What exactly is a defined contribution pension?

Recently we’ve written some simple ‘What is’ articles.

These focus simply on specific products used in financial planning.

For example ‘What is an Approved Retirement Fund?

Or ‘What is income continuance?’

The feedback from these articles is really positive.

In an industry that’s convoluted with jargon, they keep it simple in describing a specific product.

Sticking with simplicity let’s look at a pension.

What it is.

Why we need one.

What it does.

And, importantly, the benefits of having one.

Firstly, Why do we need a pension?

Undoubtedly, there are a number of reasons.

Let us skip the immediate benefits of tax relief and tax-free growth.

We are living longer.

That means there is a longer retirement period to finance.

Lifestyle in retirement, potential long term care.

More importantly, the state pension in Ireland is only €13,171 per annum.

That’s €1,097 per month, before tax.

This is designed to cover bare living expenses.

If you earn €2,000 per month net of tax at the moment, a retirement where the state pension is your only income will mean a 50% reduction in your earnings.

Therefore, to live the life you want in retirement, you require a private pension.

Without a doubt, this will help you maintain your lifestyle in retirement.

What is a defined contribution pension?

In its simplest form, a pension is a long term, tax-efficient, savings account.

Long term as retirement is typically our furthest away financial objective.

And tax-efficient because we get tax relief on our contributions.

We also benefit from tax-free investment growth and receive a tax-free lump sum at retirement.

How does it work?

With a pension, we pay into it.

If it’s a pension via our employer, our employer also pays into it.

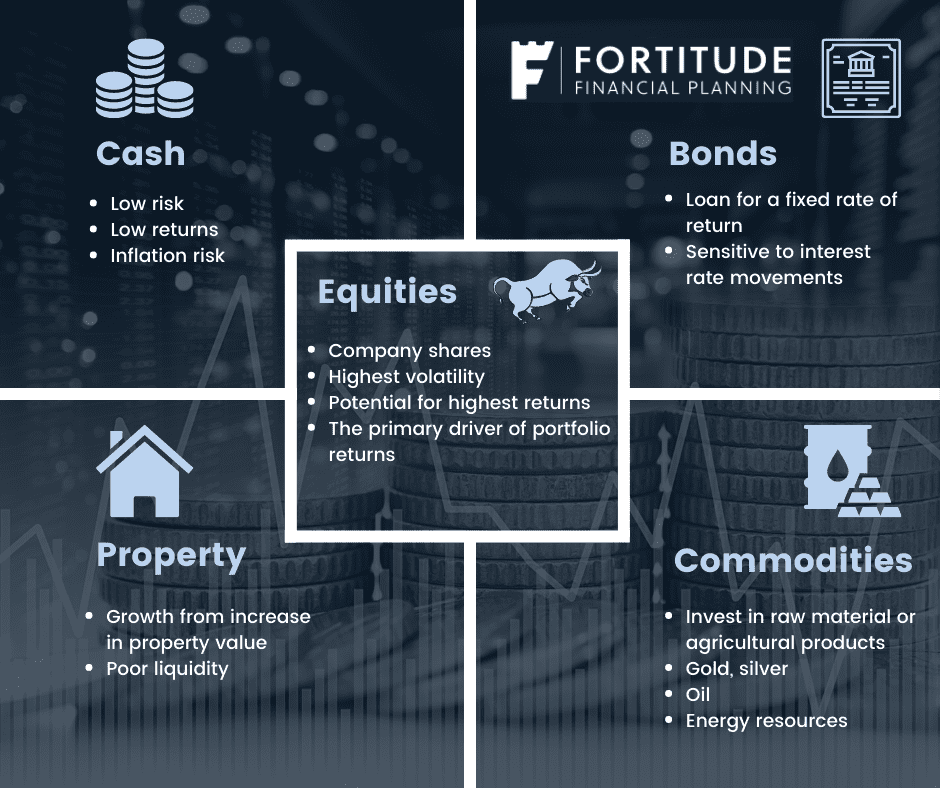

The money is exposed to investment markets so grows over time.

