Your Approved Retirement Fund (ARF) and Current Market Volatility

As I write this the S & P 500 has just completed a 5-day losing streak of -3.75%.

The Nasdaq -4.32%.

Year to date they are -11.90% and 19.21% respectively.

Clearly harsh numbers.

However, it should be noted, not unprecedented.

Nevertheless, if you have an Approved Retirement Fund (ARF), this may be causing you to get anxious or nervous.

Especially as this is your pension fund that makes up a part of your retirement income.

Let us have a look at how market volatility could be affecting your ARF and more importantly what you should (and shouldn’t!) do.

What is an ARF?

Firstly, back to basics, pensions 101 – we’ll recap what an ARF is.

Simply, it’s a post-retirement investment fund that you draw an income from.

After you withdraw your pension tax-free lump sum, you can purchase an Annuity or invest in an ARF.

When invested, it generates growth and feeds you an income.

You can learn more by clicking here.

What is Market Volatility?

Secondly, keeping it simple.

Volatility is a term to describe markets when they experience periods of unpredictable and sometimes sharp price movements.

Often associated with falling markets, it also applies to sharp price increases.

Sticking with simplicity, we won’t get into too much detail as to what causes market volatility however below are some causing factors:

- Political and economic factors

- Industry and sector factors

- Company performance

Is Market Volatility Normal?

Perfectly normal.

And we don’t mean to come across flippant but yes volatility is a completely normal part of investing.

Market volatility is the price of entry, the price of getting your long-term return.

The problem with the current volatility is that investors have become so accustomed over the past 10 years or so to very little volatility that the current period is a reminder that markets can be volatile.

As a result, it can clearly be unsettling.

Particularly when it is affecting your ARF which is providing you with an income!

How is market volatility affecting my ARF?

Again, keeping it simple.

If your ARF is invested to any level, with some exposure to stocks and bonds, it will likely be down in value Year to Date.

Certainly in the intervening period moving up and down but Year to Date, likely down.

Example

We will look at a ‘Risk 4’ category multi-asset strategy we would use.

Year to Date (31/07/2022), this strategy has drawn down -10.05%.

So, keeping it simple (again!), if your ARF was 100% in this strategy, your ARF would have drawn down (declined) in value, approximately 10.5% (including charges) Year to Date.

The above is a simple back of a napkin example of how market volatility will be affecting your ARF.

What can I do to help my ARF during market volatility?

So, we’ve ascertained what volatility is and how it will be affecting your ARF, importantly, what can you do to combat it?

Have a clear investment strategy suited to you

It’s important that you have a well diversified investment strategy designed for you.

This is important for three main reasons:

- You retain your required level of income during volatility

- This then allows you to ride out periods of volatility

- As a result, you have peace of mind

What does a good investment strategy look like?

Income:

Firstly, income. How much income do you actually need to draw from your ARF?

Understanding this can help you identify the long term investment objectives of your ARF.

Secondly, your short term income requirements can be ringfenced within your ARF.

This then gives your ARF the capacity to take investment risk and you’re safe in the knowledge that short term market volatility won’t affect your income.

Understand your ARF investment funds

Knowledge is power. Power gives confidence.

If your advisor says to you ‘you’ll be invested in a fund risk rated 4 out of 7’, how are you supposed to understand how that fund works? How it has reacted in the past to a market drawdown?

Then, when it draws down by 10% you’re shocked, nervous, uneasy.

Simply because it hasn’t been properly explained to you that a) this could happen and b) if it does it’s a perfectly normal part of investing.

When you are prepared at the outset for periods of volatility and drawdowns on the journey, you are less likely to be surprised when they happen.

Consequently, you will act more rationally.

As a result, retain focus on your long term financial goals.

