flow when it comes to expenses that are not urgent (taking your family out to dinner or on a small trip) versus larger financial goals (such as buying a new kitchen appliance)?

- Finally, and perhaps most importantly, do you have a desired retirement age?

- And will you be able to retire at your target retirement age?

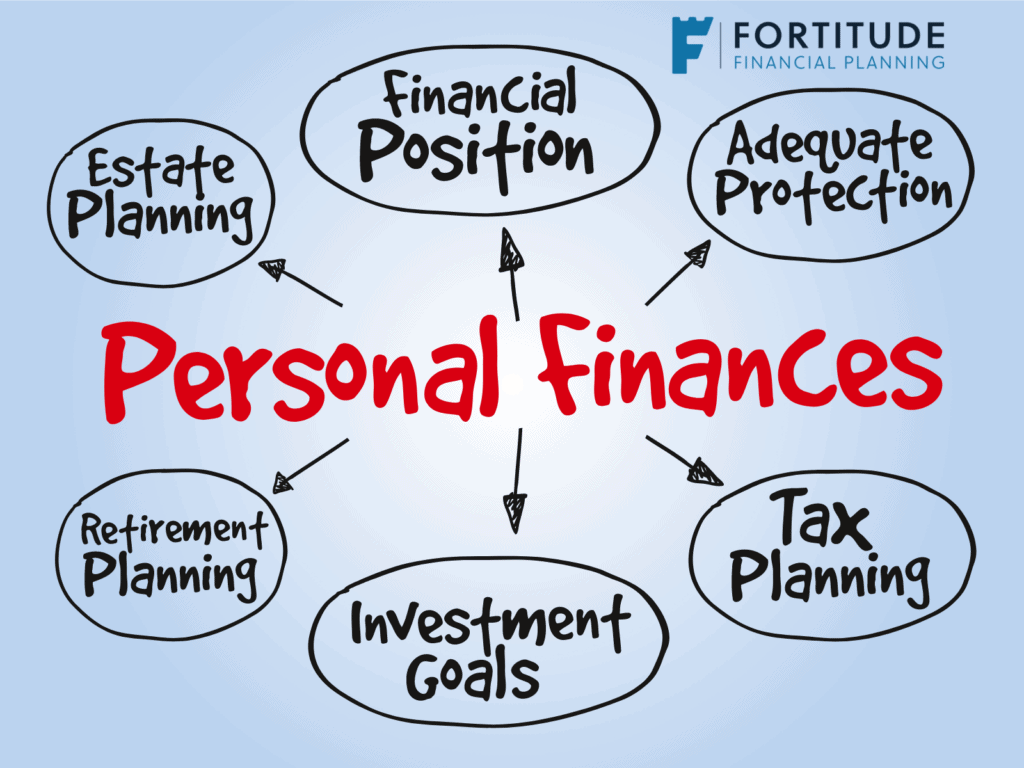

Financial Wellness Goals

Thinking about financial wellness is often a matter of setting goals.

These are goals for what you can accomplish now and what you can work on as a part of your larger financial strategy.

This article has some good information on short, medium and long term goals.

For now, consider taking these actions:3

Besides, if you don’t take action, nothing will change.

Book Your No Obligation Consultation

Financial Wellness Action #1

Have a values-based conversation with the decision-makers in your household, meaning any tax-paying adult who contributes income and shares responsibility for the bills.

This is likely your could be your spouse or another contributing family member.

Make sure that the non-essential things you are spending money on line up with your commitments to meet your financial needs.

This is not a “stop getting lattes” conversation.

It’s simply a “are we spending money on the things that matter?” conversation.

Firstly, just be aware of where you’re spending your money.

Leave your details here and request a copy of our free budget template.

This simple one pager will highlight to you exactly what you’re spending your money on and where it’s going.

Financial Wellness Action #2

Consider automating payments, especially towards regular items, including student loans, credit cards and other instalment payments.

Automating payments is one of the best pieces of financial advice I can give to anyone.

Also, automate savings.

If you think ‘I’ll save what I have left at the end of the month‘, you will struggle.

Because what’s in your hand (or bank) is easier to spend. Human nature.

Save first, spend what’s left.

I’d bet a penny to a pound your lifestyle won’t change.

Actually, it’ll be improving as you’ll be saving.