Then, when we retire, we draw our benefits from our accumulated pension fund.

The benefits will typically consist of a tax-efficient retirement lump sum (a portion of which is tax-free) and either a fixed pension payable for life or continued investment in a post-retirement investment fund.

Types of pension

Generally speaking, there are 3 types of defined contribution pensions:

- Occupational pension scheme – this is set up via our employer

- Personal Retirement Savings Account (PRSA) – this can be set up personally or via our employer

- Personal Pension – typically set up by the self-employed

Tax relief and efficiency

Yes.

Your own personal contributions qualify for tax relief.

You receive tax relief at your rate of income tax.

So, if you pay 20% income tax, you get 20% tax relief.

If you pay 40% income tax, you get 40% relief.

In short, Revenue will cover either 20% or 40% of your pension contributions.

That’s how important a pension is deemed.

The growth in a pension is also tax-free.

No Capital Gains Tax and no Exit Tax.

Tax Relief Example

Let’s say you pay tax at 40%.

Therefore, you will receive 40% tax relief.

This means for every €100 you pay to your pension, the actual cost to you will be €60.

That’s your €100 minus the 40% tax relief you receive.

As highlighted above, Revenue will cover that 40%.

Is my pension invested?

Yes, your pension should be invested.

Importantly, your pension will afford you the opportunity to beat inflation.

It should be noted however you should take a level of risk in line with your individual risk tolerance, capacity for risk and investment objectives.

Alternatively, you can invest your pension in cash.

However, clearly, as with all cash instruments, low or no returns, coupled with charges will see the real value of your fund decline over time due to inflation.

Options at retirement

The good part!

You have paid into your pension, reached retirement, now what do you get?

Broadly speaking, there are three main options:

- A tax-efficient retirement lump sum (a portion of which will be completely tax free) plus

- Either a fixed income payable for life (an annuity) or

- A post-retirement investment fund (an Approved Retirement Fund, ARF)

I like to get clients to think of their tax-free cash as their ‘fun fund’.

They have built this up, now it’s time to clearly go and enjoy it.

Furthermore, the income from the annuity or ARF can supplement your lifestyle.

Advantages of a pension

We have clearly covered some of these above but let’s recap:

- Tax-relief going in

- Tax-free growth

- Retirement lump sum (of which a portion is tax-free) at retirement

- An additional income in retirement to supplement ones lifestyle

Disadvantages of a pension

None.

Simply, there are no disadvantages to having a pension.

They clearly make sense from a tax perspective.

Secondly, along with the tax benefits, they provide additional income in retirement.

Thirdly, at retirement, you receive a tax-efficient lump sum.

So, they are a necessity and they make sense.

It is our opinion there is no disadvantage to having a pension.

