Early retirement? What to know before you plan to go!

Early retirement may seem like a dream come true.

However, you need to be well prepared if you want to retire early.

If you’re not prepared, you might run into complications, and not just complications like running out of money.

It’s a significant lifestyle change also.

Here are a few things to consider before retiring early that no one talks about.

Will you have enough money for your entire retirement?

Retirees spend more money than they expect. Fact.

Every day becomes a Saturday and Sunday.

They might spend more on travel, home renovations, or other retirement-related lifestyle changes.

Sticking to a budget early in retirement might not be a high priority compared to enjoying your free time, but you need to consider the later years, even as you’re enjoying the early ones.

Making a budget with plenty of room for travel and other things you finally have time for will help you strike a balance.

People are living longer than ever before. This means that you might need to make your savings last longer than expected.

If you talk to any group of retirees or pre-retirees, the prospect of outliving their money is likely to be one of their top concerns.

Some people will live past 90 or even to 100.

If your retirement lasts 20, 30, or even 40 years, how well do you think your retirement savings will hold up? What financial steps could you take in retirement to try to prevent those savings from eroding?

What about inflation?

Some retirees address the gap in their finances by working part-time in their 60s and 70s. The income from this work can be an economic lifesaver for retirees.

What if you worked part-time and earned €20,000 a year? You might effectively give your retirement savings five or ten more years to grow.

When it comes to future healthcare costs you can never save too much

Healthcare costs can be high, particularly in later years.

If you want to avoid public, you will have to pay for private health insurance, which can be costly.

How many people retire with a dedicated account or lump sum to address future health costs or care home fees?

Some retirees end up winging it, paying their out-of-pocket expenses out of income and savings.

While couples can save together, individuals may have considerable healthcare costs.

People who plan forward have begun adjusting their retirement expectations by considering projected healthcare expenses.

There is no easy answer for retirees preparing to address future healthcare costs.

Staying active and fit may lead to long-term healthcare savings, but tomorrow’s retirees may already have some physical ailments.

Planning for future health costs is always a good idea, especially if you want to retire early.

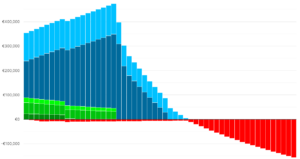

Compound Interest Needs Time To Work

The longer you work and save for retirement, the more money you will have. If you retire early, the power of compounding interest fades away because you stop contributing to your investments.

Compounding interest works best for those who start saving early and save for as long as possible before withdrawing.

There is an old saying that compound interest “is the most powerful force in the universe,” and there is some truth to this. So what makes compound interest special?

Compound interest means that you earn interest not only on your principal investment but also on previously accrued interest.

The results are not terribly impressive in the short term, but over thirty years or more, compound interest can produce a handsome dividend.

Great minds have been fascinated by compound interest for generations. Founding Father Benjamin Franklin believed that a penny saved was a penny earned, and he decided to put this belief to the test.

At his death in 1790, he bequeathed $1,000 each to the cities of Boston and Philadelphia for the purpose of building trade schools and public works projects after 100 years had passed. Compound interest did the trick, netting $572,000 for those cities in 1891.

The fund was closed in 1990, with institutes named after the statesman and scientist earning a $7 million bounty.*

If you place a small sum of money into an account offering compound interest and leave it alone for an extended period, your money will grow just as Franklin’s did.

For example, €100 left alone in the bank for 30 years at a 10% annual compounded interest rate would increase to €1,744.94. However, if you were to add money to the account over time, the compounded interest would continue to grow and would create a healthy supplement to whatever other retirement plans you may have.

Let’s say that you started with €1,000 in an account offering 15% interest and added €600 per year (€50 monthly). In 40 years, if you kept up your deposits, the account would hold €1,495,435.86.

These are hypothetical situations; you will contribute more or less money as time passes and your circumstances change, and your account may earn a different amount of interest.

Keep inflation in mind, as well. Money doesn’t go as far today as it did 40 years ago, and it may not seem like a lot of money once you’re ready to retire.

The compounding stops if you take the money out of the accounts early.

Your house is not necessarily an investment

You will need to live somewhere in retirement, whether you rent or own your home.

Home ownership has associated costs, especially if you plan to sell the house at some point, including making additions and improvements like putting on a new roof. It all adds up.

Is the house you are in now an investment that you might use to finance early retirement? If you buy a house to flip it or buy it as a rental property, the answer is yes.

If you buy a home to live in with hopes of selling it later, the answer may be no. Your home is an expression of your lifestyle, a wonderful setting for your life, and a place where you can enjoy privacy and comfort.

As an investment, though, it is essentially illiquid, and its rate of return is uncertain.

Home values do not automatically increase over time. Over the decades, property values have risen, and they will probably keep growing over the short term, but perhaps not as quickly as some buyers hope.

Stocks and investments, unlike your home, do not need upkeep. You will never need to repair, reroof, or repaint a portfolio.

And they are liquid, accessible.

Houses need maintenance over time, which can eat into your gains. You must also pay taxes. If you envision your home as an income-producing asset during your retirement, that means playing landlord on some level. Many are not ready to take that step.

Remember that home values tend to increase gradually. If you see your home as an investment, consider it a long-term one.

While every household is different, be careful if you plan to use your house to fund your early retirement.

The short version: Look before you leap

Early retirement is possible if you can finance your lifestyle from the day you quit working.

It’s a worthwhile goal for anyone willing to take the steps to make it both feasible and relatively uncomplicated and stress free.

How we help

The life expectancy of a male in Ireland is currently 78 years and 82 years for women.

Let’s assume you retire at 65, you work approximately 40 years to freely enjoy potentially 13 or 17.

Even at that, how is your health in those final years? Likely not as good as it was pre-60.

It’s not an exact science but you get my point.

So what can you do about it? How can we help you?

You can plan to retire early so you can really enjoy life and we can help you get that plan in place.

We will help you make sure you don’t run out of money when you want to hang up the boots.

Schedule your initial chat by clicking below.

Schedule my Financial Planning Consultation

Get in touch

Email us at info@fortitudefp.ie or request a callback.

Alternatively, you can get us on 041 213 0307.

Why not visit our insights?

A multitude of information on various financial subjects covering all aspects of saving, investing, financial planning, protection, and pension advice.

Our blog posts are intended for information purposes only and should not be interpreted as financial advice.

You should always engage the services of a fully qualified financial planner before entering any financial contract.

To discuss engaging the services of Fortitude Financial Planning please email us at info@fortitudefp.ie.

Fortitude Financial Planning Ltd will not be held responsible for any actions taken as a result of reading these blog posts.

Production

Production