A Guide to Investment & Pension Fees and Charges

Pension and investment fees and charges.

Without a doubt an area with a historical negative stigma attached.

Obviously, we all know fees and charges apply to investments and have to be paid (unless you are someone who thinks people work for free, if so see this blog) but what are they?

It’s the historical opacity surrounding them that has created the negative stigma.

Because of this, it’s essential and important that we educate our clients about the various fees that may apply to remove any confusion.

This also promotes our ethos of trust and transparency with our clients.

Let’s break down the various types of charges that may apply.

Allocation Rate Charges

Every investment carries an allocation rate, this is the % of the investment that is actually invested.

For example, if you’re investing €500 per month, an allocation rate of 100%, your full €500 gets invested.

On the other hand, if you’re allocation rate is 95%, only €475 is invested, i.e. there is a 5% charge on the way in.

We always strive to provide 100% allocation meaning no entry charges however some factors can reduce this.

Most of our clients receive 100% allocation.

Policy Fee

A policy fee is typically a monetary amount, sometimes billed monthly, sometimes annually.

It could be €5 per month or €250 per year, anything, it may not even apply.

Each different pension or investment contract varies.

Government Levy

This doesn’t apply to a pension, only a personal investment.

The good old Government take 1% of your investment before it goes in!

Exit Penalties

For the most part, exit penalties apply to pensions and investments set up within the first five years.

For example, you set up with Provider A, and after 12 months you don’t like Provider A and want to transfer to Provider B.

Provider A will keep a portion of your fund to cover their costs.

Typically, after 5 years, these fall off and no exit penalties apply.

Please note, exit penalties do not apply to a switch of funds within your existing contract or appointing a new advisor as your financial advisor with the provider.

Exit penalties are not necessarily a bad thing as the recommended minimum investment term for any investment is 5 years, thus they can act as a deterrent to do something wrong should an investment have a tough 12-18 month period.

Annual Fund % Charges

This is the % of your fund that is taken on an annual basis, usually including the advisors’ fee and ranges anywhere from 0.50% (with no ongoing advice fee, i.e. you’re on your own) to 2%, depending on the type of contract.

It is our view, that up to 1.5% is fine depending on the actual product, and providing you are receiving an ongoing proactive advice and planning service.

In the UK, a larger and more developed market, the average annual charge is around 1.8%.

The annual % charge can be communicated in a couple of ways.