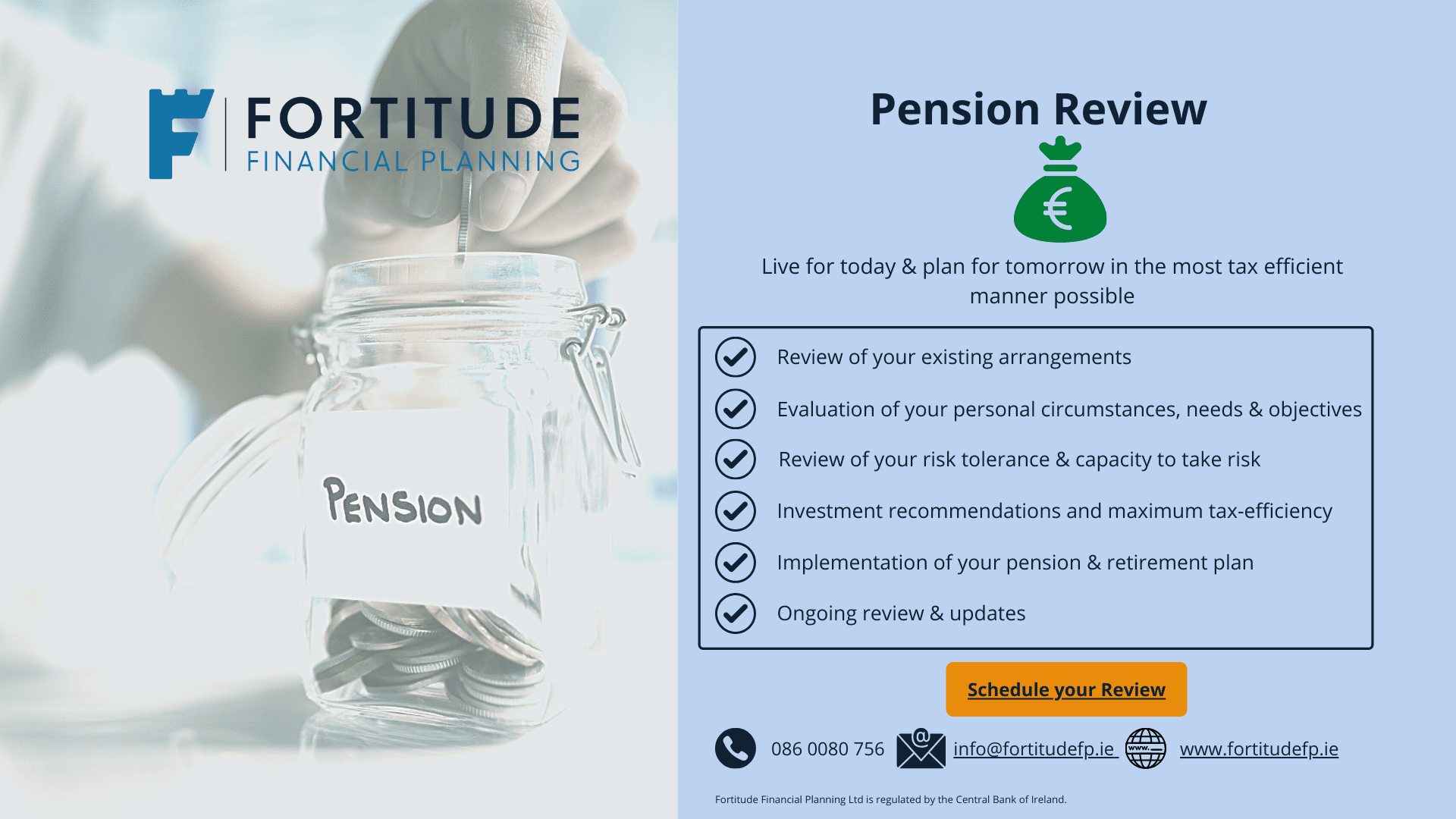

How often should I review my pension?

If you have an existing defined contribution pension, once per year.

How thorough depends on where you are in the life cycle.

Thirties or forties, you will likely get away with a quick check on the investment performance, asset allocation and charges.

First and foremost, check how suitable the investment allocation is for your objectives.

Secondly, is it performing to its best?

Late forties onwards, you really need to be a bit more thorough, particularly from age 50.

What are the projections looking like?

What is it on course to pay me?

Do I need to be paying more?

Is the asset allocation still suitable?

From age 55 onwards we like to review our clients twice per year.

Summary

To summarise, very few people like pensions.

Some people are even anti-pension.

This is normally because they don’t know how they really work.

The truth is, due to the inadequacy of the state pension, we all need some form of personal pension.

Like it or lump it, they’re a necessity and they’re useful.

Unless you want to live on €1,000 per month in retirement.

Strip it back, a pension is simply a long term, tax-efficient savings account.

A finance vehicle where we can help our future selves whilst reducing our tax liability for our current selves.

