Your 8 Step Summer Financial Check-Up

Summer is here (although the weather suggests otherwise!).

The kids are finishing school soon and hopefully you have a holiday to look forward to.

It seems like when summertime hits, time slows down.

If you find yourself with a bit of extra time on your hands in the upcoming months, you should use this opportunity to check in on your family’s finances.

Sometimes it can appear that checking on the finances is daunting.

However, here are 8 simple for a financial check up steps to keep you focused and on track.

Step 1: Analyze Your Budget

In early 2022, the Bureau of Economic Analysis reported that the personal savings rate is at only 6%.1

An effective way to avoid spending more than you’re earning is to step back and take stock of your monthly and annual budget.

And if you don’t have a budget at all, use this time to make one.

Importantly, a budget is not about restricting what you spend.

It is about being conscious of where you are spending.

Subsequently allowing you to make effective adjustments.

Many credit cards or banks will offer categorical breakdowns of your spending.

This is clearly a great way to find out what you’re spending the most money on and if there’s room to cut back.

Revolut is really good for this.

To get the best look at your spending habits, evaluate your savings and spending record over the past six to 12 months.

Want our free budget template – click here.

Step 2: Seek Out Tax Savings

No financial check-up is complete without saving on tax.

Do you scramble to pull your paperwork together every September and October?

This year, try taking a different approach to tax season by evaluating your tax-saving strategies early.

Understand your options and tax-saving opportunities.

Opportunities such as last-minute pension contributions.

Do you have a personal income protection policy?

If so are you claiming tax relief on the cost?

Health expenses?

Reaching out to a tax professional now could mean you have more time to prepare and strategize together for next year’s returns.

Step 3: Tackle Your Debt

An alarming 38% of adults carry credit card debt from month to month.2

If you’re guilty of putting off managing your amounting expenses, start planning to pay them off.

Most of us have what I call ‘good debt’ on our plate (mortgages, maybe a car payment).

On the other hand, it’s the bad debt (credit card debt, overdrafts, credit union loans, etc.) that drag us back.

You should want to and be focusing on managing and eliminating this.

While you can be tempted to simply pay off what shows up on the bills each month, you may want to create a debt summary to get a better idea of your total debt’s big picture.

By creating an annual debt summary, you can better understand whether you’re gradually working down the amount or falling farther into the hole.

There are a few ways to beat bad debt.

One of my favourites is to organise your debt, smallest to largest.

Keep paying the minimum amount to every debt except the smallest.

Then. increase your payment amount to the smallest debt.

You’ll clear this quicker and then pay more to the new smallest debt.

Step 4: Revisit Short and Long-Term Goals

A lot can change in a year – marriage, death, divorce, growing your family and experiencing a major career change.

Even seemingly small adjustments, like a job promotion or sending a kid off to college, can have a significant impact on your financial status.

That’s why it’s important to regularly review your long-term goals and progress towards them while revisiting and evaluating your shorter-term goals as well.

Do you want to grow your wealth?

If you plan to still be on this Earth in five years time, you should be planning.

Step 5: Evaluate Bills and Providers

As you’re reviewing your budget and expenses, take the extra time to thoroughly evaluate your current utility providers and options.

This includes your gas, electric, internet and TV service providers in addition to your insurance coverage options.

If you tend to set up auto payments and forget about your monthly bills, it’s an opportune time to revisit what it is you’re actually paying for.

Do not just renew with the existing providers.

Search for what’s best on the market.

www.bonkers.ie is great for gas and electricity.

Step 6: Reassess and Rebalance Your Investments

Or start investing if you don’t already.

It’s important to visit your portfolio and risk tolerance regularly to help keep it in line with your tolerance, goals and objectives.

It is important to take stock of your investments’ big picture.

Doing so can help you determine if you need to diversify differently or reassess your risk tolerance.

Not investing yet?

It’s a great way to grow your wealth.

Step 7: Review Your Pension Savings

Ok, I get it, no one likes pensions.

But they’re important.

And extremely tax efficient.

Whether retirement is decades down the line or within the upcoming year, reviewing your retirement savings on an annual basis is a great habit to start.

Alternatively, the day will come and you’ll realise you only have €13,000 per year from our Government to live on.

Take the time to assess whether or not you’re maxing out your retirement contribution options.

Learn how the savings you’re making today will translate into retirement income later down the line.

