Two Effective Ways To Tackle Your Personal Debt

If you’re a regular reader of our articles, you will be familiar with the terms good debt and crappy debt.

Good debt is your mortgage, you need it to keep a roof over your head.

Crappy personal debt is high interest stuff you don’t need, bank loans, Credit Union loans, credit cards, car HP, etc.

Carrying crappy debt is like a noose around your neck when it comes to your financial plan.

Crappy debt is a burden that can be prohibitive in the process of creating true wealth for you and being debt-free ranks near the top of many people’s financial goals.

Here are a couple of tried and tested methods of paying down your personal debt that you can put into place today.

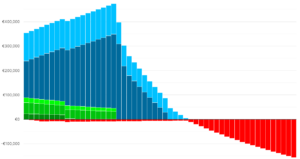

The Snowball Method

With the snowball method, we focus on the lowest balance of personal debt you have first.

Firstly, when you have completed your budget (yes, there’s that word again), you allocate additional resources towards your lowest debt.

When your lowest value debt is cleared, you direct the whole payment you were making to that debt to your second lowest debt.

And so on.

Rinse, repeat and as a result, you will get to a position where you’re debt free.

Psychologically, this method is said to be the most rewarding.

This is a consequence of early wins as you clear off smaller debt balances.

Furthermore, you build momentum as you free up cash flow to allocate to tackle the next balance in line.

Nevertheless, while this is a popular method, technically it may not always be the most mathematically correct approach.

This is a result of focusing on the smallest to largest balance with no consideration of their interest rate.

The Avalanche Method

This method, my own favourite, is the most mathematically correct method for eliminating debt.

What you do here is tackle them in order of interest rate, highest to lowest.

As a consequence, you save more money in interest.

However, this method can sometimes be seen as more mentally challenging than the snowball method as your personal debt with the highest interest could also be your debt with the highest balance resulting in taking longer to clear it.

Every time you pay towards it you will be making progress but it could take longer to see the final result.

With this method, firstly you list out all of your debts individually, noting the balance and interest rate, and order them from highest interest rate to lowest interest rate.

Secondly, create your budget (again!).

Thirdly, following the completion of your budget, assign some extra resources to increase your payment to the debt with the highest interest rate.

Finally, when that debt is clear, assign the whole payment to the debt with the second highest interest rate.

Rinse and repeat!

Summary

To really get ahead with your finances, you need to shake off the crappy personal debt you are carrying.

High interest, bank loans, car loans, credit union loans, credit cards.

The rates of interest you pay on them can be like a weight on your ankles when you’re trying to swim.

The above are two tried and tested methods you can put into force to get yourself ahead with this stuff.

How We Help

Control your finances, don’t let them control you.

Are you carrying personal debt you want to get on top of as part of improving your overall financial picture?

Our low cost financial planning consultation is a great way to get started.

You can schedule your consultation by clicking the below.

Get in touch

Email us at info@fortitudefp.ie or request a callback.

Or give me a call on 041 213 0307.

Why not visit our insights.

A multitude of information on various financial subjects covering all aspects of saving, investing, financial planning, protection and pension advice.

Our blog posts are intended for information purposes only and should not be interpreted as financial advice.

You should always engage the services of a fully qualified financial planner before entering any financial contract.

To discuss engaging the services of Fortitude Financial Planning please email us at info@fortitudefp.ie.

Fortitude Financial Planning Ltd will not be held responsible for any actions taken as a result of reading these blog posts.

Production

Production