Understanding Investment Diversification

Generally speaking we all (or should!) carry some kind of investment exposure.

You may be part of your employer’s pension scheme.

Or you may have a post-retirement Approved Retirement Fund (ARF).

Furthermore, you may have an investment account to combat the dreaded inflation.

Importantly, when you created your investment strategy, your asset allocation reflected your goals, time horizon and tolerance for risk.

At that time.

Over time, however, any of these three factors may have changed.

If so, importantly your portfolio may need adjustments to reflect your changes.

Even your age can impact your investment decisions.

Let’s get back to basics and look at investment diversification.

Diversification

The saying “don’t put all your eggs in one basket” can clearly apply to investing.

Over time, certain asset classes may perform better than others.

Asset classes generally are cash, bonds, property, alternatives and equities.

If your assets are mostly held in one kind of investment, you could find yourself under a bit of pressure if that asset class experiences volatility.

For example, if you are 100% invested in equities, you would have experienced higher levels of volatility this year than recent times.

However, remember that diversification is an approach to help you manage investment risk.

It does not eliminate the risk of a decline in the value of the investment.

Asset allocation strategies are also used in portfolio management.

When we ask you questions about your goals, time horizon, and tolerance for risk, we are getting a better idea of what asset classes may be appropriate for your situation.

Like diversification, asset allocation is an approach to help manage investment risk.

Also, like diversification, it does not eliminate the risk of a decline in the value of the investment.

You can even diversify between active and passive management.

Or regular investment contributions versus one lump sum.

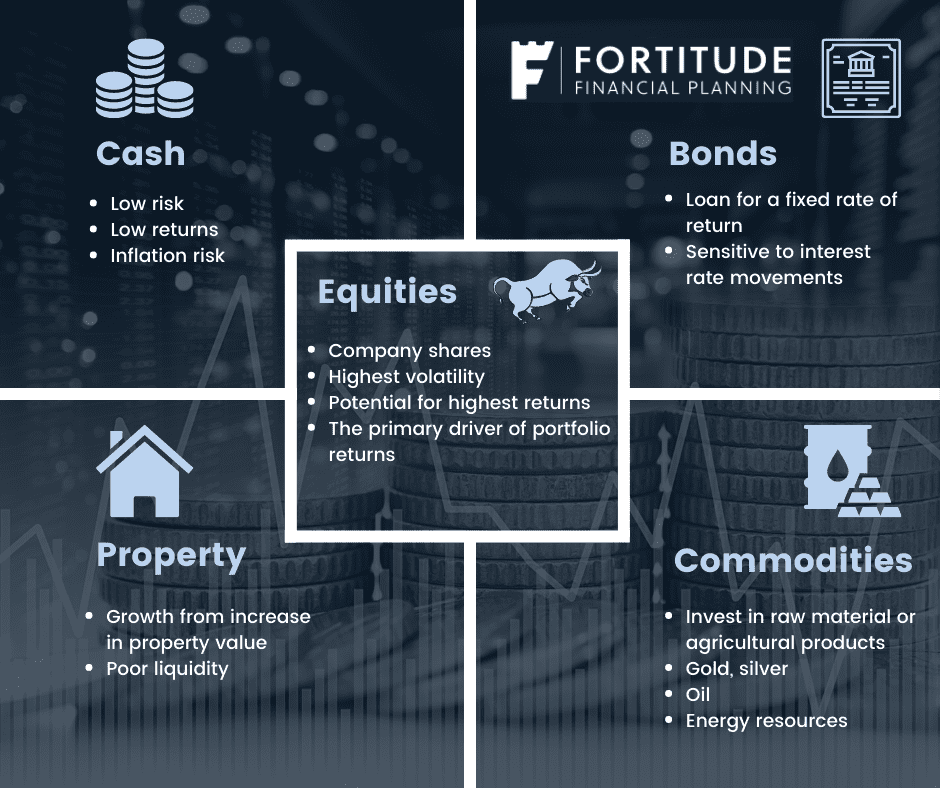

Asset Classes

Importantly, let us quickly recap the various asset classes.

