You 7 Step ‘Summer’ Personal Finance NCT

It seems like when summertime hits, time slows down. Holidays are scheduled and are approaching or even at time of writing have gone!

If you find yourself with some extra time on your hands in the upcoming months, you may want to use this opportunity to check in on your family’s personal finances.

While conducting a thorough analysis of your finances may feel intimidating, we’ve provided seven simple steps to keep you focused and on track.

Step #1 Review Your Budget

We can’t reiterate enough and constantly beat this drum: everyone needs a budget to get their personal finances on sound footing.

A budget is not about restricting yourself, it’s about giving you the knowledge of where your money is going. In turn, you can then make informed decisions on what changes to make.

It’s also effective at stopping you from spending more than you earn. To get the best look at your spending habits, you may want to evaluate your savings and spending record over the past 6–12 months.

To get our free budget template just click here.

Step #2 Review Your Debt

Many people (too many) carry credit card and loan debt from month to month. Crappy debt.

If one of them is you, start planning to pay them off. Your personal finances will be in a much better place with no crappy high-interest debt hanging over you.

Crappy high interest debt is like a noose around your finances neck. Focus on managing and eliminating this bad debt.

Don’t be tempted to just pay off what shows up on the bills each month.

Take a note of all of your crappy debts individually and the interest rate, order them highest rate to lowest.

After doing your budget, allocate extra € to the highest rate debt. When that is paid off, reallocate the full payment for that one to the next highest rate and so on.

Furthermore, create an annual debt summary. By doing this you can better understand whether you’re gradually working down your amount of debt or falling farther into the hole.

Step #3 Evaluate Your Bills and Utility Providers

Take the extra time to evaluate your current utilities and providers.

Gas, electric, tv, broadband, insurances. A great way to save money is to not auto renew, look at the market, and switch.

So far in 2023, across all of my own personal insurances, I’ve seen a decrease in the cost versus 2022, simply by reviewing the market. Yet I hear people consistently moan about their insurance costs going up.

www.bonkers.ie is a great place to start for gas and electricity.

#4 Revisit Your Short and Long Term Goals

One year is a long time, alot can change.

Career changes, salary increases or decreases, marriage, divorce death and even birth. Sending the kids to college, this has a significant impact on your finances.

This is why it’s important to regularly review your long-term goals and progress toward them while revisiting and evaluating your shorter-term goals.

It allows you to make adjustments to existing plans or make new plans.

Step #5 Seek Out Tax Savings

Tax efficiency, is a key component of financial planning.

Are you someone who rushes around come September and October to close off the previous years tax? Take a different approach to the tax season by evaluating your tax-saving strategies early.

Think about tax saving opportunities such as last minute pension contributions for tax relief. If you pay income tax at the highest rate, every €100 into your pension only costs your €60, i.e. 40% tax relief.

If you have an income protection policy, are you claiming your tax relief?

#6 Rebalance Your Investment Portfolio

Markets change, volatility kicks in. 2022 was tough and it’s important to visit your portfolio and risk tolerance to help keep it in line with your investment objectives.

Statistics say rebalancing a portfolio gives an investor better long term returns.

#7 Review Your Pension

Whether your plan to retire in a few decades or within the next 5 years, checking in on your pension once a year is great practice. It’s super important to be invested correctly (see step 6) and you may also be missing out on key tax reduction opportunities.

If you’re closer to retirement, take stock of how the savings you’re making today will translate into retirement income later down the line.

A pension is a tax wrapper, the most tax efficient vehicle in the country. Use it or lose it.

Summary

To summarise – 7 small and simple steps to take.

If you don’t take them, they can be costly. Not only in monetary terms, but also stress and anxiety.

In a world where mental wellbeing correctly dominates, financial worries are the number one cause of stress in the US according to the American Psychological Association. Taking small and simple steps regularly, will reduce finance stress and anxiety.