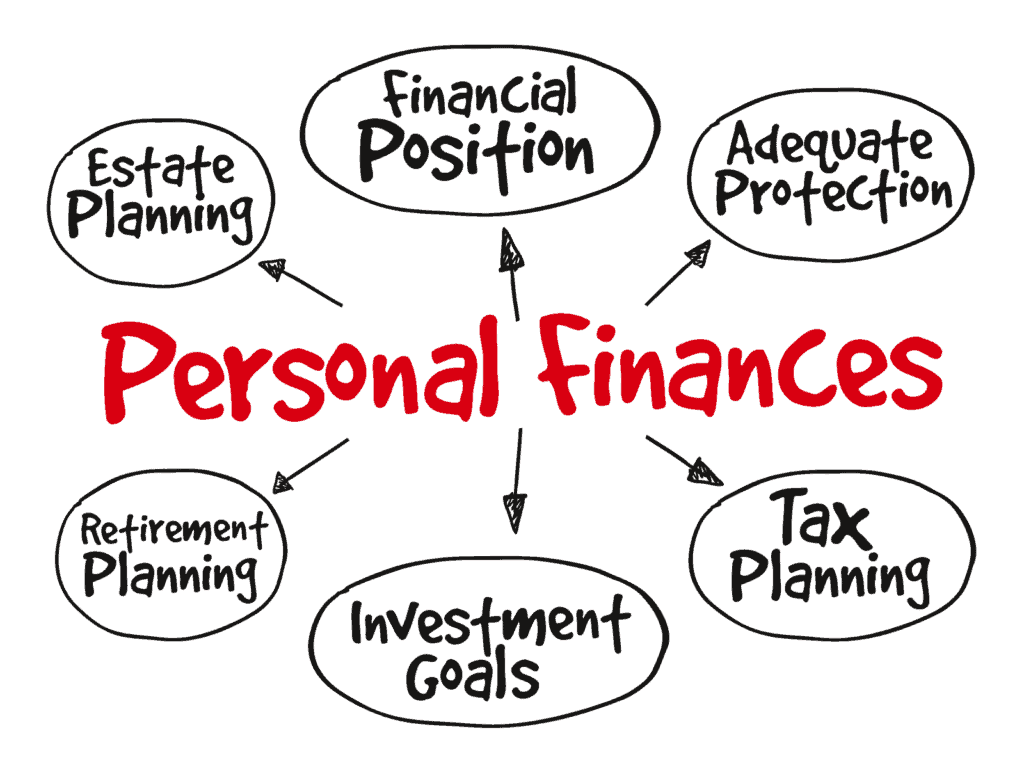

Step 8: Create Your Long-Term Financial Plan

This blog is published Wednesday 8th June 2022.

Do you intend on being on this Earth on 8th June 2027?

Clearly, of course, you do.

So you should be planning your finances.

Think about personal financial goals you may have.

Goals such as buying a new house, a new car, regular family holidays or even long term comfortable retirement.

Work with us to draft out a plan that includes savings, investing and other ways to build the wealth you need to achieve these goals.

We can start with smaller goals, so they seem less daunting.

Having a plan in place will help you stay on track and guide your financial decisions and give you confidence.

Summary

There you have it.

8 simple steps for a financial check-up.

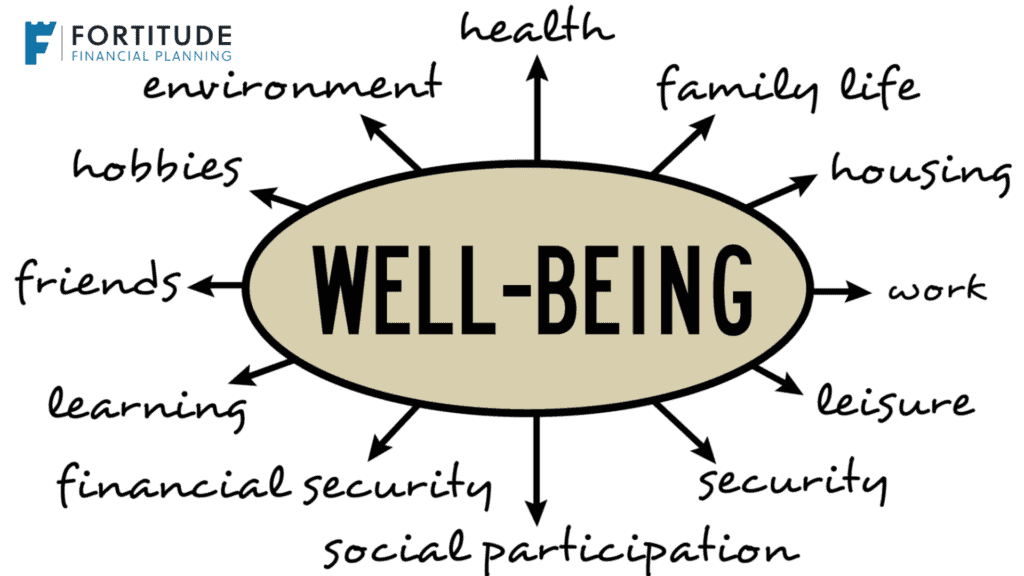

Finances can cause stress and anxiety.

Taking a bit of time to plan your finances, and aligning them with what you want to achieve will give you confidence and peace of mind.

How we Help

It’s always a good time to take charge of your finances.

You control them, don’t let them control you.

We can help you work through the above financial check-up list.

This will be part of an overall plan for your present and future.

Importantly, we won’t tell you to save, save and save some more.

Without a doubt, we want our clients to live for today.

Life, after all, is not a rehearsal.

Whilst keeping one eye on tomorrow.

Get in touch

Let’s talk.

Email me, francis@fortitudefp.ie or request a callback.

Or give me a call on 086 0080 756.

Access our diary here and book a call at your convenience.

Why not visit our insights.

A multitude of information on various financial subjects covering all aspects of saving, investing, financial planning, protection and pension advice.

Our blog posts are intended for information purposes only and should not be interpreted as financial advice.

You should always engage the services of a fully qualified financial planner before entering any financial contract.

To discuss engaging the services of Fortitude Financial Planning please email us at info@fortitudefp.ie.

Fortitude Financial Planning Ltd will not be held responsible for any actions taken as a result of reading these blog posts.

Production

Production