Is now a good time to invest in the stock market or should I wait?

‘The markets are high, is now a good time to invest in the stock market?”

This is a common question at the moment.

When the markets goes up it’s great. We enjoy it. Investing appears easy.

However, what goes up must come down – to some degree – sometime.

The markets can’t keep going up forever. They don’t work like that.

The market is at an all-time high and some think ‘it must be about to turn downwards, any day now, then I’ll buy in!’

Successful investors realise trying to time the market (buy low & sell high) is not realistic.

It may yield the odd success but it is not a consistent, repeatable, successful investment strategy.

So, what are you supposed to do when the markets keep going up?

If you have cash to invest, pension funds or existing investments, markets being at an all-time high may give you cause for concern.

Don’t try and time the market

The future can’t be predicted. Short term markets can’t be predicted.

No one knows where the market is going to be tomorrow, next week, next month.

Investing is about time in the market, not timing the market.

Irrespective of where the market is today, focus on the long term.

Let the markets do their long term thing to your advantage.

What’s the alternative? Cash?

If you’re concerned about markets or investing, what’s the alternative, cash?

The days of high interest cash accounts are gone.

Interest rates are rock bottom and inflation is reducing the value of our money.

If the market doesn’t drop, how much time will you let pass before investing?

The longer you’re in cash the more difficult it is to find the answer to that question.

When markets dip, this is highlighted as bad news in the financial press.

A cognitive bias we carry called ‘Recency Bias’ then kicks in.

Recency bias is the unfounded conviction that recent trends will continue into the near future.

In simple terms, it’s a sneaky trick our brains play on us.

This then tempts you to wait even longer to invest and before you know it, the markets are climbing again and you still don’t know when to invest.

A bell doesn’t ring at the bottom.

All the while inflation is decreasing the value of your money.

The Data

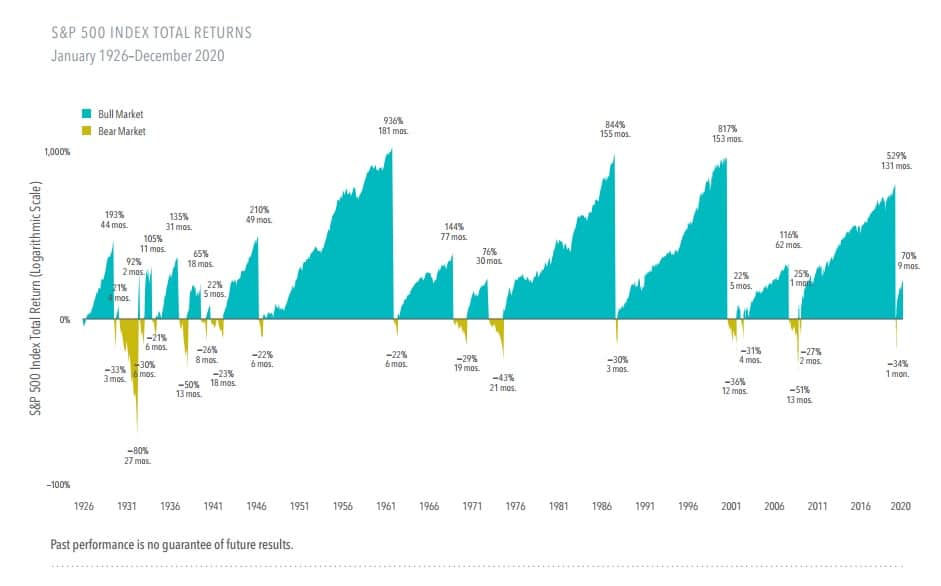

Nearly a century of bull and bear markets show that the good times have outweighed the bad.

From 1926 through 2020, the S & P 500 Index has experienced 17 bear markets.

The declines ranged from -21% to -80% with an average length of about 10 months.

On the upside there were 18 bull markets.

They averaged 54 months in length and gains ranged from 21% to 936%.

View these together and it’s clear that markets reward disciplined investors.*

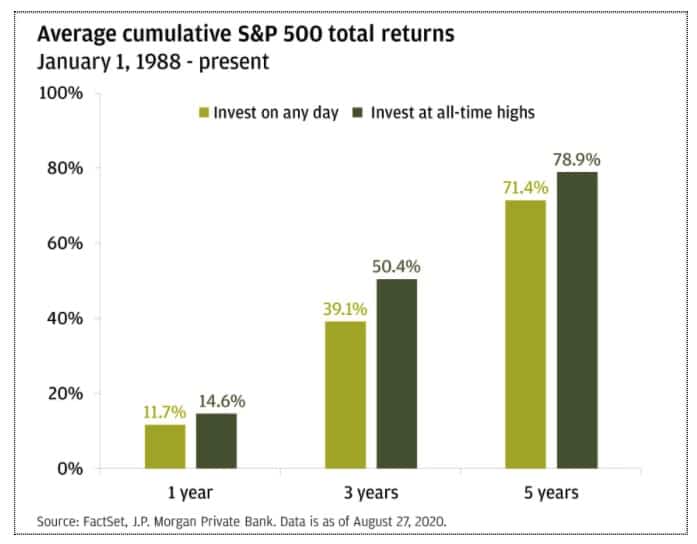

What may be surprising, is that future returns from investing at an all-time high have statistically been better than investing on the average day.

This is using data over the past 30+ years.

This timeframe includes a few sizeable pullbacks and historical market collapses.

That’s correct, if you’d invested money at the previous all time highs, you’d have come out ahead.

And that includes the crazy volatility found in between.

So, is now a good time to invest in the stock market?

Simply put, it’s always a good time to invest.

Sitting in cash just because market indices are hitting new levels is a mistake.

Investing now begins your period of earning compound interest earlier.

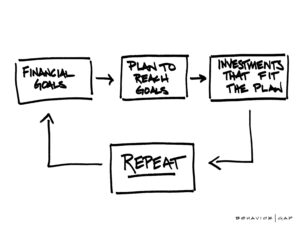

It’s important to make decisions based on your own short, medium and long term goals and expectations, not on short term market movements.

This article will give you more hints and tips on setting goals.

The stock market ups and downs are unpredictable but history supports an expectation of positive returns over the long term.

For the best shot at the benefits the market can offer, stay the course.

Stick to your plan and trust the process.

Need Help?

Are you worried about your existing pensions or investments due to high markets?

Do you have cash currently losing value in the bank, credit union or post office and are considering your options?

Reminder – never invest without engaging the services of a fully qualified CERTIFIED FINANCIAL PLANNER™.

Francis McTaggart CFP® SIA RPA QFA

Disclaimer: All content provided in these blog posts is intended for information purposes only and should not be interpreted as financial advice.

You should always engage the services of a fully qualified financial planner before entering any financial contract.

Fortitude Financial Planning Ltd will not be held responsible for any actions taken as a result of reading these blog posts.

*Source: Dimensional Fund Advisors

Production

Production