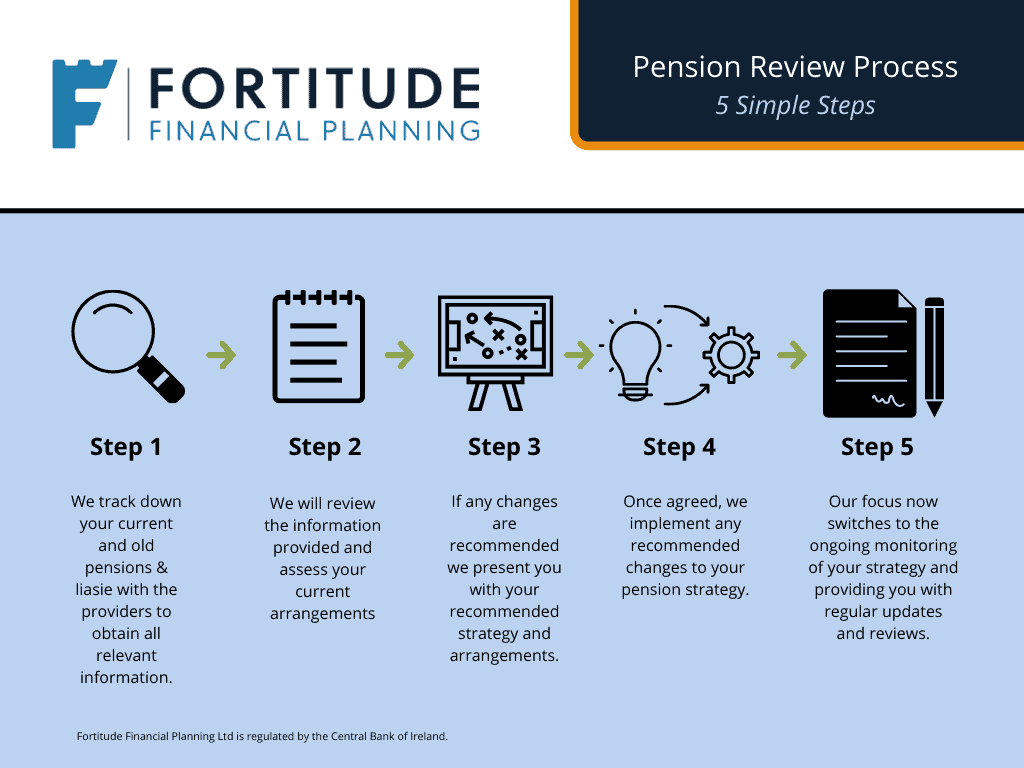

How We Help

Pensions are one of our main advisory areas.

We set them up for new clients.

On the other hand new clients come to us with existing arrangements, we review them.

They can be looked at as part of an overall plan or specifically as part of a pension review.

Without a doubt, the important thing is to take stock of what you have or what you’re lacking.

Schedule My Review

Get in touch

Do you have an existing pension you are looking to review?

Changed employment and you are unsure what to do with your old employer’s pension?

On the other hand, maybe you are looking to kick off your pension saving journey.

Whatever your pension issue, let’s have a chat, no-obligation, at our expense.

Drop me an email, francis@fortitudefp.ie or request a callback.

You can also give me a call on 086 0080 756 or access our diary here and book a call at your convenience.

Visit our content library.

Over 50 articles on various financial subjects and learn more about our experience and expertise.

A wealth of free information on hand, covering all aspects of saving, investing, financial planning, protection and pension advice.

Our blog posts are intended for information purposes only and should not be interpreted as financial advice.

You should always engage the services of a fully qualified financial planner before entering any financial contract.

To discuss engaging the services of Fortitude Financial Planning please email us at info@fortitudefp.ie.

Fortitude Financial Planning Ltd will not be held responsible for any actions taken as a result of reading these blog posts.

Production

Production