6 reasons you need a pension

Pensions.

A painful subject sometimes.

Sometimes touchy.

Certainly not the most exciting of subjects.

Last week we covered what a pension is.

Whilst not exciting, without a doubt very important.

Now that we’ve ascertained what a pension is, exactly why do we need one?

Below we’ll outline 6 strong reasons why we all need a pension.

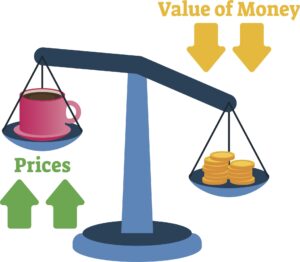

#1 Income & Inflation

Simply speaking, we need income when we stop working.

We need income to live.

Everything costs money, and increases in price!

Clearly, we are seeing that increase considerably at the moment.

The state pension is inadequate, see point #2 below.

Without a doubt, it only covers basic living expenses.

If we want to enjoy a comfortable post-work life, we need additional income.

Income for nights away, holidays, the golf club membership, family events and occasions, transport costs etc.

Every day in retirement is a Saturday and Sunday.

Currently, we spend most of our money on Saturdays and Sundays.

#2 Inadequate State Pension

The state pension in Ireland is currently €13,171 per annum.

That’s assuming you are entitled to the full pension.

That’s €1,097 before being assessed for tax.

Now, let’s assume you retire on the average salary of €49,000 – with no private pension.

That’s obviously a significant drop in our income.

Approximately a 75% reduction.

However, most definitely not a reduction of 75% in your outgoings.

When you finish work, every day becomes a Saturday and a Sunday.

More eating out, nights away.

Above all, more time to spend more money.

Furthermore, there is so much uncertainty surrounding the state pension.

It was payable from 65, then pushed to 68, pulled back to 66.

Currently payable from 66 but will be pushed back to 68 again.

Importantly, the role of the state pension is to cover minimal living expenses – not to ensure we enjoy a fruitful post-work life.

#3 We’re living longer

Increased knowledge and awareness of living healthy.

Advancements in medical treatments.

This means we are living longer these days.

The current life expectancy for a male in Ireland is 79.*

For a female 83.*

Back in 2002, these were 75 and 80 respectively.*

Undoubtedly we’re living longer.

Clearly a bonus!

The downside – a longer post-work life to fund financially.

#4 Reduce Our Tax

Fact, no one likes paying taxes.

If you do then you’re the odd one out.

Without a doubt, we pay too much here in Ireland.

We have one of the lowest thresholds for hitting the higher rate around.

However, we get tax relief on our pension contributions.

If you are a higher rate (40%) taxpayer, Revenue will cover 40% of your pension costs.

Should you only pay 20% tax, Revenue will cover 20% of your pension costs.

So, you pay €100 to your pension, you are a higher rate taxpayer, it costs you only €60.

Importantly, a pension is the most tax-efficient savings vehicle around.

Essentially getting an immediate 40% gain on your contributions is not available elsewhere.

So, in short, we can pay our future selves whilst reducing our current tax liability.

Keeping the tax man’s hands from our hard-earned money, legally.

#5 Tax-Free Growth

It should be noted, the tax breaks don’t stop at tax relief.

Not only do we benefit from tax relief, we also benefit from tax-free growth.

No Capital Gains Tax.

Nor Exit Tax.

That means our pension can work away, grow over time and not be taxed.

Compare that to an investment property.

When you sell an investment property, you pay Capital Gains Tax.

Your rental income is fully assessed for tax.

An investment, either subject to Capital Gains tax or Exit Tax, is dependent on the structure.

Tax-free growth on your pension, more tax efficiency.

#6 Long Term Compound Growth

To quote Albert Einstein:

“Compound interest is the 8th wonder of the world”.

Who wouldn’t like interest being added to interest?

Indeed, your pension will grow over time.

Interest on interest.

Compound interest is a great equalizer.

It doesn’t care about race or gender, we can all benefit.

Once your pension is invested, you’ve initially benefited from the tax relief, sit back and benefit from the power of compound interest.

Summary

There you have it.

6 simple reasons why we all need a pension.

Provide our future selves with an income.

Whilst reducing our current tax liability.

Not everyone likes pensions.

Even the sound of the word can make some contort with annoyance.

I’m certain this is because they don’t know how they really work.

Undoubtedly, they’ve not taken the time to learn.

The reality is, pensions have a role to play in our lives, no matter our age.

How We Help

One of our main advisory areas is pensions.

Either as a standalone offering or as part of a financial plan.

If you want to get started, we can set them up.

You may have an old pension you want to review, we can do that.

Left employment and unsure what to do with that pension, we’ll advise you.

Importantly, be knowledgeable about pensions and what they do for you and how you benefit.

Get in touch

Are you looking to get on the pensions ladder at this time?

On the other hand, do you have an existing pension you are looking to review?

Maybe you’re looking to reduce your 2021 tax bill before October.

No matter your issue, let’s have a chat, no obligation, at our expense.

Drop me an email, francis@fortitudefp.ie or request a callback.

You can also give me a call on 086 0080 756 or access our diary here and book a call at your convenience.

Visit our content library.

Last but not least, we have over 50 articles on various financial subjects and learn more about our experience and expertise.

A wealth of free information on hand, covering all aspects of saving, investing, financial planning, protection and pension advice.

Our blog posts are intended for information purposes only and should not be interpreted as financial advice.

You should always engage the services of a fully qualified financial planner before entering any financial contract.

To discuss engaging the services of Fortitude Financial Planning please email us at info@fortitudefp.ie.

Fortitude Financial Planning Ltd will not be held responsible for any actions taken as a result of reading these blog posts.

*Source: www.cso.ie

Production

Production