Euro cost averaging is sometimes referred to as Dollar cost averaging.

For the purpose of this article, I will use both terms as you will find many more articles on Dollar cost averaging than Euro cost averaging.

They are exactly the same thing – just different currencies.

One of the biggest fears of any new or seasoned investor is losing money.

This fear can actually inhibit some people from ever investing at all.

It can also lead to selling preemptively or opting for the lower risk investment option time and again.

To minimize the fear of losing money, investors sometimes choose to go with a risk-reduction strategy, such as Euro Cost Averaging.

Despite the fact that the majority of academic research has shown that Euro cost averaging may help to manage risk, but that on average it just reduces returns (and therefore is inferior to lump-sum investing), the popularity of Euro cost averaging remains high among practitioners and the investing public.

However, given that research has shown that the pain of losses is more severe than the joy of gains for investors1, risk-averse investors may prefer to Euro cost average simply to minimize the potential regret of not doing so and seeing markets decline shortly thereafter.

Euro Cost Averaging

Euro Cost Averaging is an investment strategy where a fixed amount of money gets invested at regular intervals.

The intended goal of the strategy is to provide the investor with a lower average cost of shares over time.

The investment amount will be the same at each interval.

The idea is that more shares will be purchased when the price is low and fewer will be purchased when the price is more expensive.

Those who support the use of this strategy claim that it can provide a lower average purchase price for a risky asset.

This proposes that purchasing assets (that are higher risk) with regular contributions when prices are declining will provide better returns than lump-sum investing.

The Advantages

Risk Mitigation

By only investing a portion of your lump sum, price drops will not impact your portfolio as heavily had you invested a larger portion of your entire sum.

This strategy is meant to mitigate the risks involved in lump-sum investing.

Through lump-sum investing, an investor could face major losses if the market crashes or prices fall drastically.

Risk-aversive individuals may, therefore, prefer to use Dollar cost averaging.2

Managing Emotions

Market fluctuations and losses can greatly affect an individual’s emotional well-being.

Further, emotional responses to these ebbs and flows, such as overconfidence or panic, can affect future investment decisions.3

Only part of your lump sum is exposed to the market.

This means losses may not be as drastic.

As a result, many individuals may experience a duller emotional reaction than if all of their sums were to be affected.

This decreases the likelihood of them making emotionally-driven investment decisions in the future.4

As such, Euro cost averaging may be a good option for those looking to minimize the impact of emotion on their investment choices.

It helps those with less to invest

Dollar cost averaging enables investors who do not have a lump sum to invest to commence investing.

You can begin investing with small amounts of money.

It gets smaller amounts of your money into the market regularly.

You continue to invest, even when the market is down.

This helps you build a strong position over time.

The Critiques

Missing Out On Gains

When employing Dollar cost averaging, portions of your money sit uninvested.

The main argument against Euro cost averaging, these portions are not given the chance to accumulate any return at all.

As a result, some investors and financial professionals may prefer another strategy such as lump-sum investing, which exposes a larger portion of your funds to the market.

Lump-Sum Investing vs. Euro Cost Averaging

When you invest a lump sum, a larger portion of your money has a chance to make gains sooner rather than later.

However, investing a significant portion of your money also means that you may experience more pronounced losses in a vacuum.

Over time, however, you can make up for these losses.

This long-term thinking also supports the idea behind Euro cost averaging.

Ultimately, the decision to use either tactic will depend on your unique situation.