Financial Wellness Action #3

Create an emergency fund reflecting 3–6 months of net after-tax income or household expenses.

This will give you a stable financial foundation going forward.

If that seems too ambitious, build the fund a month at a time until you reach your goal.

Incremental steps to where you want to get to.

Financial Wellness Action #4

Make regular contributions to your pension.

Take advantage of any matching contributions you might get from your employer.

A pension is the most tax-efficient way of saving.

If you pay income tax at the 40% rate, Revenue will cover 40% of your pension contributions.

Consequently, due to the long term nature of retirement planning, you will benefit considerably from Euro/Cost Averaging and compound interest.

You can read more here.

Financial Wellness Action #5

Make long-term financial goals.

If you are thinking in terms of buying a house, for instance, and that is your main goal, let that guide your overall financial strategy.

Other goals may be changing the family car every three years.

Or a nice family holiday (Covid permitting) every year.

Yes – I Want To Sort My Finances

Financial Wellness Action #6

Is becoming totally debt-free an achievable goal?

Is this what you want?

If so, it can be if you make it a priority.

That said, being totally debt-free is a difficult task for most households.

For that reason, it may be better for you to focus on your other goals first and make debt freedom a target for a later date.

For example, being debt-free by retirement could be your target.

Financial Wellness Action #7

One of the things that is either difficult to track or falls by the wayside is our relief available on medical expenses.

To track these and make it simpler for you, do this:

- Set up a new email address specifically for medical expenses (Gmail, Outlook etc)

- or set up a specific folder on your computer

- Whenever you have a receipt, scan the receipt and email it to your new email address or into the folder

- Create subfolders by year, ie 2022

Then, next year, when it comes to claiming your medical expenses, you’re not rooting around for them.

You know where they are and none get missed.

Small, incremental changes.

Summary

In the modern world in 2022, there is so much emphasis on personal wellness and mental health.

It’s so important.

There are many moving parts to this, not just your finances.

But there is a proven link between finances and personal wellbeing.

Personal finances are our speciality and if we can help people with this element on their personal wellness journey then we’re doing good.

There are, of course, no hard and fast rules.

As mentioned above, every individual has their own specific, individual definition of financial wellness.

Some of these examples might feel like a long reach.

Others, you might already be practising.

The good news is that with careful practice and judicious scrutiny, many people will gain a feeling of satisfaction and even pleasure from maintaining financial wellness.

Having your personal financial strategy in place not only can mean a great deal to you in the long term but will also provide you with some comfort in the short term.

How we help

We help many people from all walks of life on their financial journey.

Typically, in Ireland, the financial advice industry puts the cart before the horse.

Historically, a ‘financial advisor’ is only interested in the sale of a product for the sole purpose of generating a commission for themselves.

The industry is changing.

Yes, advisors who only want the sale still exist but there are a number of great advisors out there and we’re doing the correct thing.

Our business is not based on the traditional model and we (correctly) put the client before the product.

Our experience assists us in helping people to articulate their financial and life goals.

Once they have uncovered what their goals are, it works back into the plans and strategies we then create for them.

This means that our clients are only recommended products and strategies that are specific to their own individual plan, circumstances and goals.

This then helps them on their financial wellness journey.

The key indicator of a ‘proper advisor’ is the Certified Financial Planner™ or CFP® accreditation.

This indicates a globally recognised excellence in financial planning whilst being held accountable to the highest ethical standards.

It’s important consumers engage with CFP® accredited firms like ourselves.

Contact Us

Take the first steps to a more comfortable financial journey and request a callback.

Alternatively, drop me an email, francis@fortitudefp.ie give me a call, 086 0080 756 or access our diary here.

We are happy to have a no obligation chat with you to see if we can help and bring value to you.

We have over 30 articles we’ve written on various subjects and they can be accessed here.

A wealth of free information covering all aspects of saving, investing, financial planning, protection and pension advice.

Francis McTaggart CFP® SIA RPA QFA

These blog posts are intended for information purposes only and should not be interpreted as financial advice.

You should always engage the services of a fully qualified financial planner before entering any financial contract.

To discuss engaging the services of Fortitude Financial Planning please email us at info@fortitudefp.ie.

Fortitude Financial Planning Ltd will not be held responsible for any actions taken as a result of reading these blog posts.

Production

Production