Investing for beginners – Many of us have heard the term “investments” used in many ways.

It’s a concept most of us are familiar with to some degree.

But unless you’ve really taken an interest in the markets or set aside time to study them, you may not have a total understanding of what investing is, everything involved with investing or what different types of investments are out there.

Before you do a deep dive into theories, past performances or principles, this article will get you up to speed with the basics of investing and what you should know as you look to grow your financial knowledge (and your money!!)

What Is Investing?

This is Investing 101 – Investing for Beginners, meaning we’re going to start by defining what exactly investing is.

In its simplest form, investing is the process of giving money to another entity (such as the government or a company) with the hope that they will return more money to you (a profit) at a later time.

While it sounds simple enough, giving money to another with the expectation of gaining more in return introduces the idea of weighing risk versus reward.

Why Do People Choose to Invest?

Due to inflation, the value of a euro in your hand (or under the mattress) is continuously deteriorating.

This is what makes investing an appealing choice for many.

The idea is to put a certain amount of your euros in a place where they’re expected to earn more in the future (assuming a positive return is earned) than a euro left sitting in savings.

Common Types of Investments

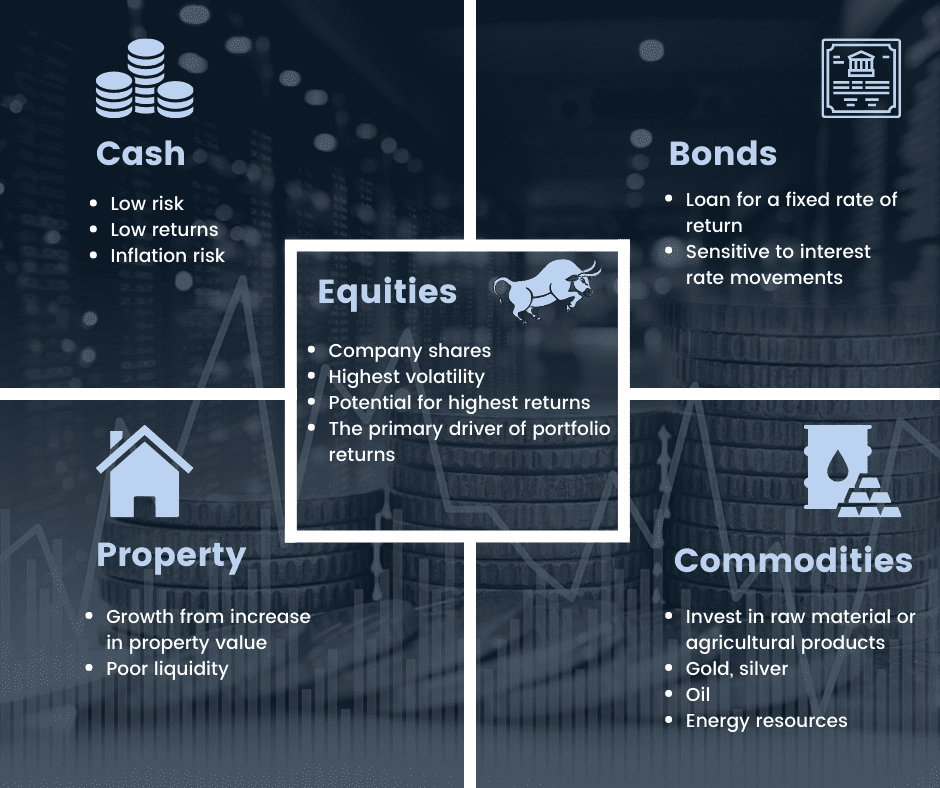

While there are more out there, below are a few of the most common types of investments along with a brief description of each.

Stocks/Shares/Equities:

All three terms are the same thing.

Giving your money to a specific company, earning you a share or piece of the company in return.

Equities have the highest volatility but the potential for the highest returns.

Typically the primary driver of portfolio returns.

Bonds:

Loaning your money to a government or other issuer, with the agreement that you will receive that amount back with interest at a later date.

Property:

Typically broken down into four categories: residential, commercial, industrial and land, property investment is purchasing, owning, leasing and/or selling land with the intention of gaining a profit.

Commodities:

Investing in the likes of gold, silver or energy resources.

Funds:

Using a fund manager.

A fund typically has a mix of the above assets.

Funds will give you exposure to some or all of equities, bonds, cash, commodities and property.

Index Trackers:

A type of fund that aims to mirror the performance of the index they’re tracking (such as the S&P 500).

Exchange-traded funds:

Index funds that can be traded on an exchange throughout the day, as the prices of stocks fluctuate.

What Is Investment Risk?

According to the Securities and Exchange Commission, risk refers to “the degree of uncertainty and/or potential financial loss inherent in an investment decision.”1

How does this relate to investments?

In general, the higher the risk of an investment, the greater the potential reward.

Every investment vehicle and product comes with its own set of risks.

