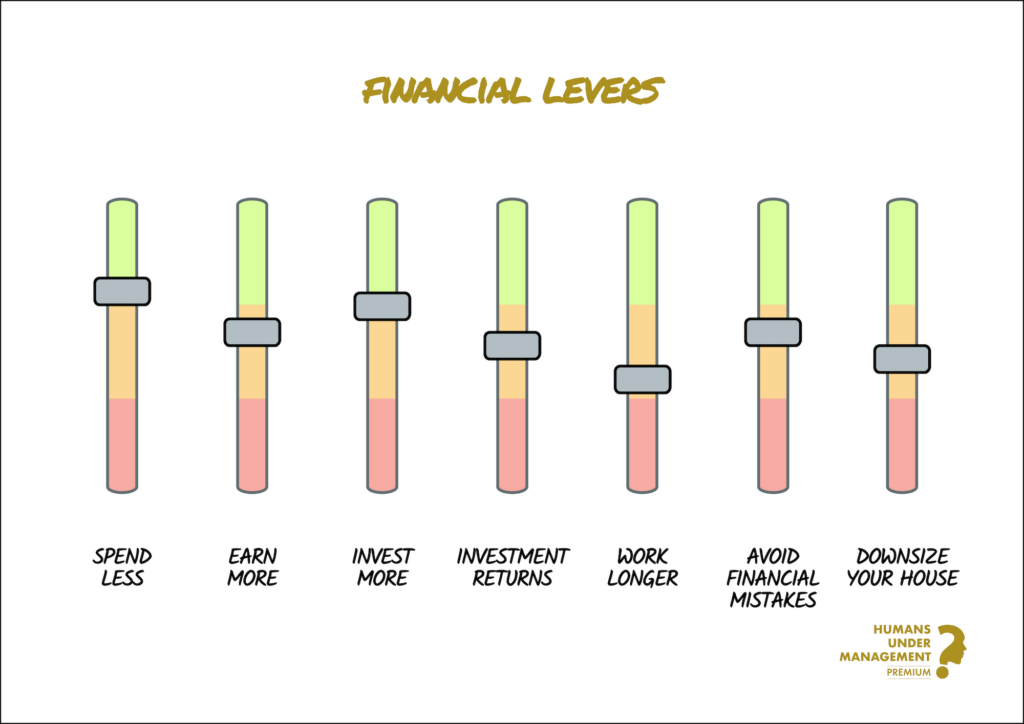

Understanding Your Financial Levers

Your life goals are powered by your finances.

When managing money working towards your financial goals, it’s important to understand which factors you can control and which you can’t.

Interest rates, inflation, investment market returns, and economic growth fall outside your control.

However, there are many factors you can control, and each of these becomes a lever you can pull to adjust your future financial circumstances.

In this article, we will explore the various financial levers that you can utilise to enhance your financial well-being and achieve your desired life outcomes.

Controlling Expenses

Firstly, one of the most powerful levers at your disposal is the ability to control your expenses.

It’s especially vital to assess your lifestyle choices and avoid falling into the ‘lifestyle creep’ trap.

This is where people progressively increase their spending as their income rises.

How mindful are you of your spending habits?

By spending less and living within your means, you can free up resources for savings and investments.

Increasing Income

Another financial lever that you can pull is increasing your income.

While this may seem obvious, many individuals underestimate its potential.

You can accelerate your wealth-building journey by actively seeking ways to earn more through career advancement, side hustles, or entrepreneurial ventures.

Increasing your income provides you with more resources to save and invest, expands your financial opportunities, and enhances your financial security.

Investing More

Investing more is a simple and powerful lever that will significantly impact your long-term financial success.

By allocating a larger portion of your income towards investments, you will capitalise on the power of compounding and benefit from the growth potential of various asset classes.

Adopting a disciplined approach to investing, such as automatic savings and paying yourself first, is crucial.

By consistently investing over time, you will build an investment portfolio that aligns with your financial goals.

Enhancing Investment Returns

While controlling expenses, increasing income, and investing more are essential, you should also focus on enhancing their investment returns.

This lever involves making informed decisions about asset allocation and diversification, and selecting simple investments that align with your long-term objectives.

While investment returns alone should not be relied upon as the primary driver of financial success, optimising your investment strategy and seeking opportunities to maximise returns can significantly impact your overall wealth accumulation.

Adjusting Retirement Timeline

One often overlooked financial lever is adjusting your retirement timeline.

While many individuals plan to retire at a specific age (in Ireland people think of 65), it’s important to re-evaluate this timeline based on your financial situation and life goals.

Extending your working years can give you additional time to save and invest, allowing your assets to grow further. On the other hand, you may choose to retire earlier, focusing on achieving financial independence and creating a fulfilling lifestyle.

By carefully considering your retirement timeline, you can make informed decisions that align with your unique circumstances.

Avoiding Financial Mistakes

Avoiding financial mistakes is critical to protecting your wealth and financial well-being.

By being vigilant and educated about common financial pitfalls, you can mitigate risks and preserve your financial resources.

As well as that, learning from your mistakes and seeking wisdom from experienced individuals can help you navigate the complex landscape of personal finance and make sound financial decisions.

Housing Considerations

Often not considered, housing decisions can also serve as a financial lever.

Downsizing (or right-sizing as I prefer to call it) your house can release equity and reduce housing related expenses, freeing up resources for savings and investments.

You can optimise your housing decisions to align with your broader financial goals by carefully evaluating your housing needs and considering the financial implications.

Summary

In summary, you have a range of powerful financial levers to take control of your financial situation.

Pulling these levers consistently over time will compound to create life-changing results.

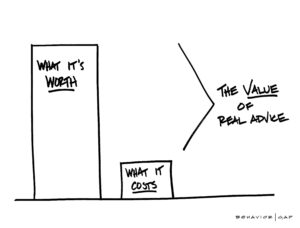

On the other hand, working with a certified financial planner will provide invaluable guidance in adjusting these levers to match your specific circumstances and financial goals.

By understanding these levers and collaborating with a financial planner on how and when to pull them, you put yourself in the best position to choose your financial path and progress steadily toward your definition of financial success.

How We Help

Taking control of your finances may seem daunting, but it doesn’t have to be.

We can help you.

Maybe you’re just looking for a confirmation you’re doing the correct things.

We can help you.

Importantly, we have different levels of service so everyone is catered for.

A great low cost starter service to get you up and running or a more in-depth comprehensive service.

Book your initial consultation below using the button below, the cost for this is absorbed by us.

Get in touch

Email us at info@fortitudefp.ie or request a callback.

Or give me us a call on 041 213 0307.

Why not visit our insights page.

A multitude of information on various financial subjects covering all aspects of saving, investing, financial planning, protection and pension advice.

Our blog posts are intended for information purposes only and should not be interpreted as financial advice.

You should always engage the services of a fully qualified financial planner before entering any financial contract.

To discuss engaging the services of Fortitude Financial Planning please email us at info@fortitudefp.ie.

Fortitude Financial Planning Ltd will not be held responsible for any actions taken as a result of reading these blog posts.

Production

Production