Active versus Passive Investing

When building an investment portfolio, one of the biggest decisions is choosing between active and passive investing.

Both strategies have their merits and drawbacks, and the best choice often depends on your financial goals, risk tolerance, and personal preferences.

In this blog, we’ll break down the key differences between active and passive investing and help you decide which approach might be better suited for your needs.

What is Active Investing?

Active investing involves hands-on management of a portfolio by a professional fund manager or individual investor.

The goal is to outperform the market by selecting stocks, bonds, or other assets that are expected to perform better than average.

Key Features of Active Investing:

- Active Management: Fund managers or investors analyze market trends, economic data, and individual company performance to make investment decisions.

- Flexibility: Active investors can quickly react to market changes, seizing opportunities or minimizing losses.

- High Potential for Returns: If done successfully, active investing can lead to significant returns by capitalizing on market inefficiencies.

Drawbacks of Active Investing:

- Higher Fees: Active funds typically have higher expense ratios due to management fees and trading costs.

- Performance Risk: Many actively managed funds fail to consistently outperform their benchmark index after fees.

- Time-Intensive: For individual investors, active investing requires extensive research and monitoring.

What is Passive Investing?

Passive investing is a strategy that focuses on long-term growth by mirroring the performance of a specific market index, such as the S&P 500 or FTSE 100. Instead of trying to beat the market, passive investors aim to match its performance.

Key Features of Passive Investing:

- Index Tracking: Passive funds, such as ETFs or index funds, replicate the performance of a specific index.

- Low Costs: Since passive funds require less management, they typically have lower fees and expense ratios.

- Diversification: Investing in an index provides instant diversification across a broad range of assets.

Drawbacks of Passive Investing:

- Limited Upside: Passive investors are unlikely to outperform the market since they are designed to match it.

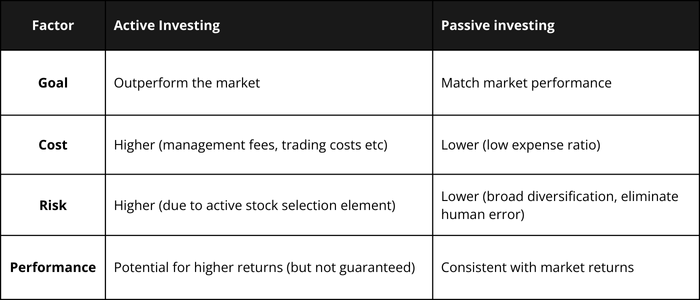

Active and Passive Investing: A Quick Comparison

When should you choose active investing?

Active investing may be a better fit if:

- You believe in the expertise of a specific fund manager.

- You’re comfortable with higher fees in exchange for the potential of greater returns.

- You have a high tolerance for risk and a shorter investment horizon.

- You want to focus on specific industries or trends.

When should you choose passive investing?

Passive investing might be ideal if:

- You want low fees and broad diversification.

- Your goal is long-term, steady growth aligned with market performance.

- You’re skeptical of the ability to consistently outperform the market.

Middle Ground Consideration

For many investors, a hybrid strategy can work.

This might involve combining active funds for specific asset classes or sectors with passive funds for core holdings.

Diversifying across both strategies can provide stability while still allowing for the potential of higher returns in targeted areas.

Key Considerations

Now, a couple of key considerations.

When it comes to market outperformance by active management, there is no evidence to support that fund managers can consistently outperform the market over time.

Secondly, costs, and costs specific to the market in Ireland.

If you have a pension or investment with a traditional life insurance company, you are provided a policy document.

On your policy document you are quoted an Annual Management Charge, however, that charge is not reflective of all costs levied by you.

The more accurate cost is an Ongoing Charges Figure (OCF).

Particularly with active management, as more work is involved, undisclosed costs can be really high.

So, for example, you have an Annual Management Charge of 1.25% on your policy document and are invested with an active manager.

The true cost (the OCF), could be in the region of closer to 2%.

Summary

There’s no one-size-fits-all answer when it comes to active vs. passive investing.

The key thing is that either you, or the advisor you work with, has an investment philosophy and is not working off a random ‘who had the best performance quarter?’ approach.

By understanding the pros and cons of each strategy, you can make informed decisions that align with your long-term objectives.

Our Investment Philosophy

Here are a few documents for you to read on our approach to investing:

- Fortitude Financial Planning’s Investment Philosophy

- The principles that underpin our Investment Philosophy

- Why your advisor should have an Investment Philosophy

How we help

We can review your portfolio and confirm to you that you are invested actively, passively or a mixture of both.

If you wish we can dive deeper into the age-old active versus passive argument.

Get in touch

Email us at info@fortitudefp.ie or click below to schedule an introductory call at our expense.

Why not visit our insights page.

A multitude of information on various financial subjects covering all aspects of saving, investing, financial planning, protection and pension advice.

Our blog posts are intended for information purposes only and should not be interpreted as financial advice.

You should always engage the services of a fully qualified financial planner before entering any financial contract.

To discuss engaging the services of Fortitude Financial Planning please email us at info@fortitudefp.ie.

Fortitude Financial Planning Ltd will not be held responsible for any actions taken as a result of reading these blog posts.

Production

Production