Do not try and time the market

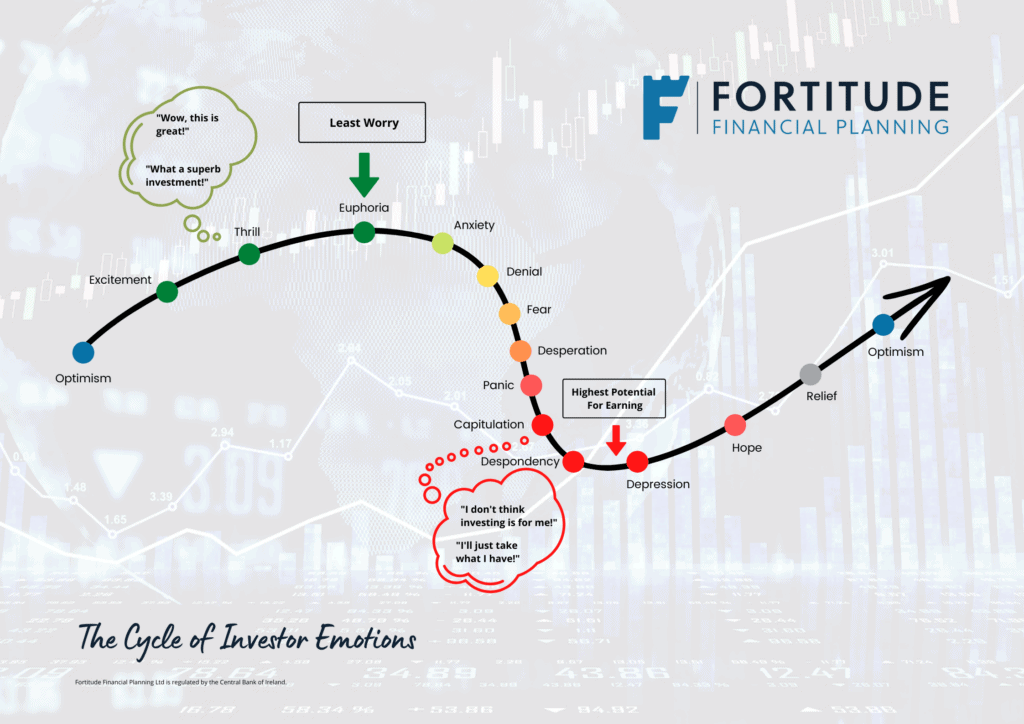

Investing can trigger emotions, it’s an emotive act.

Emotions can lead to irrational decisions.

Can you relate to any of the emotions on the chart below?

When markets draw down, it is only natural to feel you have to do something.

One of the main things people want to do is reduce risk or even switch to cash completely.

They then plan to get back in when ‘the time is right’.

However, this is impossible to do, you essentially have to make two calls and get them correct.

When to get out, and when to get back in.

The problem is when you decide to get out, your funds have devalued, by getting out, you crystallise the devaluation to a loss. A bell doesn’t ring at the top.

When you decide to get back in, markets inevitably have turned and are on the rise, you’ve missed the bottom. A bell doesn’t ring at the bottom.

‘Time in the market’ is more important than ‘timing the market’ and you can learn more about that here.

Once your strategy is in place to provide you with your income, you can abide by this critical investment principle.

Ongoing Advice

Ongoing advice from an advisor is critical when it comes to an ARF.

Not only do your personal circumstances change, but economic and market conditions also continually change.

Therefore, it is important that your ARF investment strategy remains relevant to you.

You can only ensure this with good, ongoing, regular advice.

Summary

To sum up, market volatility will affect your ARF.

That is only correct as your ARF has to carry investment risk to generate a return.

To what degree the effect is, is dependent on your investment strategy.

Obviously, it is important that you understand your investment strategy.

Furthermore, ensure it has been set up with your own requirements in mind.

Above all, once your strategy is correct, when markets are volatile, do nothing.

How We Help

Most clients who contact us to review their ARF are typically unsure about what they have or how it’s reacting to market volatility.

Usually, they have dealt with a bank or a corporate company, usually the company that was the administrators of their employers’ pension scheme.

Where the advisors who are setting up the ARF have significant sales targets to meet.

As a result, these clients tend to get an off the shelf solution with high commissions.

Risk rated 4? In you go, with little consideration for their overall financial plan or actual income requirements.

You may be a member of a pension scheme approaching retirement and looking to discuss your options.

Alternatively, you may have an ARF in place, but you’re unsure of the investment strategy and how it works.

Maybe you’re just worried about current market volatility and performance.

Are you getting advice from your current advisor?

If you haven’t heard from your advisor in the past 6-12 months you don’t have an advisor, you know someone who sold you an ARF (see line above re sales targets!).

At Fortitude Financial Planning, we create our clients’ ARF investment strategies with the client front and centre.

Firstly, we plan with them and ensure they have a set amount of income set aside.

Consequently, this then provides the remainder of the ARF with the capacity to take risk and aim to generate the longer term return required to meet their longer term income needs.

We provide our clients with knowledge of how markets work so that when volatility hits, there are NO surprises.

Finally, we provide a regular, comprehensive, ongoing advice service ensuring we are regularly in touch with our clients and they are safe in the knowledge we’re always available.

In many instances, even whilst allowing for our fee, we can reduce the fees you are paying. We’re with you.

Discuss Your Retirement Options

Get in touch

If so, get in touch to review your retirement options or your ARF.

Email us at info@fortitudefp.ie or request a callback.

Alternatively, you can get us on 086 0080 756 or access our diary here and book a call at your convenience.

Why not visit our insights.

A multitude of information on various financial subjects covering all aspects of saving, investing, financial planning, protection and pension advice.

Our blog posts are intended for information purposes only and should not be interpreted as financial advice.

You should always engage the services of a fully qualified financial planner before entering any financial contract.

To discuss engaging the services of Fortitude Financial Planning please email us at info@fortitudefp.ie.

Fortitude Financial Planning Ltd will not be held responsible for any actions taken as a result of reading these blog posts.

Production

Production