Financial Planning Priorities in Your 30’s

We continually highlight how financial planning is important and can be of benefit to anyone at any stage in life.

Recently, we looked at financial priorities for those of us in our 20’s.

Continuing with the trend of financial planning per decade, we are going to focus here on the 30’s.

Your 30’s

So, your 20’s are over, they’re in the history books and you’re moving on.

This is a stage in life where our health becomes considerably more important to us.

You may still be career focused or settling down with your family.

Middle age now sits in your sights but a decade, one in which your career, relationships and identity stand between it.

Your 30s are a great time to take your financial plans to the next level and achieve some important financial goals by the time you turn 40 years old.

Create a Budget

I admit, this part is constantly and consistently repeated.

Why?

One has to create a budget.

If you don’t have a budget, you don’t know where your spending or what you have.

Click here and learn more about creating your budget and download our free budget template.

Priority #1 Know Where You Are

Financially, if you don’t know where you are now, sort that.

Understand where you are today and think about where you want to be in the future.

What do I have coming in? Going out? (Budget!).

What assets do I have?

It’s super important to take stock of where you are and what your financial picture looks like now.

Take a big sheet of paper and draw a line down the middle, creating two columns.

Label the left ‘Assets’, and the right ‘Liabilities’.

Now note everything in each column.

By now you should have a strong understanding of how to effectively budget your income.

Priority #2 Think about your 30’s and beyond

Right, so you know where you stand, now for fun stuff.

Where do you want to go?

You may not have a set idea but some good questions to ask yourself are:

- When do I (we) want to get married?

- Do I (we) want to start a family? If so, when?

- Do I want to buy a home?

- Would I like the option of retiring early?

- How will we fund the kids college costs?

- How often do I (we) want to travel?

Without a doubt these are all big life goals that if you want to achieve them with minimum fuss, plan for them.

Priority #3 Start Emergency Fund or Build on the One You Have

An emergency fund is what it says on the tin.

A short-term low-risk savings account you can dip into in case of emergencies, such as a surprise medical bill, car or home repair.

Life happens.

As a rule of thumb, we recommend aiming for 3-6 months of net after tax income or 3-6 months of living expenses.

If you’ve followed our advice from your 20’s, keep building on this.

If you don have it, start saving now to accumulate it.

Priority #4 Get rid of Debt

Importantly, you should know by now that debt is bad.

Any debt other than a mortgage is crappy debt, high interest stuff, credit cards, credit union loans, bank loans etc.

Unquestionably it’s like a noose around your neck.

If you’re carrying debt, prioritize paying this down.

Firstly, organize your debts by interest rate, highest to lowest.

Secondly, pay the minimum payment off every loan.

Thirdly, devote extra payment to the highest interest loan.

Finally, when that is clear, redirect the whole payment to the second highest interest rate debt.

And so on.

Priority #5 Protect What You Have

Plan for absorbing a financial shock.

If you get sick or injured and cannot work for an extended period of time, it’s important to plan for this.

Check to see if your employer provides income protection, if not then protect your income.

Furthermore, it’s likely in your 30’s your family will grow.

Therefore, it’s important to review your life insurance and specified illness cover requirements.

Life insurance will protect your future, as of yet unearned income and provide your family with a financial safety net.

Priority #6 Grow Your Wealth (save/invest)

Your 30s are the start of your wealth accumulator years.

Leave 10%-20% of what you earn free for saving and investing.

Treat your savings and investments as a fixed expense each month, similar to a gas or electricity bill.

It’s important to get the balance between saving (bank, credit union) and investing (stocks and shares) correct.

To much saving, inflation is killing you.

Putting too much into investments, you’re carrying to much risk.

Learn more about getting the balance by clicking here.

Priority #7 Contribute to a Pension

As with any decade, if you don’t have a pension, start one.

If your employer provides a pension, join it.

At least pay to it what you need to to get your employer’s contribution.

Hard fact, the state pension is less than €14,000 per annum.

If you retire on a salary of €40,000, that’s a 65% reduction in your earnings in retirement.

Undoubtedly, it’s our own responsibility to plan for our own retirements.

Furthermore, if you pay tax at 40%, the government will cover 40% of your contribution by way of tax relief.

Priority #8 Enjoy Your Money

Many people think financial planning is all about saving for the future and sacrificing today.

Whereas the reality is different.

It’s about prioritizing what’s important, both now and in the future, and making a plan to get there.

This then leaves you free to spend your money today on what you want to spend it on, guilt free.

Priority #9 Speak to a financial planner

A good financial planner will be able to help you with the above.

They can tell you what you’re doing that’s good.

What you’ve done to date that’s good.

And what can be improved and the steps to take to make the improvements.

Summary

To summarise, taking the correct steps now whilst living your life will have you in a much better place.

Your 30’s is a decade of wealth creation and where you should really start it.

Don’t let them slip away and then think in future ‘if only I done this…’.

How we help

Confused about where to start or what you’re doing?

Wondering what you’re doing that’s good, bad, indifferent?

Avail of our low cost starter financial planning service.

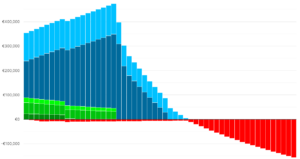

For one small fixed cost we can help you with all of the above and give you a graphical forecast of your financial future.

Schedule my Financial Planning Consultation

Get in touch

Questions?

Email us at info@fortitudefp.ie or request a callback.

Alternatively, you can get us on 041 213 0307.

Why not visit our insights.

A multitude of information on various financial subjects covering all aspects of saving, investing, financial planning, protection and pension advice.

Our blog posts are intended for information purposes only and should not be interpreted as financial advice.

You should always engage the services of a fully qualified financial planner before entering any financial contract.

To discuss engaging the services of Fortitude Financial Planning please email us at info@fortitudefp.ie.

Fortitude Financial Planning Ltd will not be held responsible for any actions taken as a result of reading these blog posts.

Production

Production