From determining how quickly an investor will be able to access their money when they need it, to figuring out how fast their money will grow where it is.

Everyone’s tolerance for risk is unique to them.

Another common determining factor may be a person’s time horizon, such as how far away they are from retirement, or how close they are to needing access to the money invested.

If an investors time horizon is long, they have the capacity for more risk.

If it’s a shorter term investment, their risk capacity is reduced.

Another factor could be considering how much money you’re willing to risk losing without affecting your lifestyle or jeopardizing your needs.

Review Your Portfolios Current Risk Levels

Measurements of Risk

Below are some of the more common measurements of risk.

Volatility:

A statistical measure of how much the value of an investment moves up and down.

In mathematical terms, we call this Standard Deviation.

Investments with a higher standard deviation are considered riskier.

Drawdowns:

A drawdown is a measure of a peak to a trough.

We focus on the maximum drawdown.

This is the largest drawdown over a period of time.

By focusing on downside risk, this gives us an idea as to how much an investors investment can be devalued.

There is risk in not taking risk

The problem with the word ‘risk’ is that people associate this with losing their money.

It’s an emotive word.

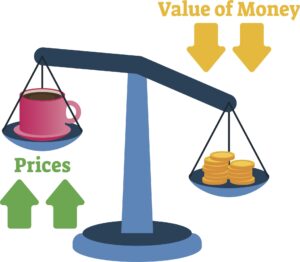

The problem with not taking some level of risk is inflation.

Inflation is the general increase in prices and fall in the purchasing value of money.

Do you ever walk into a shop and say ‘I remember such and such only cost €2 – it”s now €2.75?’ – or similar!

That’s inflation.

If we don’t take some level of risk with our money, the low or zero returns on offer from our banks, credit unions and post office ensure our money continuously devalues.

The risk in not taking risk is the constant eroding of our monies purchasing power caused by inflation.

Reasons why people don’t invest

I’ve had hundreds, if not thousands of conversations on investing and risk.

With clients, family members, friends, recommended prospective clients, professional people, and many more.

I believe there are two main reasons some don’t take enough investment risk with a portion of their money:

Lack of understanding so it’s best avoided

Naturally, we’re wary of things we don’t fully understand.

Again, the misconception of the word risk.

People can associate this word (incorrectly) with losing money.

Once the thought of losing money enters the playing field, the strategy is avoided.

Once Bitten twice shy

A large % of the Irish population have in fact lost money in the past due to bad advice.

Think bank shares – probably the most common past occurrence.

I’ve lost count of the number of conversations I’ve had where people invested in bank shares.

Or with people who have seen their parents get burned by bank shares.

Understandably they feel aggrieved and that maybe investing is not for them.

But investing in one share, say Facebook, Netflix or bank shares – is more akin to gambling than investing.

One share can completely crash creating a permanent loss of capital.

When you create a properly diversified portfolio you hold hundreds of different stocks across different sectors and global regions.

Not one share, in one entity, in one sector in one country.

The Key components of investing for beginners

There are three key components to be considered when creating a portfolio.

Risk Tolerance

A measure of the degree of volatility an investor can withstand in their portfolio.

The industry measures this usually by way of a questionnaire.

This typically measures your feelings about risk.

Risk Capacity

This is not based on your feelings about risk.

Instead it to how much risk you can afford to take.

Your investment time horizon affects this.

Once you are investing for the longer term, you have an increased capacity for risk.

If your advisor is doing their job, they should model your risk capacity and see what effects an adverse market event would have on your finances.

Target rate of return

Finally, what is an investors target rate of return?

What rate of return do they require to achieve their financial goals.

If an investor requires a 2% rate of return, there is absolutely no point in them taking more risk than necessary.

The flip side.

If they have a really low tolerance and limited capacity for risk but require a 6% return – that’s a different issue.

The three components above knit together when creating an investors portfolio.

Investment philosophy

It’s important that a financial planner or advisor has a set investment philosophy.

This shows they have a belief as to how markets work.

At Fortitude Financial Planning we believe investing shouldn’t be complicated.

We adopt a simple investment philosophy – long term investing with an emphasis on diversification.

You can read more about it here.

Summary

Whether you’re new to the world of investing or you’re looking to work with an advisor to develop a portfolio, it’s important to understand the basics of what investing is.

Understand how diverse your options are and the risks involved with seeking returns.

Ready to discuss investing or do you require a review of your current pension or investment portfolio?

Request a callback or schedule a call with us.

Francis McTaggart CFP® SIA RPA QFA

These blog posts are intended for information purposes only and should not be interpreted as financial advice.

You should always engage the services of a fully qualified financial planner before entering any financial contract.

To discuss engaging the services of Fortitude Financial Planning please email us at info@fortitudefp.ie.

Fortitude Financial Planning Ltd will not be held responsible for any actions taken as a result of reading these blog posts.

Production

Production