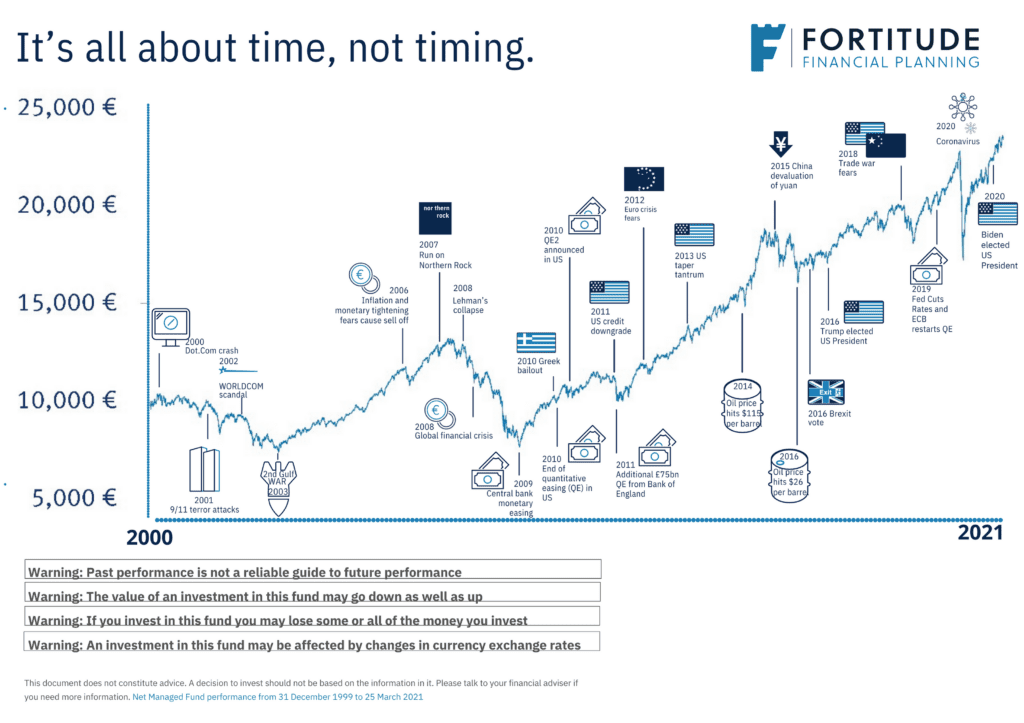

Euro Cost Averaging versus Timing the market

Dollar cost averaging works because over the long term asset prices tend to rise.

Over the short term though asset prices don’t always rise.

In the short term, they rise and fall and don’t follow any predictable pattern.

Many people try to time the market and buy assets when their prices appear low.

In theory, it sounds good. In practice, it’s near impossible.

Simply because we can’t predict the future and how markets will move over the short term.

A low price today could be a high price next week and this weeks high price could be low next month.

The old saying, a bell doesn’t ring at the bottom, or at the top.

When you wait on the sidelines to attempt to time your investment, you’ll likely buy at a price that’s not as attractive in future.

Trying to time the market can cost you.

According to research conducted by Charles Schwab, investors who try to time the market see fewer gains than those who invest with Euro cost averaging.

It’s about time in the market, not timing the market.

Euro Cost Averaging versus Lump Sum Investing

It’s important to know, we cannot know ahead of time whether lump-sum investing or Euro cost averaging will lead to a better outcome.

Again we do not know where markets will go in the short term, no one can predict the future.

Don’t be tricked by financial news filled with market predictions.

History favours lump-sum investing

Vanguard conducted a study in 2012.

This compared lump sum investing with Euro (Dollar in the study case) averaging.

They found at the end of a 10 year period, lump-sum investing beat Euro cost averaging about two-thirds of the time.

This was across the USA, UK and Australia.

Managing risk favours Euro cost averaging

You may be more interested in managing risk or concerned about losing money than maximizing returns.

The Vanguard study mentioned goes into this as well.

It found that during a down market, Euro cost averaging resulted in losses less frequently than lump-sum investing.

When to Consider Using Euro Cost Averaging

Investors might choose to employ Euro cost averaging for a variety of different reasons.

These can include investments that are historically more volatile.

Euro cost averaging is also a way to potentially regulate emotional responses.

You use Euro cost averaging in the following circumstances:

- You are beginning to invest and only have smaller amounts to buy

- Investments are volatile

- You are contributing to regular long term investments, such as pensions

- A time in life where any volatility is not feasible and may cause immediate ramifications (i.e. nearing retirement)

- Individuals who are risk-aversive

- As part of a diversified investment strategy utilising both lump sum and Euro cost averaging investments

- Individuals who do not have the funds for a lump-sum investment

The alleged benefit of euro cost averaging is that it encompasses the unpredictability of the market yet intends to lower the cost of your shares as a result.

When choosing how to invest, always seek the assistance of a financial planner, contact us.

How we can help

We help all of our clients with the creation and ongoing management of their investment portfolio.

I recently wrote an article on the importance of investment diversification – you can view it here.

A combination of lump-sum investing and Euro cost averaging is a layer of diversification.

You can also view our investment philosophy here.

Request a callback from us or call me on 086 0080 756 to commence your investment journey or review your current portfolio.

Francis McTaggart CFP® SIA RPA QFA

These blog posts are intended for information purposes only and should not be interpreted as financial advice.

You should always engage the services of a fully qualified financial planner before entering any financial contract.

To discuss engaging the services of Fortitude Financial Planning please email us at info@fortitudefp.ie.

Fortitude Financial Planning Ltd will not be held responsible for any actions taken as a result of reading these blog posts.

- https://www.apa.org/science/about/psa/2015/01/gains-losses

- https://www.onefpa.org/journal/Pages/OCT15-Dollar-Cost-Averaging-The-Trade-Off-Between-Risk-and-Return.aspx

- https://www.aeaweb.org/articles?id=10.1257/jep.29.4.61

- https://www.onefpa.org/journal/Pages/FEB18-Using-a-Behavioral-Approach-to-Mitigate-Panic-and-Improve-Investor-Outcomes.aspx

Production

Production