How We Help

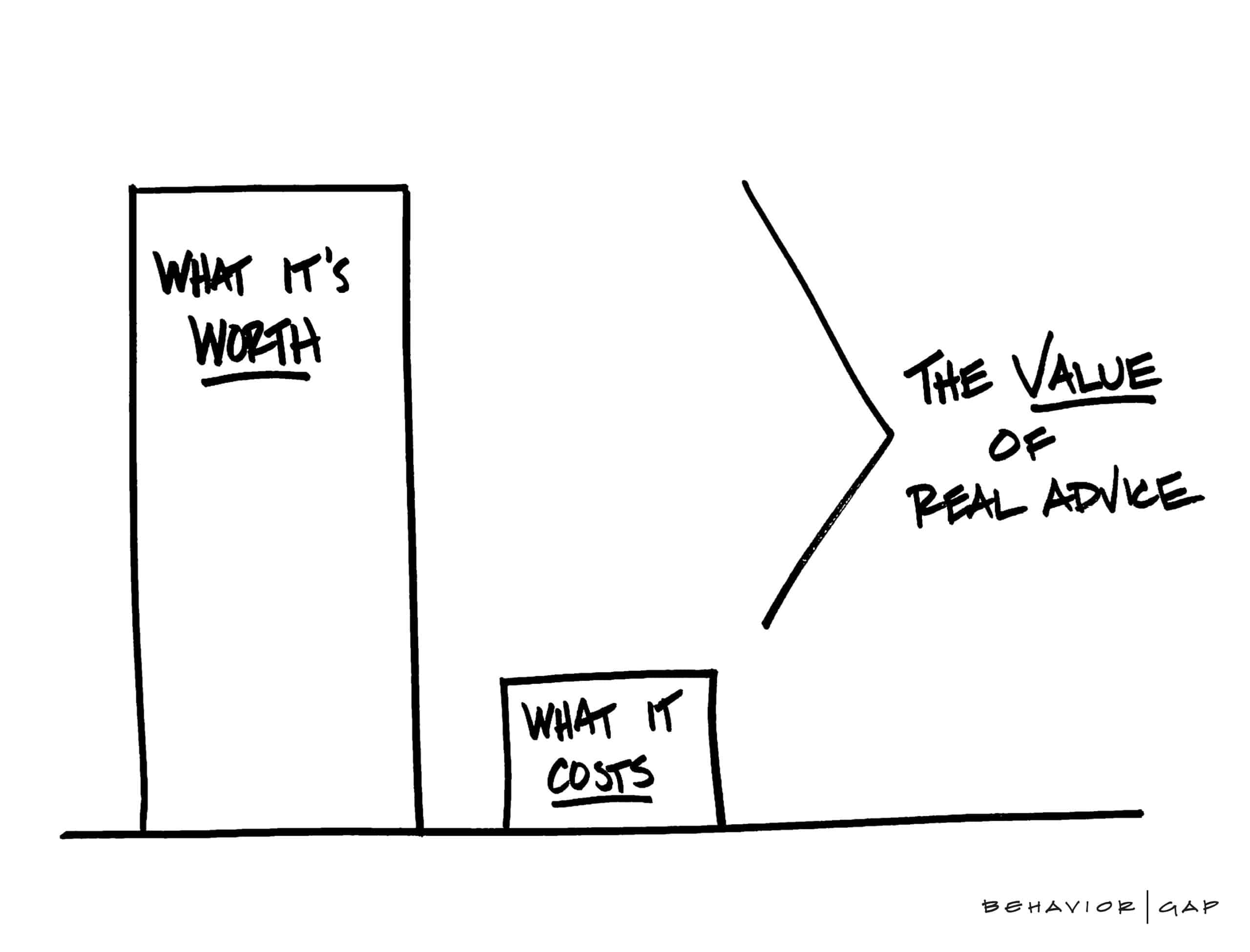

Fancy a chat? Control your finances, don’t let them control you.

Our low cost starter financial planning consultation is a great way to get you up and running and on sound financial footing.

You’ll have your own personal financial road map created specifically for you.

You can schedule your consultation by clicking the below.

Get in touch

Email us at info@fortitudefp.ie or request a callback.

Or give me a call on 041 213 0307.

Why not visit our insights.

A multitude of information on various financial subjects covering all aspects of saving, investing, financial planning, protection and pension advice.

Our blog posts are intended for information purposes only and should not be interpreted as financial advice.

You should always engage the services of a fully qualified financial planner before entering any financial contract.

To discuss engaging the services of Fortitude Financial Planning please email us at info@fortitudefp.ie.

Fortitude Financial Planning Ltd will not be held responsible for any actions taken as a result of reading these blog posts.

Production

Production