Stocks/Shares/Equities:

All three of these are the same thing.

Here, you give your money to a specific company, earning you a share or piece of the company in return.

This asset class carries the highest level of volatility.

In addition to higher volatility, however, also potential for the highest returns.

Typically, it is the equity component that is the primary driver of portfolio returns.

Bonds:

Here you lend your money to a government or other issuer.

With the agreement, you will receive that amount back with interest at a later date.

Property:

Typically broken down into the following categories: residential, commercial, industrial and land.

Property investment is purchasing, owning, leasing and/or selling land with the intention of gaining a profit.

Commodities:

Investing in the likes of gold, silver or energy resources.

Determining an Asset Allocation

Appropriate asset allocation for diversification is determined by each individual client’s situation.

Broadly speaking, here are some key factors to consider:

Time

A client with longer timeframes may be comfortable with investments that offer higher potential returns but also carry a higher risk.

Above all, a longer investment timeframe allows a client to ride out the market’s ups and downs.

An extreme example of a long time horizon would be a 25 year old investing in their employers’ pension.

The pension has a normal retirement age of 65.

That’s a potential 40-year investment timeframe.

A client with a shorter timeframe may need to consider market volatility when evaluating various investment choices.

On the other hand, a client with a really short timeframe has to consider if investing is even appropriate at all.

Goals

Individual goals.

We all have them.

Some are long-term, while others have a shorter time horizon.

Without a doubt, knowing your investment goals will help keep you on the correct track.

Capacity for Risk

Capacity for risk is how much risk you can afford to take.

Your investment time horizon affects this.

Once you are investing for the longer term, you have an increased capacity for risk.

If your advisor is doing their job, they should model your risk capacity and see what effects an adverse market event would have on your finances.

Risk Tolerance

The old risk tolerance questionnaires.

No one likes them, but they are an important part of the process.

An investor with higher risk tolerance will be more willing to accept greater market volatility in the pursuit of potential returns.

An investor with a lower risk tolerance may be willing to forgo some potential return in favour of investments that attempt to limit high/low swings.

My problem with risk questionnaires is that some advisors only use them.

The client comes out with a risk level 4 so the client gets a risk level 4 investment.

Not so, the risk tolerance output should be used in conjunction with other things, like the client’s investment time horizon & capacity for risk.

Have Your Investing Priorities Changed?

If so, this is all the more reason to review and possibly adjust the investment mix in your portfolio.

Whether you hold a personal investment, a pre-retirement pension, an ARF, it should be reviewed.

Asset allocation is a critical building block of investment portfolio creation.

Having a strong knowledge of the concept will help you when considering which investments are appropriate for your long-term strategy.

Nevertheless, you should always seek guidance from a fully qualified financial planner when determining your asset allocation.

How We Can Help You

Do you have a current investment, whether it be a pension, an ARF or a personal investment?

How about a personal investment?

Are you looking to start investing to combat inflation or are you faced with your pension retirement options?

New to investing and just fancy a chat?

Maybe you just need guidance on whether you should be saving or investing.

