What is the value of financial planning?

Historically, financial advice and financial advisors in Ireland were viewed with skepticism.

Probably correctly due to the typical non disclosure of commissions and the very little value or contact that was provided to clients on an ongoing basis.

This was due to the typical interaction with a financial advisor placing emphasis on a specific product that the client needed at that point in time.

Thankfully the industry is changing with the introduction of the globally recognised CFP® (CERTIFIED FINANCIAL PLANNER™) qualification which focuses on providing sound advice and value to clients.

The CFP® certification is the only globally recognised mark of excellence in financial planning.

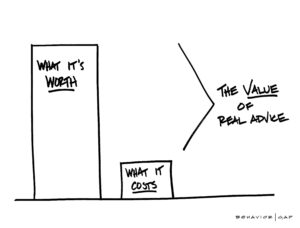

Still, where does the value in financial planning lie for clients & prospects? It is a question that can be difficult to explain or even quantify.

Is it tangible? Intangible? Both?!

My experience is some people can’t see the value in financial planning until they actually experience it.

What does financial planning mean?

Financial planning is not just recommending investments or a pension.

It’s not just placing some insurances.

Planning is engaging in clear process with a professional.

Financial Planning involves the process of building your plan as well as the ongoing support to ensure you remain on the correct track of your original plan.

People who have never engaged in financial planning don’t have the opportunity to observe the impacts of it in the way I can so let’s look at what I see regularly.

Financial Planning empowers you to make informed decisions – knowing how to deploy your financial resources most effectively to achieve your personal goals and objectives.

At the same time, you can do this whilst mitigating financial risk.

This can be via savings strategies, cash flow management, insurance coverages, estate planning, tax efficiency and lifestyle preferences.

As well as helping you understand what you should be doing with your finances, a CFP® professional is also alert to potential risks and threats and can let you know how to mitigate them.

We help you avoid mistakes. Mistakes like paying too much tax, retiring before you’re financially ready or chasing the next big investment thing!

Couldn’t I do this by myself?

The DIY route.

Maybe, but you would have to put in hours upon hours into the study of the technical side of financial planning, processes, products etc.

Then, keep yourself up to date with constant changes in markets, the economy, ongoing legislation and product changes.

Our services also don’t stop with the technical advice we give.

Behavioural finance guidance and support are key pillars of a financial planning service and this holds value in euros.

As humans we are hard wired to avoid risky situations, including volatile markets.

During a market downturn we want to sell off and run and this comes at a cost.

We are biased when it comes to our own money and it clouds our judgement when making financial decisions. Fact.

Research shows that people who work with a financial planner receive better returns (growth) than those who don’t.

Research

Vanguard are one of the worlds largest investment companies.

They have a commitment to providing value to investors and through their Advisor Alpha study show where they suggest advice adds value.

Whilst it’s clear every case is different, they suggest working with a financial planner can provide investors with an additional 3% return.

Interestingly, they allocate 1.5% of this 3% to behavioural coaching.

I think back to March 2020, the markets were in free fall, and I was reaching out to clients or clients called me.

Whilst every client is different, by keeping clients on the straight and narrow , preventing clients from making some adjustment or even going to cash, I could have saved them in the region of 25% – maybe more.

Investing appears easy at the moment, markets are increasing – continually going up it feels like.

It’s not always this easy – trust me.

There will come a time when markets drop and running for the hills appears to be the best option!

Access the Vanguard study here.

The Financial Planning Standards Board (FPSB) is the global governing body who license CFP® professionals.

This short video produced by the FPSB is based on a consumer survey and is further evidence of the value of financial planning.

It’s not just about money

The services of a CFP® can give you a psychological boost. Confidence that you are actually doing the correct thing, implementing the correct strategies.

This frees up stress and time allowing you to focus on the things that really matter – family and life.

It removes the sense of wrongdoing as you wonder are you doing the correct thing. You now know you are. It stops the worry.

This all frees up your time and choosing how you spend your time can have a large impact on your personal happiness.

Who can benefit from financial planning?

Everyone. Literally. I mean that.

No one who takes the DIY approach has their financial lives perfectly in order, running completely efficiently and risks mitigated.

Parents with a young family, single, approaching retirement, in retirement, a business owner, an employee, young or old.

There is some level of benefit and value for everyone.

Fortitude Financial Planning

At Fortitude Financial Planning, our commitment is to our clients and to increase our value to our clients we have teamed up with some of the leading bodies in our profession.

I myself am a fully qualified CERTIFIED FINANCIAL PLANNER™ professional licensed by the Financial Planning Standards Board.

Individually I am a a member of the Society of Financial Planners in Ireland (SFPI) and the Life Insurance Association of Ireland (LIA).

The SFPI is committed to its members providing the highest value in advice and provides us with ongoing education and training.

The LIA is the professional education and development association for those who work in financial services.

I hold Specialist Investment Adviser (SIA), Retirement Planning Adviser (RPA) and Qualified Financial Adviser (QFA) qualifications through the LIA.

The company are members of the Trusted Advisor Group and Brokers Ireland.

Two industry bodies committed to supporting and empowering its members to maintain the highest level of client advice and value.

Conclusion

There are many tangible and non-tangible benefits and value of working with a financial planner.

The important thing is there are benefits and value to everyone. Research shows this.

Financial planning works much like a sat-nav does in the car. It guides you through the financial aspect of your life.

You wouldn’t jump in the car to a destination unknown without a sat-nav.

Why take the chance with your finances?

Check out our short video on cash flow planning here.

Discussion

If you would like to discuss the contents of this blog or schedule a call to discuss how we can help you book a call in my diary.

Francis McTaggart CFP® SIA RPA QFA

Disclaimer: All content provided in these blog posts is intended for information purposes only and should not be interpreted as financial advice.

You should always engage the services of a fully qualified financial planner before entering any financial contract.

Fortitude Financial Planning Ltd will not be held responsible for any actions taken as a result of reading these blog posts.

Production

Production