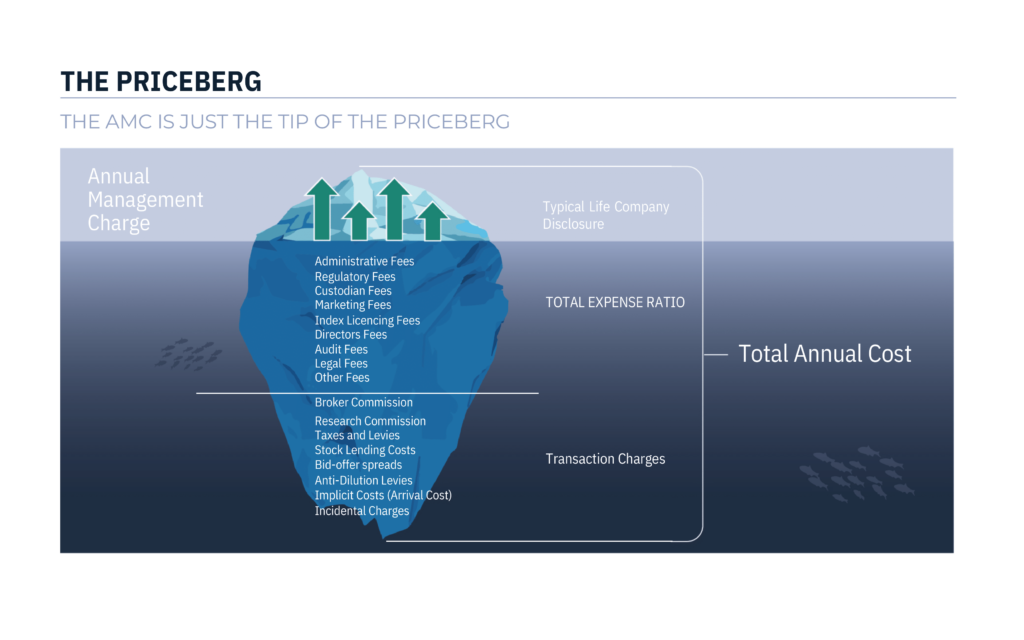

Annual Management Charge (AMC) or Fund Management Charge (FMC)

This is the most common and traditional way of this being communicated in Ireland.

You set up a pension or investment, receive a policy document, and it quotes an AMC.

However, there are numerous implicit charges applicable that are not included in the AMC.

Additional charges like (but not limited to) custodian fees, audit & legal fees.

In contrast, there is a more accurate representation.

Ongoing Charges Figure (OCF) or Total Expense Ratio (TER)

The more modern, wider measure of the impact of charges is the OCF or TER.

The OCF or TER tries to capture as many ongoing costs as possible and is a more accurate reflection of the actual cost to an investor than the sole AMC.

Clearly, this figure will be significantly higher for active investment funds due to the high level of ongoing management (but do they perform better?).

For Example

One example, let us look at one of the main Irish providers’ balanced multi-asset fund, a household name with a strong marketing machine.

The AMC would be quoted as (excluding advice) 1.15% but looking at the Key Investor Information Document (KIID), the actual cost is 3.1% – nearly 2% higher.

Furthermore, looking at another main provider, a similar balanced multi-asset fund.

Headline AMC is 1%, the actual cost is 2.63%.

Significant difference.

Go ahead, Google ‘AMC versus OCF’.

The Issue

Without getting too much into it, providers are not really forced to disclose total investment costs.

Due to the difference in actual cost versus AMC, they’re in no rush to either, and neither are most advisors!

Even so, you will find advisors who will use certain investment platforms that will disclose the OCF.

At Fortitude, we use a platform like this and also work with other providers who are happy to provide us with OCF’s.

We avoid providers who are not proactive at providing us their OCF’s.

Overall, our core investment strategies are designed to keep your OCF as low as possible.

Summary

To summarise, understanding the fees that apply to your pensions and investments is important.

It’s not to say the cheapest is best, that’s not necessarily the case.

A race to the bottom when it comes to fees helps no one, least of all clients as low fees typically equals limited or no ongoing advice which in turn equals poor client outcomes.

However, it’s important to know 1) what you are paying and 2) what you get in return from your advisor.

We aim to make things as clear and simple as possible for our clients.

How We Help

If you are not a client of ours and have any of the following products, we recommend scheduling a review with us:

- Pre-retirement pension (Retirement bond, directors pension, PRSA, personal pension)

- Post-retirement pension (Approved Retirement Fund)

- Personal Investment (investment bond, regular investment policy)

Charges, fees, and particularly products and service models have progressed significantly over the past 5-10 years and it’s important you’re on a competitive structure to suit your needs.

We’re confident we can help you improve your current arrangements and provide you with a better service as a valued client.

If you are an existing client and require information just let us know.

Get in touch

Email us at info@fortitudefp.ie or request a callback.

Alternatively, you can get us on 041 213 0307.

Why not visit our insights?

A multitude of information on various financial subjects covering all aspects of saving, investing, financial planning, protection, and pension advice.

Our blog posts are intended for information purposes only and should not be interpreted as financial advice.

You should always engage the services of a fully qualified financial planner before entering any financial contract.

To discuss engaging the services of Fortitude Financial Planning please email us at info@fortitudefp.ie.

Fortitude Financial Planning Ltd will not be held responsible for any actions taken as a result of reading these blog posts.

Production

Production