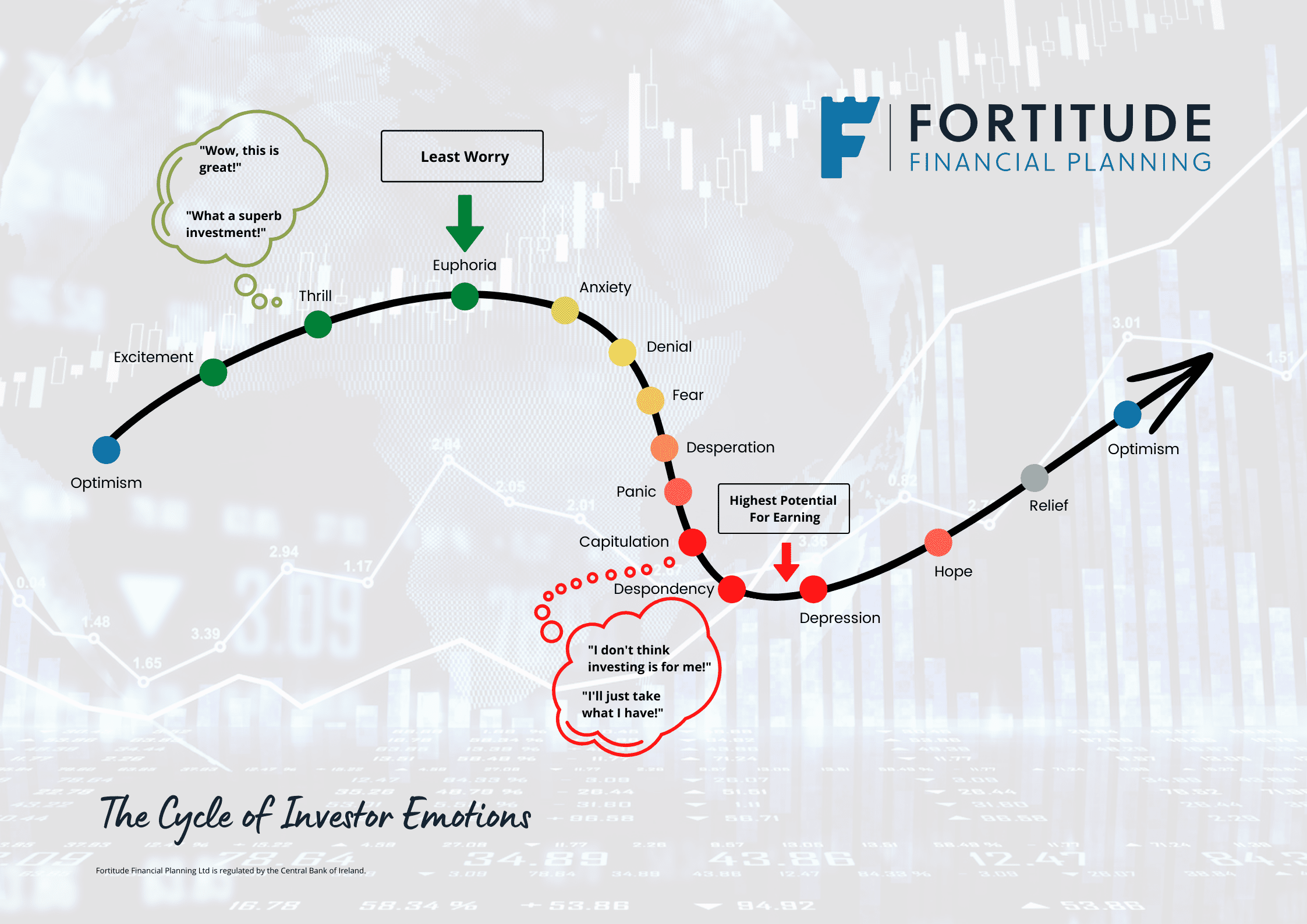

Current volatility in markets may be causing you some anxiety, investing after all is simple but no one said it was easy.

We will review your asset allocation for you, and collaboratively with you.

Importantly we will consider the following:

- Your investment risk tolerance and capacity for risk

- What you are actually looking to achieve

- The expected time horizon of the investment

We will marry all of your parts together and advise on the appropriateness of what you have and make any recommendations.

Get in touch

Let’s have a chat.

We can get to know what it is you’re looking for and advise you if we can help you.

Drop me an email, francis@fortitudefp.ie or request a callback.

You can also give me a call on 086 0080 756 or access our diary here and book a call at your convenience.

Visit our content library.

We now have over 50 articles on various financial subjects.

A wealth of free information on hand, covering all aspects of saving, investing, financial planning, protection and pension advice.

Our blog posts are intended for information purposes only and should not be interpreted as financial advice.

You should always engage the services of a fully qualified financial planner before entering any financial contract.

To discuss engaging the services of Fortitude Financial Planning please email us at info@fortitudefp.ie.

Fortitude Financial Planning Ltd will not be held responsible for any actions taken as a result of reading these blog posts.

Production

Production